Up a bit, but still weak and in a downtrend, and employment declining:

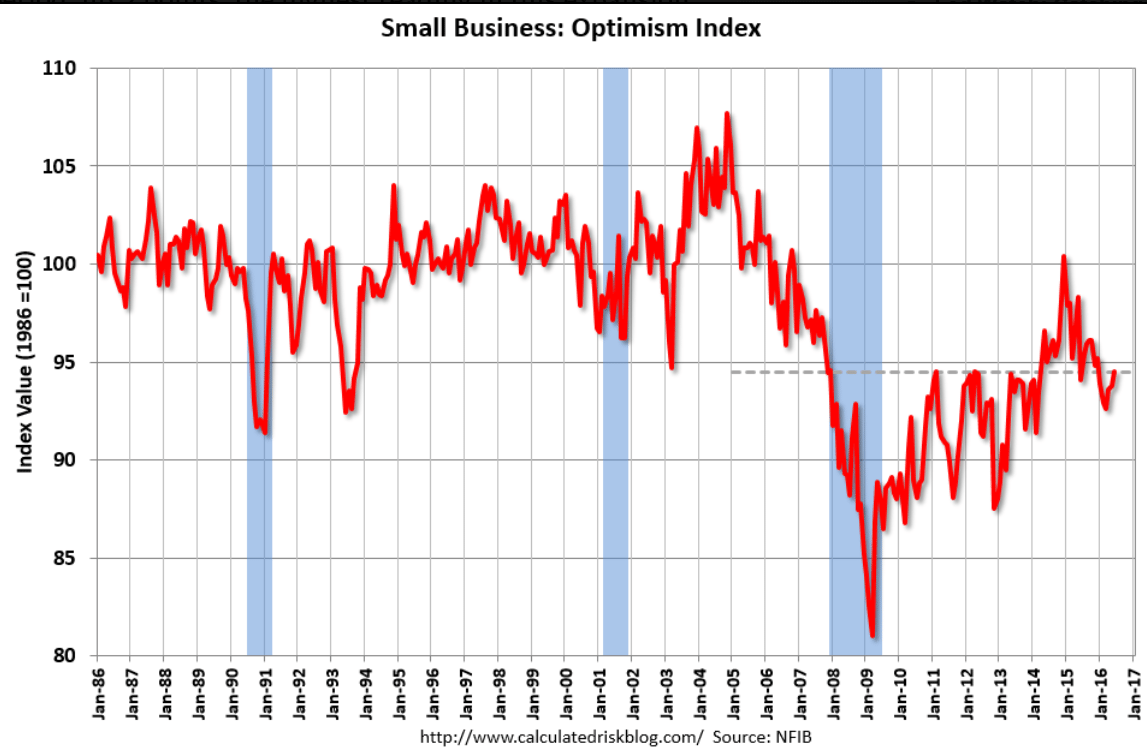

Highlights

The small business optimism index rose 0.7 points in June to 94.5, the third monthly increase since falling to a 2-year low in March. The improvement in small business optimism slightly exceeded expectations, though the index remains in the downtrend in place since the 100.4 recovery peak set in December 2013 and below the 42-year average of 98. Four of the 10 components of the index posted gains, three fell and three remained unchanged. Expectations that the economy will improve rose 4 points, posting the largest gain just as it did in May, but with the index still negative at minus 9 the majority of business owners continue to expect a worsening of business conditions. The two strongest components of the index recovered from their May declines, with plans to increase capital outlays rising 3 points to an even more solid 26, while job openings were even harder to fill, rising 2 points to 29. Expectations of an improvement in real sales rose 1 point to 2, but plans to increase inventories fell 2 points to a minus 3 and plans to increase employment dropped 1 point to 11. Business owners were slightly less optimistic than in May about now being a good time to expand, with the component falling 1 point to 8, and most continue to be negative about earnings trends, with the component remaining unchanged at minus 20 as the most pessimistic part of the index.

