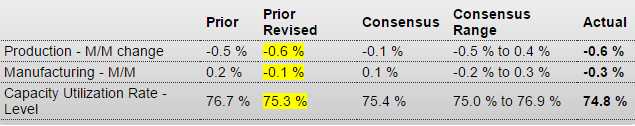

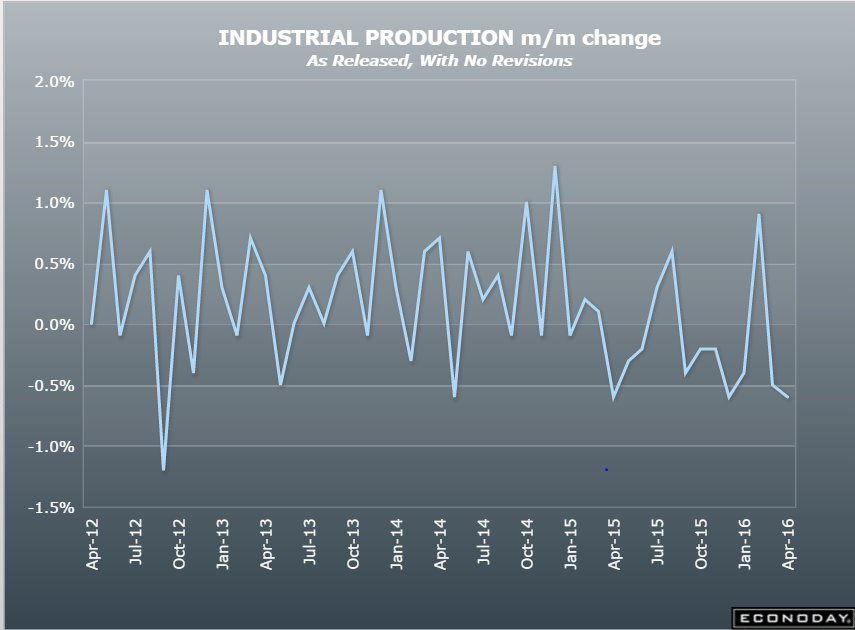

Serious setback, worse than expected and last month revised down as well.

Look for more Q1 GDP reductions:

Industrial Production

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.6 percent in March for a second month in a row. For the first quarter as a whole, industrial production fell at an annual rate of 2.2 percent. A substantial portion of the overall decrease in March resulted from declines in the indexes for mining and utilities, which fell 2.9 percent and 1.2 percent, respectively; in addition, manufacturing output fell 0.3 percent. The sizable decrease in mining production continued the industry’s recent downward trajectory; the index has fallen in each of the past seven months, at an average pace of 1.6 percent per month. At 103.4 percent of its 2012 average, total industrial production in March was 2.0 percent below its year-earlier level. Capacity utilization for the industrial sector decreased 0.5 percentage point in March to 74.8 percent, a rate that is 5.2 percentage points below its long-run (1972–2015) average.

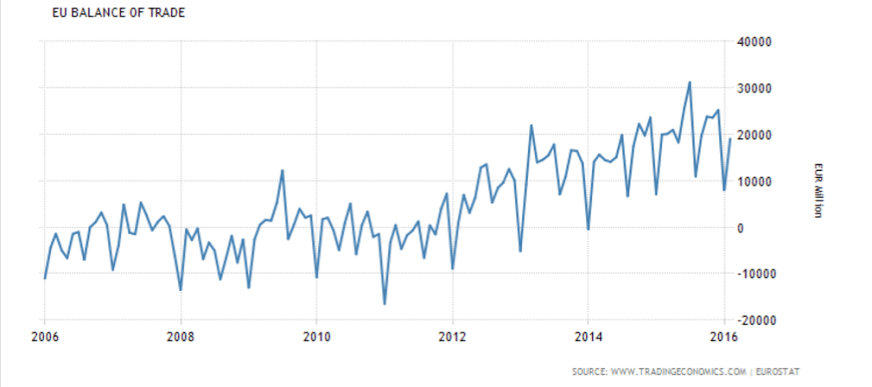

Trade surplus still chugging along, adding that much support to the euro:

Euro Area Balance of Trade

The trade surplus in the Eurozone decreased slightly to €19 billion in February of 2016 from a € 19.9 billion surplus a year earlier. Both exports and imports increased, recovering from falls in January. Balance of Trade in the Euro Area averaged 3804.90 EUR Million from 1999 until 2016, reaching an all time high of 31194.80 EUR Million in July of 2015 and a record low of -16509.80 EUR Million in January of 2011. Balance of Trade in the Euro Area is reported by the Eurostat.

Goes without saying when there’s a positive net propensity to ‘save’!

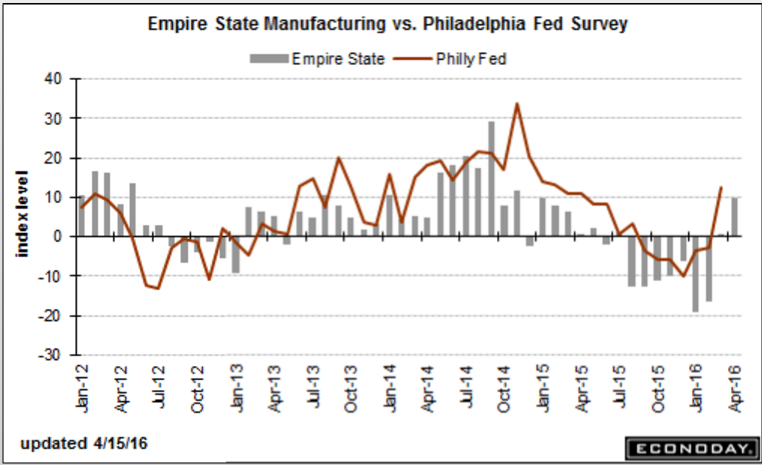

Better news here, though from depressed levels a survey response of ‘better than last month’ might not mean much in absolute terms. But always hoping for the best:

From the NY Fed: Empire State Manufacturing Survey

Business activity expanded for New York manufacturing firms for the first time in over a year, according to the April 2016 survey. After remaining in negative territory for seven months, the general business conditions index rose to a reading slightly above zero last month, and climbed nine more points to reach 9.6 in April.