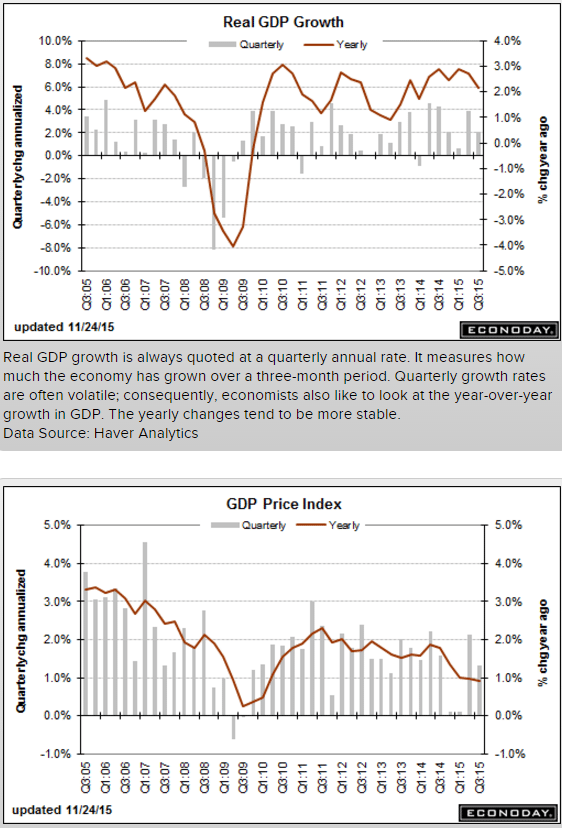

Output was revised up, but mainly due to growing unsold inventory, with other spending revised lower and showing more deceleration than the first release:

GDP

Highlights

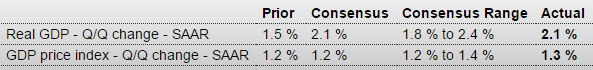

Third-quarter GDP is revised to an annualized plus 2.1 percent, up 6 tenths from the initial estimate but showing less strength by the consumer with final sales now at plus 2.7 from plus 3.0 percent. Higher inventories are a big factor in the upward revision, subtracting 6 tenths from GDP vs an initial 1.4 percent subtraction.

Net exports pulled GDP down by 2 tenths vs only a small negative effect in the first estimate. Exports rose only 0.9 percent in the quarter, down 1 percentage point from the initial reading. Readings on residential investment, adding 2 tenths to GDP, and nonresidential fixed investment, adding 3 tenths, are little changed.

Turning back to the consumer, personal consumption expenditures are revised to plus 3.0 percent, down 2 tenths from the initial estimate and reflecting less strength for durable goods and also services on lower spending for communications and natural gas.

