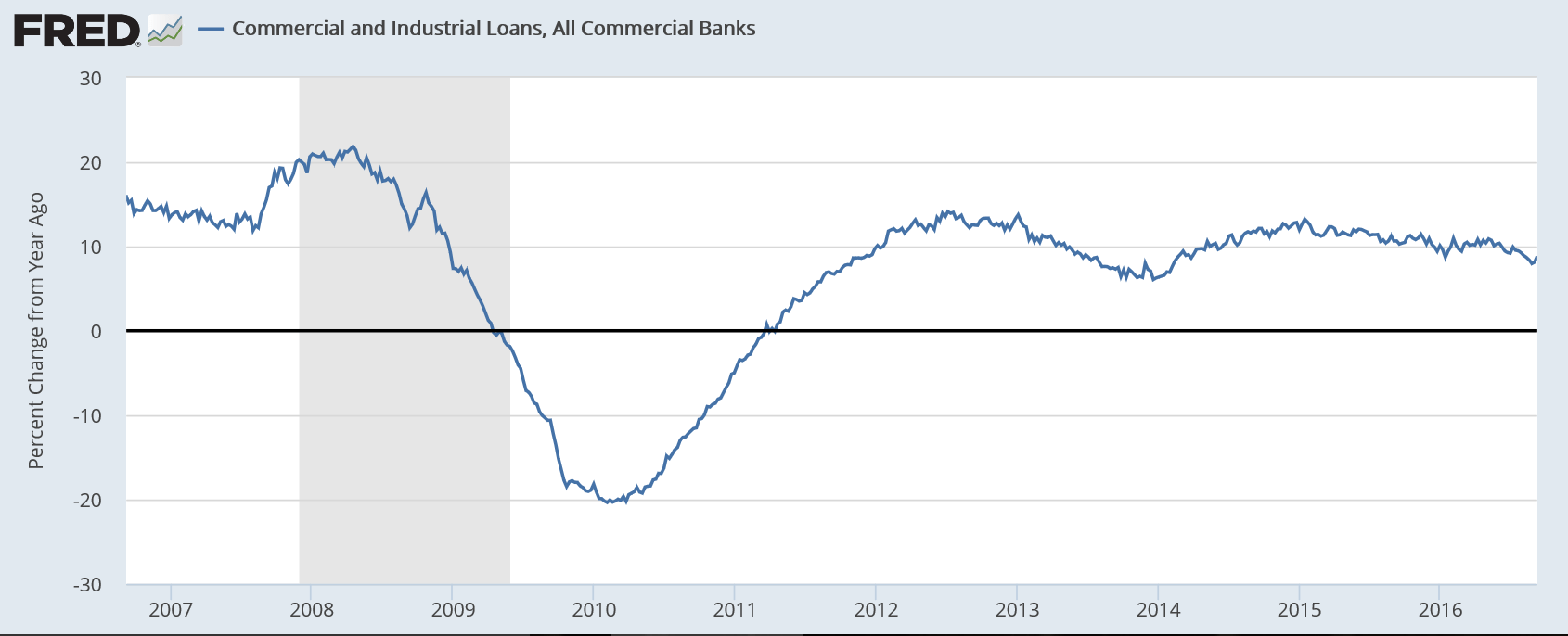

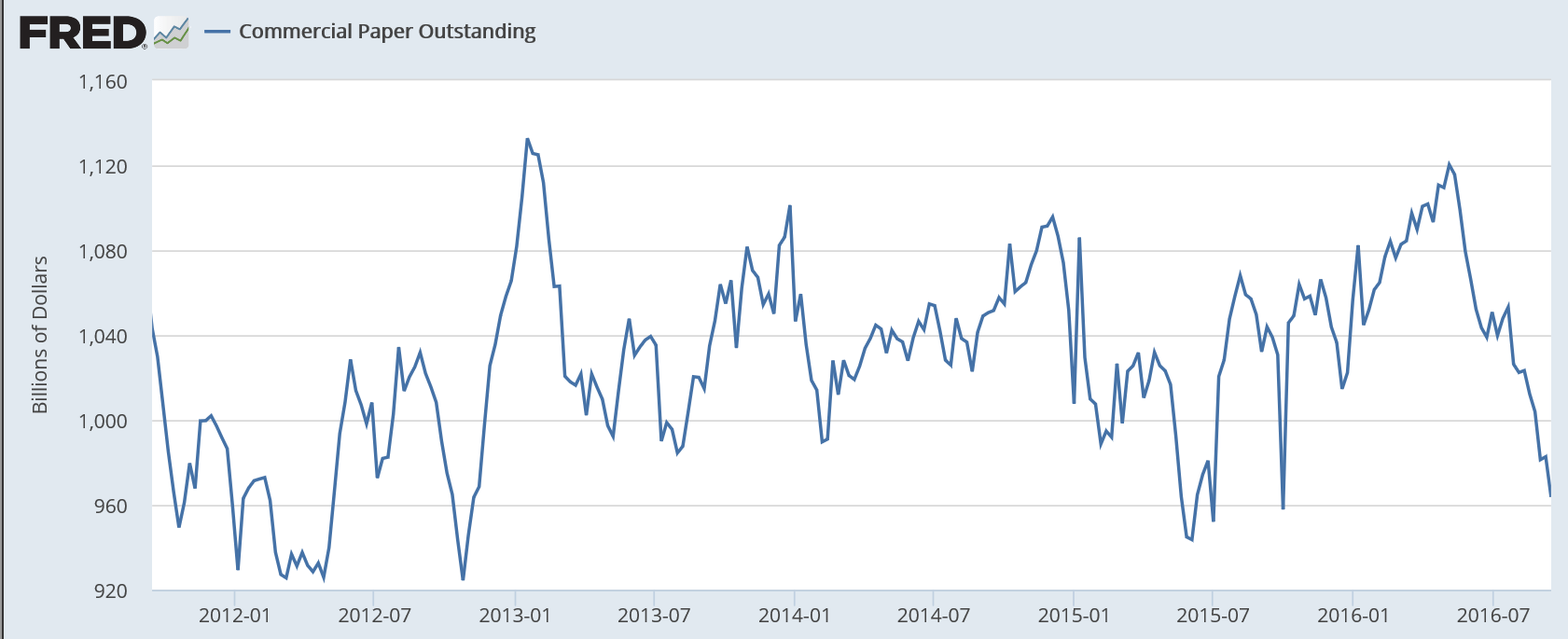

A very small move up but the deceleration trend is intact:

This has been moving lower as well for a while now:

As always, and by identity, if anyone spent less than his income, another must have spent more than his income, or the output would not have been sold.

So when the oil related capital expenditure collapsed late in 2014, it caused a general deceleration of growth that has yet to show any signs of reversal.

That is, spending continues to decelerate, causing inventory to go unsold, which leads to reduced production and reduced incomes, further slowing spending, in a downward spiral that can’t reverse until some entity spends sufficiently more than its income. At some point growth goes negative, and it wouldn’t surprise me if data revisions indicate that growth has already gone negative, perhaps as much as a year ago.

