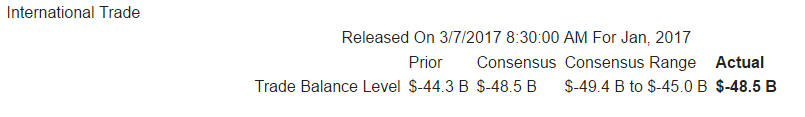

As previously discussed, trade looks to be more negative in q1 than it was in q4:

Highlights

January’s trade deficit came in very deep but at least right on expectations, at $48.5 billion and reflecting a surge in foreign consumer and vehicle imports and higher prices for imported oil.

January imports rose 2.3 percent from December to $197.6 billion with imports of consumer goods jumping 2.4 percent to $52.1 billion and with vehicle imports up 1.3 percent to $13.6 billion. Petroleum imports totaled $15.3 billion in the month, up 19 percent and reflecting both higher prices, at $43.94 per barrel vs December’s $41.45, and a rise in volumes, at 8.4 million barrels per day vs 7.7 million.

Though dwarfed by imports, exports did rise 0.6 percent to $128.0 billion led by industrial supplies (where higher oil prices are at play) and also a 1.3 percent gain for vehicle exports to $13.6 billion as well as a $0.6 billion gain for foods. Exports of capital goods fell a sharp 1.9 percent to $43.5 billion in a decline that only partially reflected aircraft. Exports of services, usually the strength for the U.S., were unchanged in the month at $64.1 billion.

Unadjusted country data show a monthly widening with China, to a monthly deficit of $31.3 billion, and a widening with Canada, at $3.6 billion. Deficits narrowed with the EU, to $11.5 billion, with Japan, to $5.5 billion, and with Mexico, to $4.0 billion.

Strong demand for foreign goods and light demand for U.S. services and capital goods is not a favorable mix for GDP. This report puts first-quarter GDP on the defensive.

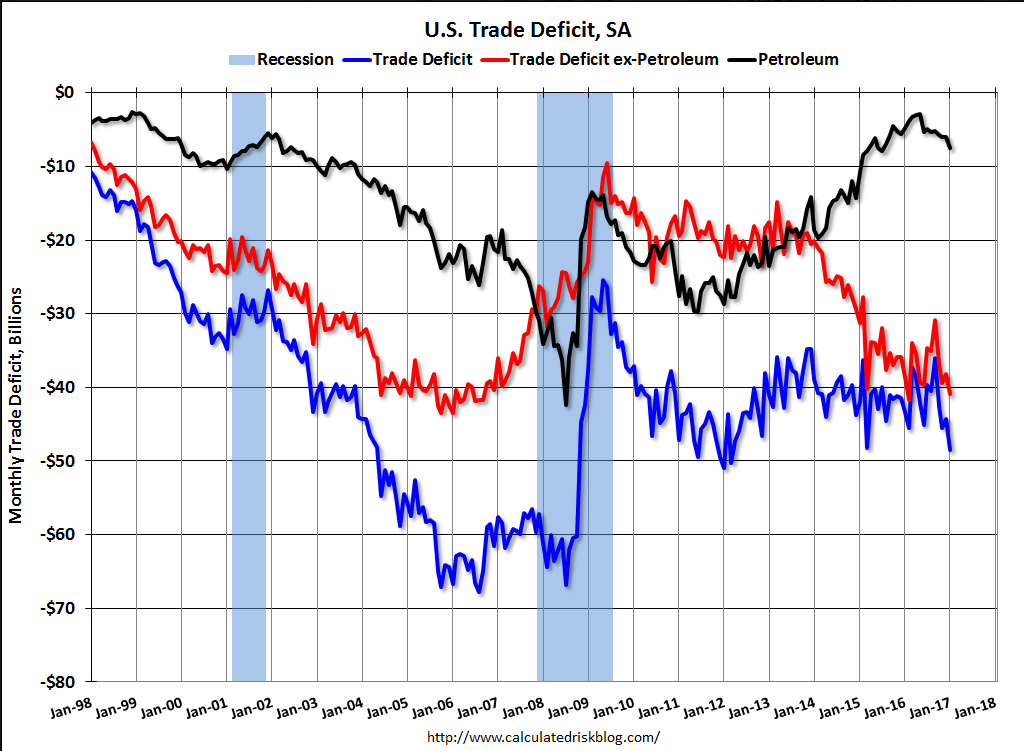

Higher oil prices and the end of the one time surge in soybean exports, etc:

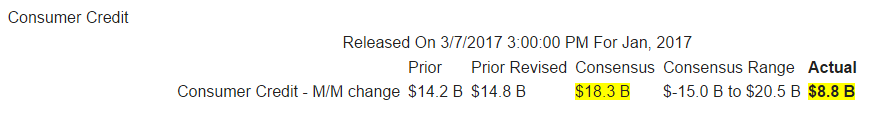

A lot worse than expected:

Highlights

Consumers held back on credit-card borrowing in January as nonrevolving credit fell $3.8 billion for the first monthly decline since February last year and the largest since December 2012. But nonrevolving credit, where vehicle financing and student loans are tracked, rose a respectable $12.6 billion and offers a reminder that overall credit growth, including revolving credit, has been steady. Yet, at least for January, nonrevolving credit couldn’t offset the weakness in revolving credit as total credit increased only $8.8 billion for the smallest rise since July 2012.