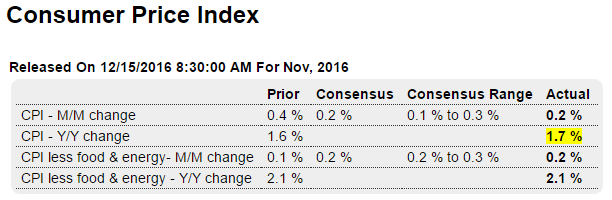

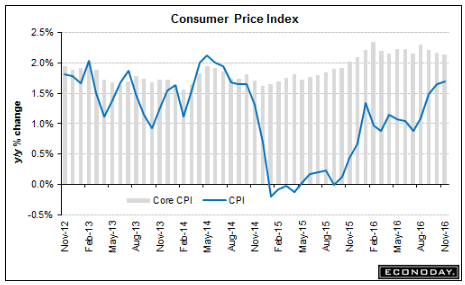

Fed still failing to hit its 2% target after years of trying, and after years of forecasting that it would hit its 2% target:

Highlights

Inflation at the consumer level remains low. The CPI rose 0.2 percent in November with the year-on-year rate up 1 tenth to plus 1.7 percent. The core rate, which excludes food and energy, also rose 0.2 percent with this year-on-year unchanged at 2.1 percent.

Food prices were unchanged in November though energy did move sharply, up 1.2 percent and led by a 2.7 percent jump in gasoline. Excluding just energy, the CPI rose only 0.1 percent.

The Labor Department is citing housing as a central area of consistent price pressure. The housing component only rose 0.2 percent in November but was up 0.4 percent in both of the prior two months. Owners’ equivalent rent, a closely watched reading in this report, rose 0.3 percent for a second straight month.

Medical prices have also been a source of pressure but were unchanged in November for a second month in a row. Apparel is a weak point in the report, down 0.5 percent for the second steep monthly fall of the last three months. Weakness here hints at holiday discounting.

The year-on-year rates are inching forward but just barely. Low inflation will allow the Fed to be patient when raising rates.

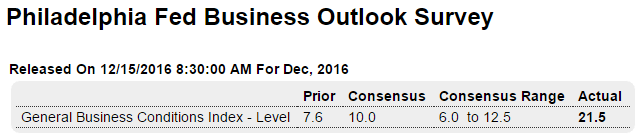

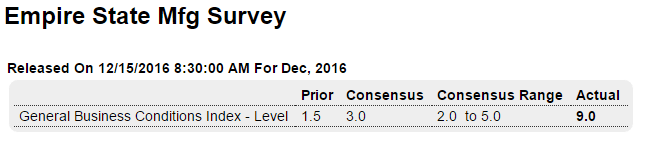

More Trumped up surveys, even as ‘real’ data sags?

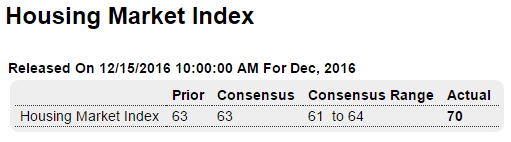

Highlights

The Empire State report is showing less strength than the Philly Fed report but momentum is building. The general conditions index is in positive ground for a second month in a row, at 9.0 for the December score vs 1.5 in November. New orders are also positive for a second month, at 11.4 vs last month’s 3.1. Like the Philly Fed report, 6-month expectations for new orders are showing a sudden surge, up 18 points in the month to 40.1. Other readings, however, are still lagging including employment, at minus 12.2, and the workweek at minus 7.0. Price data, also like the Philly Fed, show pressure for inputs but no traction for selling prices. The weaknesses aside, the strength and optimism for new orders are strong indications of wider factory strength going into year end.

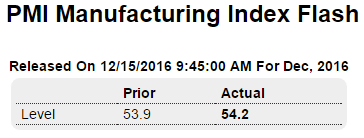

Highlights

Both the Philly Fed and Empire State reports have been pointing to accelerating strength for the factory sector, as does Markit Economics’ manufacturing PMI which comes in at 54.2 for the December flash. This index has been moving steadily higher from September’s 51.5. Positives this month include a rise in hiring and a big build for inventories, one the report says reflects confidence in the outlook. New orders are solid but slowing due to weak foreign sales while growth in output is also slowing. Price data show pressure for input costs, especially steel, and slight improvement in selling prices which otherwise remain flat. The factory sector had been flat all year but looks to post solid numbers for the fourth quarter.

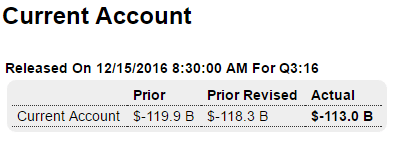

This is where I see additional risk to growth post election- stronger $US due to portfolio shifting, higher oil prices, and a weaker global (export) market:

Highlights

The nation’s current account narrowed to $113.0 billion in the third quarter from a downward revised $118.3 billion in the second quarter. The trade deficit narrowed by $8.3 billion in the quarter reflecting a $9 billion narrowing in the goods gap that offset a small decline in the services surplus. The surplus in primary income also declined while the deficit on secondary income widened, both small negatives. The gap relative to GDP remains moderate, down 2 tenths in the quarter to 2.4 percent.