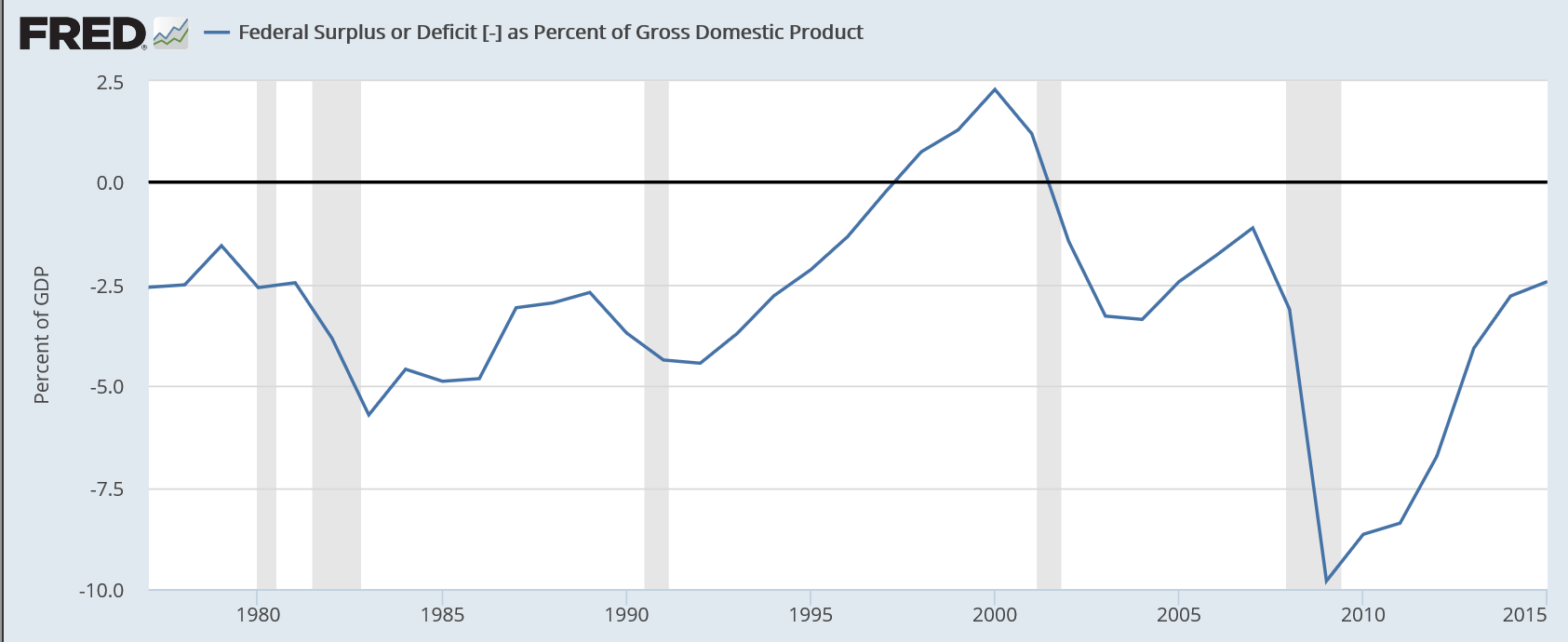

The current slowdown has begun to reduce the growth of tax revenues, which ‘automatically’ causes government to begin increasing its deficit.

If this is the only source of increased deficit spending the process of deceleration will continue until the Federal deficit gets large enough to offset the net desires to not spend incomes. Historically this has generally translated into a Federal deficit that exceeds 5% of GDP, depending on ‘non government’ (US residents + non residents) deficit spending, which accomplishes the same thing. In fact, the reason the Fed lowers interest rates is to support private sector deficit spending. Unfortunately lower rates hasn’t done that, and is unlikely to do that, for reasons previously discussed.

Currently the Federal deficit is running at something less than 3% of GDP, so there’s probably a long way to go: