Apart from the Trumped up future expectations and the sagging retail sales reports, expectations remain elevated:

Highlights

Consumer confidence shows no sign of slowing. The index is up 12.9 points since the November election in gains driven by older consumers. The level for December is 113.7 which is the highest reading since way back in August 2001.

But not all the indications from the December report point to monthly acceleration. December’s gain is centered in expectations, not in current conditions where the index, at 126.1, is still very strong but down from November’s 132.0. Within this, those saying that jobs are hard to get rose a noticeable 1.3 percentage points to 22.5 percent. This is a closely watched reading that will not heat up expectations for the December employment report.

The expectations index is very strong, up 11.1 points to 113.7. Those seeing more jobs in the months ahead jumped 4.9 points to 21.0 percent while the percentage of consumers expecting their incomes to increase rose 3.6 points to 21.0 percent. These readings are very solid.

But there is a curious negative in the report and that is a big drop in year-ahead inflation expectations, down 3 tenths to 4.5 percent which is very low for this reading. The better times that are coming will not be inflationary, at least according to the consumer.

No set of data have been showing the strength of the various consumer confidence readings. Yet this confidence didn’t help November consumer spending and how much it helped December’s spending has yet to be sorted.

Adjusted for inflation housing prices have yet to recover:

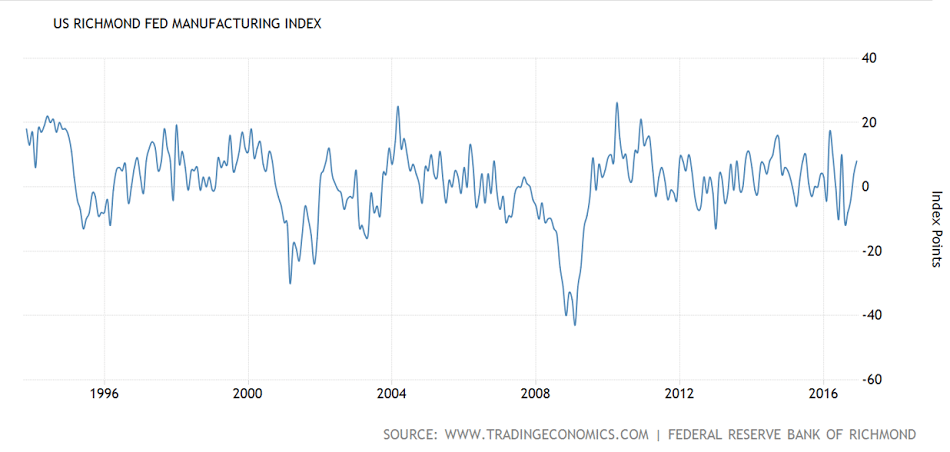

Stabilizing at the lower levels as previously discussed. The surveys indicate the number of firms reporting higher or lower numbers than the prior month. They don’t indicate magnitude:

Highlights

The Dallas Fed report joins other advance surveys pointing to year-end strength for the factory sector. December’s readings are broadly higher including a 5.0 point gain for the production index to 13.8 and a 5.3 point gain for general activity to 15.5. Importantly, new orders are up 8.7 points to 7.3 for the first positive score since August.Held down by weak foreign demand and generally weak demand for new equipment, the factory sector did not enjoy a good year. But momentum has definitely been appearing in what is good news for 2017’s outlook.

Up mainly on Trumped up expectations and even those didn’t extend to capital expenditures:

Highlights

Manufacturing activity in the Fifth district expanded further in December, with the Richmond Fed Manufacturing Index rising 4 points to 8, after coming out of contraction in November with a strong 8-point increase. The biggest gains were registered in the backlog of orders, which rose a sharp 20 points from minus 12 to 8, followed by shipments and capacity utilization, with each rising 11 points, from 1 to 12 and minus 1 to 10, respectively. Vendor lead time lengthened in the month, moving the index component up 5 points to 9. On the employment front, hiring softened somewhat, with the number of employees falling to minus 1 from 5, but the average workweek increased, rising from 4 to 12 points, and wage increases were more widespread, with the index rising from 16 to 19 points.

Looking ahead, manufacturers were optimistic about future business conditions, anticipating robust improvement in nearly all of the conditions during the next six months. The index for expected shipments and new orders rose to a very strong 45 from 41 and to 47 from 38, respectively. Producers anticipate more increases in hiring (from 15 to 22) along with broader wage gains (from 26 to 36) and longer workweeks (from 6 to 14) in the next six months. The only expectations component that declined was capital expenditures, which fell from 27 points to 20.

Prices of raw materials rose at an annualized rate of 1.23 percent, slightly more than in the previous month, but the pace of growth in prices received slowed to a 0.22 percent annualized rate.

2016 has been even more volatile but seems to have been averaging around 0:

Just watched Steve Moore, chief Trump transition team economic advisor, on Fox, talking about ‘trillion dollar deficits as far as the eye can see’ etc. and the need for fiscal responsibility, as he then tied it into supporting the new cabinet as people who knew how to cut waste and fraud and able to run things on paygo, etc. And last week he was talking about how the $trillion of infrastructure spending would be large private infrastructure like pipelines and refineries, etc. to be encouraged by govt. policy, rather than govt. spending per se.

Yes, private sector deficit spending for said capex ‘counts’ just as much as govt. deficit spending, but this kind of effort to create incentives won’t happen overnight, and won’t kick in overnight, and in any case $1 trillion over 10 years is only $100 billion per year or about .5% of GDP per year.

Also, their spending cuts ‘to pay for it all’ will be a force in the other direction. And their proposed tax cuts have far lower multiples than their proposed spending cuts.