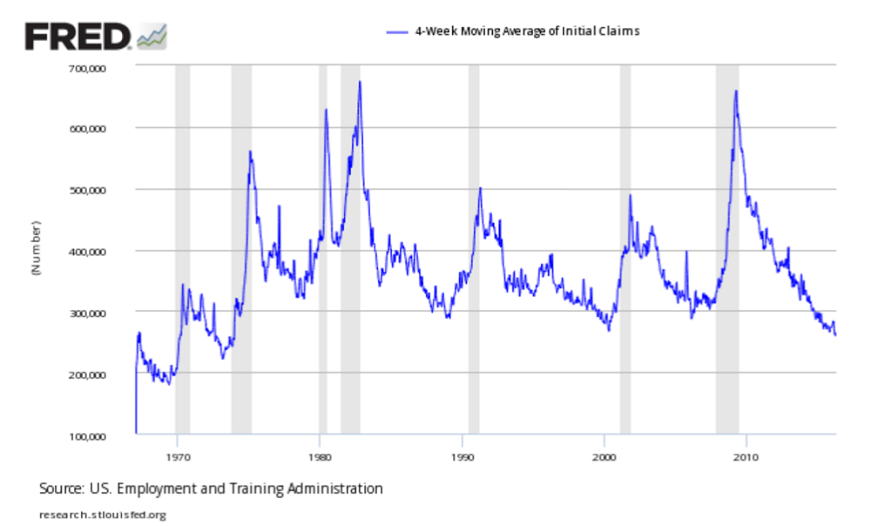

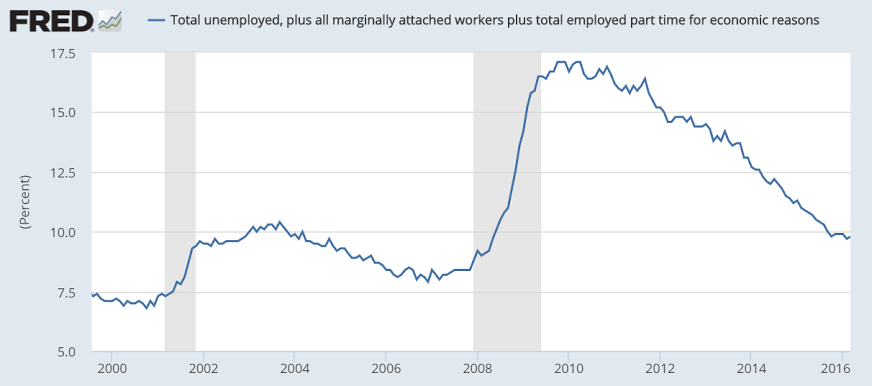

Lowest leve of new jobless claims ever on a per capita basis. Yet U6 unemployment remains near the highs of the prior recession. Leads me to suspect the reason for the low claims is they’ve become a lot harder to get, shutting off an automatic fiscal stabilizer, as previously discussed:

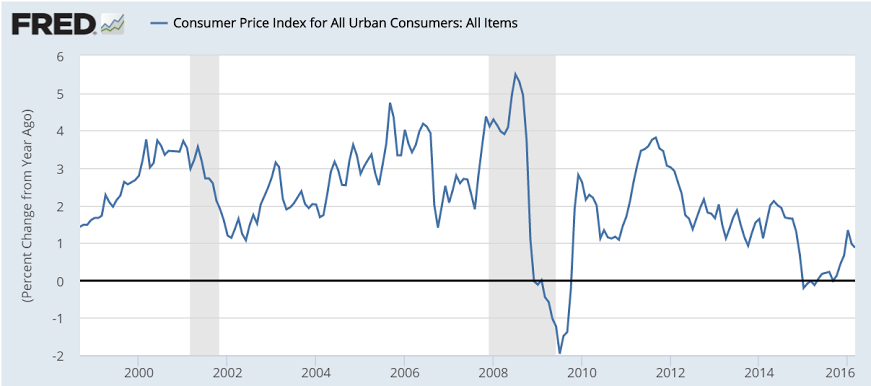

Nothing exciting happening from this point of view, either. The large year over year gains were only due to the large spike followed by a several month dip last year:

Rail Week Ending 09 April 2016: The Data Now Looks Recessionary

Week 14 of 2016 shows same week total rail traffic (from same week one year ago) declined according to the Association of American Railroads (AAR) traffic data. All rolling averages are in decline.

Lower than expected, Fed still failing to meet it’s target, even as energy and commodity prices increased as the $ weakened:

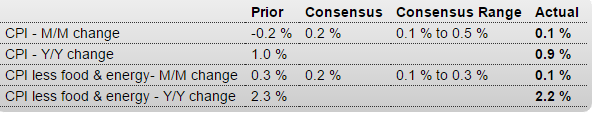

Consumer Price Index

Highlights

Slowing in shelter prices put the brakes on core consumer prices which, according to the Bureau of Labor Statistics, are no longer on a gradual path of acceleration. The core, which excludes food and energy, rose only 0.1 percent in March following two solid back-to-back gains of 0.3 percent. Year-on-year, the core is moving in the wrong direction, down 1 tenth to a 2.2 percent reading that justifies Janet Yellen’s doubts whether inflation, not getting much lift from wages, will show much traction this year.

The overall CPI, held down by food, also inched 0.1 percent higher in another disappointing reading. Year-on-year, the CPI is up only 0.9 percent and is also moving in the wrong direction, down 1 tenth from February.

Housing, pulled down by a 1.8 percent decline in away-from-home prices, inched only 0.1 percent higher for a year-on-year rate of only 2.1 percent. But other readings here are also soft including a 0.2 percent gain for owners’ equivalent rent. Food prices fell 0.2 percent on declines for fruits & vegetables and meat. Apparel was a major negative in the month, down 1.1 percent but following the prior month’s 1.6 percent gain. And service readings also weakened including medical care which rose only 0.1 percent following back-to-back gains of 0.5 percent. Energy prices were a positive, up 0.9 percent for the best monthly gain since May last year.

The ongoing rise in oil prices is coming at a good time for the inflation outlook and should help give a boost to future readings. But March’s results are very likely to push back expectations for the next Federal Reserve rate hike.

They are rediscovering fiscal does work. Must have been one heck of an argument with their western educated monetarists… ;)

China Fiscal Expenditure

Fiscal expenditure in China increased by 20.1 percent year-on-year in March 2016, while fiscal income expanded by 7.1 percent. Considering the first three months of 2016, the fiscal spending grew by 15.4 percent year-on-year. Growth in the revenue was 6.5 percent in the March quarter 2016. Fiscal Expenditure in China averaged 4064.64 CNY HML from 1990 until 2016, reaching an all time high of 25544.62 CNY HML in December of 2015 and a record low of 138.60 CNY HML in January of 1990. Fiscal Expenditure in China is reported by the National Bureau of Statistics of China.