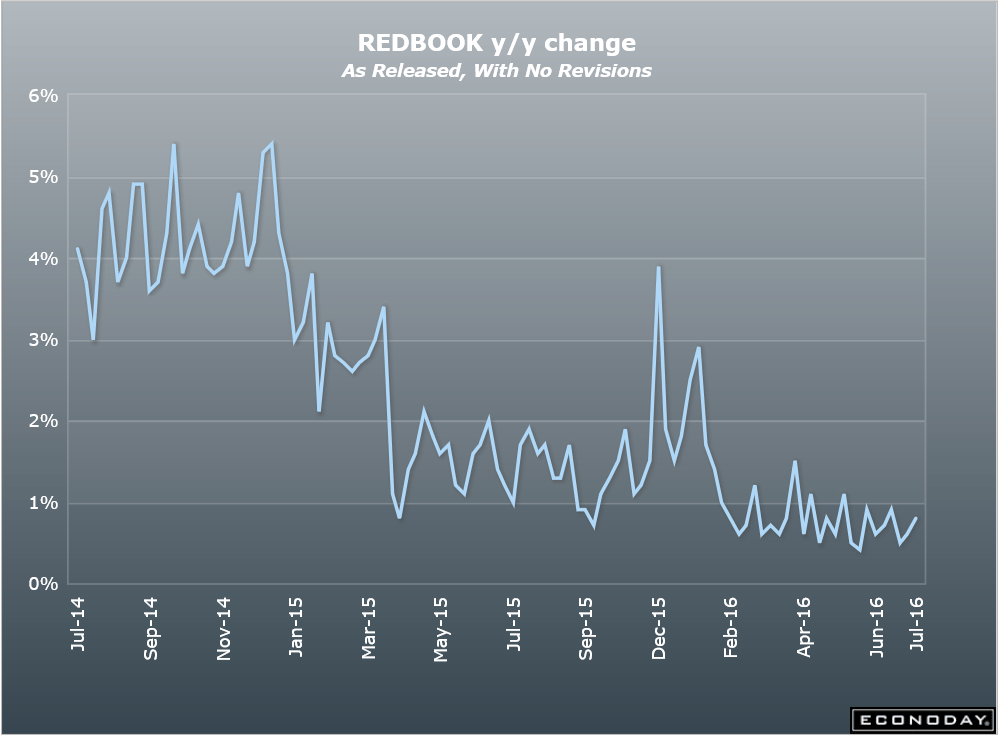

This measure of retail sales growth continues at recession levels:

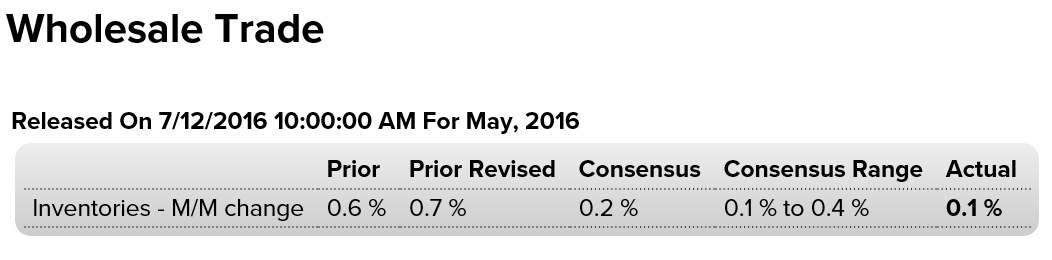

This May report reads like output has been trimmed to keep inventories, which remain too high, from rising further:

Highlights

Wholesalers held back inventory growth in May, up only 0.1 percent and well under a 0.5 percent rise in sales at the wholesale level. The stock-to-sales ratio is down one notch to 1.35 from 1.36.Inventories of two very large components — drugs and autos — fell sharply, making for leaner inventories relative to sales for both. In contrast, wholesale inventories of farm products have been on a sharp climb at the same time that sales have been falling, an unfavorable mix that is lifting the stock-to-sales ratio sharply, to 1.56 vs 1.46 in April and 1.30 in March.

But in general, inventories have been held successfully in check in line against no more than moderate rates of sales growth. Business inventories will be released Friday and will combine this report together with factory inventories, which slipped 0.1 percent in May, and yet-to-be released data on retail inventories.

