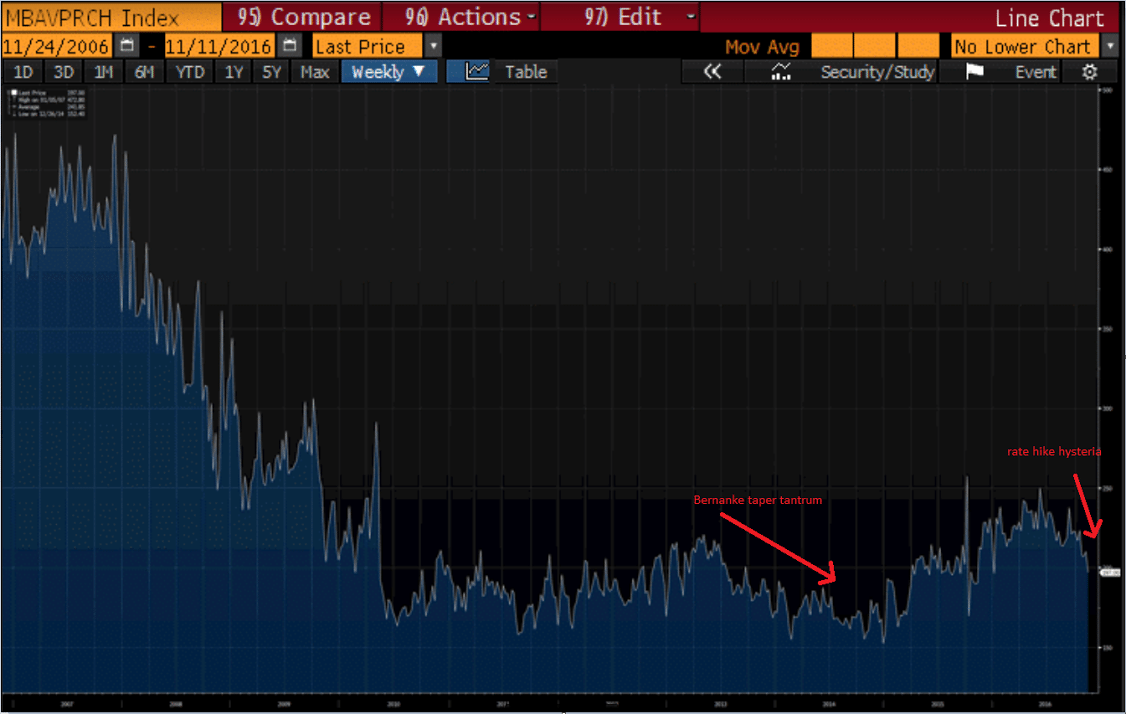

With the Bernanke taper tantrum a housing market showing at least some signs of recovery immediately reversed course and headed south. The shale boom got things going again, and the shale bust saw some softening. But with the latest anticipatory spike in mtg rates and still not much underlying effective demand, we’re seeing the beginnings of another setback. This is the chart for the index for mortgage applications for home purchases:

I haven’t yet seen any reason for a corporation to pay any tax on foreign earnings held in ‘offshore’ bank accounts? Nor does anything in the macro economy change with so called ‘repatriation’ as proponents have claimed. There are no CEO’s that I’ve ever heard of thinking ‘If only that part of our cash was in a domestic bank account rather than an offshore account I’d invest or otherwise spend more’:

House Republicans Aim to Cut Taxes Without Increasing Deficits

By Richard Rubin

Nov 15 (WSJ) — The House Republican overhaul of the tax code is being written to expand the economy and avoid increasing budget deficits. “We designed our blueprint to break even within the budget, considering that economic growth,” Rep. Kevin Brady (R., Texas), chairman of the House Ways and Means Committee, said. If there are some deficits, he said he would accept them if the result was stronger growth. Mr. Brady also rejected an idea that had some traction before Donald Trump won—using a one-time tax on more than $2 trillion in U.S. companies’ stockpiled foreign earnings to pay for U.S. infrastructure. The House plan, Mr. Brady said, uses that money to lower tax rates and remove the tax burden on U.S. companies’ foreign sales.

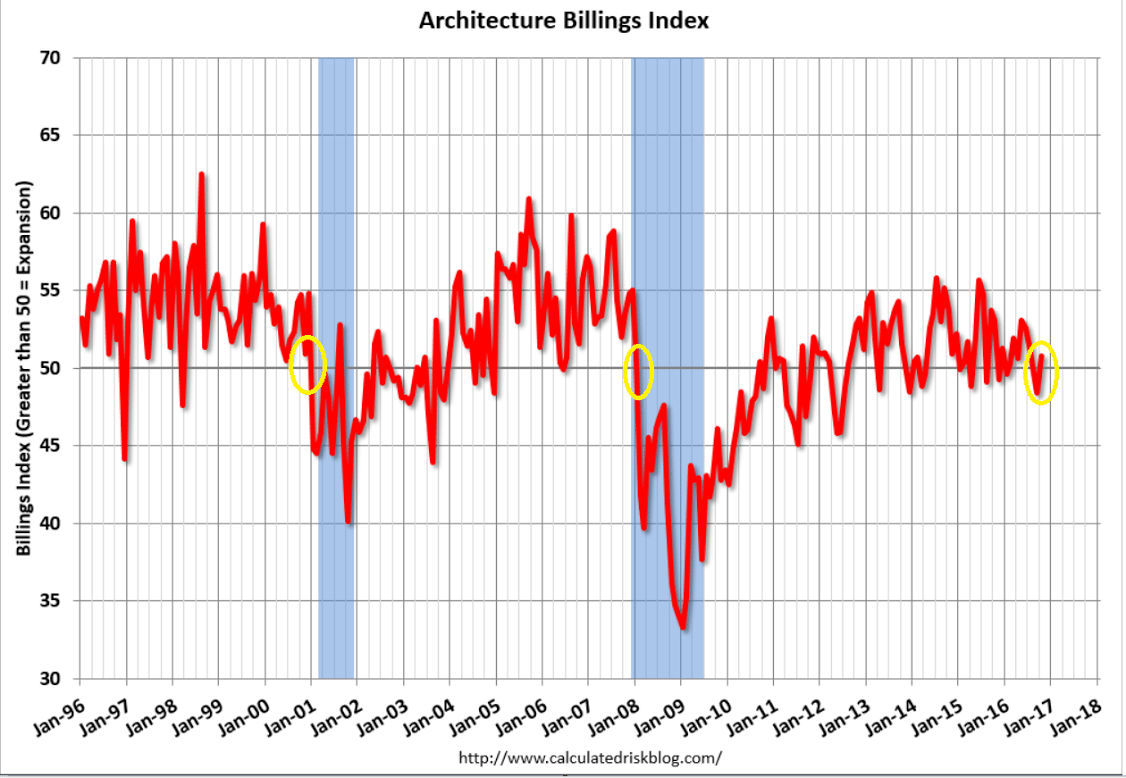

Up a bit, but hovering around levels historically associated with recessions:

From the AIA: Architecture Billings Index rebounds after two down months

After seeing consecutive months of contracting demand for the first time in four years, the Architecture Billings Index (ABI) saw a modest increase demand for design services. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI score was 50.8, up from the mark of 48.4 in the previous month. This score reflects a slight increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 55.4, down sharply from a reading of 59.4 the previous month.

Read more at http://www.calculatedriskblog.com/#wbo1cEkMiuw3lKMZ.99