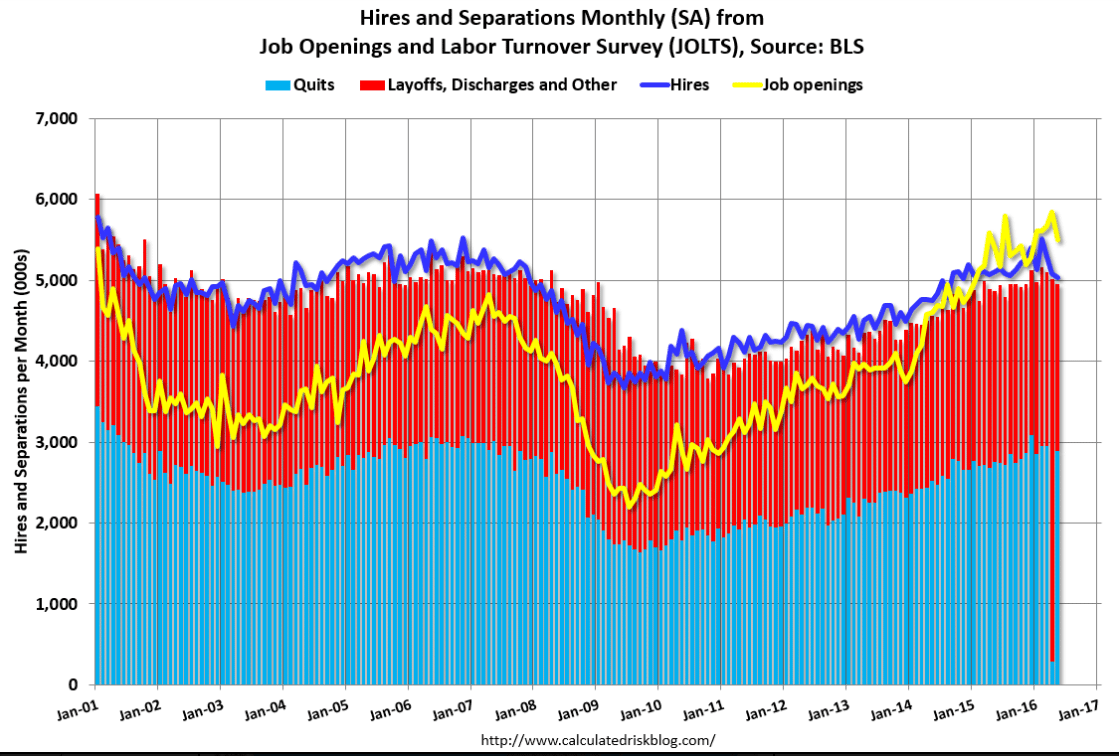

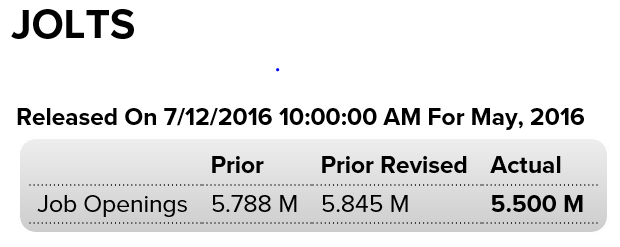

This report has been showing signs of weakening and now, while April was revised up some, May shows a much larger decline with both job offerings and hires turning lower:

Highlights

Job openings fell sharply in May, to 5.500 million from April’s revised 5.845 million for the lowest rate since February. The results pull down the job openings rate by 2 tenths to plus 3.7 percent, where it also was in May last year. The hiring rate is unchanged at 3.5 percent.On the breakup side of the labor market, the quits rate is unchanged at 2.0 percent and is not pointing to much confidence among workers who in general, despite low wage growth, are not moving up to higher paying employers. The separations rate is down 1 tenth to 3.4 percent with the layoff rate unchanged at 1.2 percent.

Employment data have been up and down of late and this report is itself mixed, showing lack of new punch on the hiring side but favorable conditions on the breakup side.