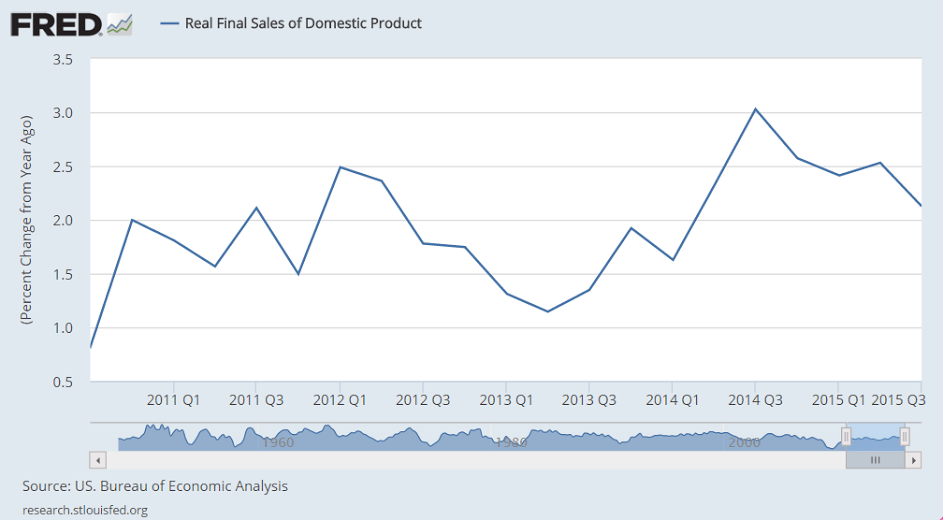

The gain in inventories is not a positive for the fourth quarter, posing headwinds for businesses which may limit production and employment to pull down their inventories. Still, the readings on the consumer are a positive and a reminder that the nation’s economy is being driven by domestic demand. Other details include a tame plus 1.3 percent rise in the GDP price index, up 1 tenth from the initial reading.

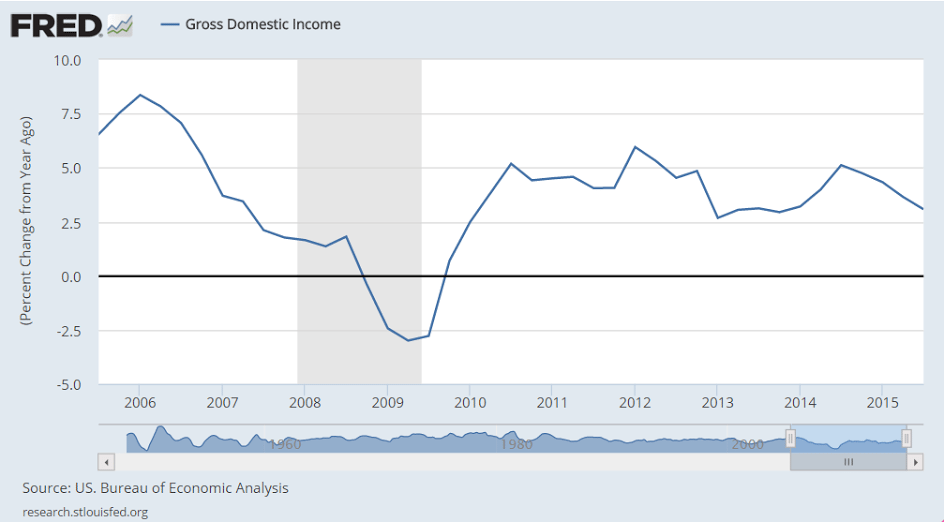

Note the decelration over the last year as oil prices and capital expenditure collapsed:

Collapsing?

Consumer Confidence

Highlights

Lack of confidence in the outlook for the jobs market sank the consumer confidence index in November, which fell to 90.4 vs a revised 99.1 in October. The November reading is far under expectations and is the lowest since September last year. Expectations, one of two main components in this report, fell more than 10 points to 78.6 which is the lowest reading since February last year. The employment subcomponent here shows fewer consumers seeing jobs opening up six months from now and more seeing fewer jobs ahead.

The present situation component shows less weakness, down 6.5 points to 108.1 which is the lowest reading since only July. Here the employment subcomponent also shows weakness but nothing dramatic, with 26.2 percent saying jobs are hard to get which is up from October’s 24.6 percent but still respectable. But those describing jobs as currently plentiful showed more noticeable deterioration, at 19.9 percent vs October’s 22.7 percent.

A plus in the report is a jump in buying plans for autos, at 12.4 percent vs October’s 9.8 percent in a reading that hints at renewed acceleration for the motor vehicle component of the government’s retail sales report. A negative is a dip in home buying plans, to 5.6 percent from 6.2 percent. Other readings include a 1 tenth dip in inflation expectations to 5.0 percent which, for this particular reading, is actually subdued but nothing dramatic.

But the decline in job expectations is dramatic and raises the question whether global effects, which have been negative for the U.S., are beginning to weigh on the American consumer — which would not be a positive for the holiday spending outlook.

Corporate Profits

Highlights

Corporate profits in the third quarter came in at a revised $1.786 trillion, up a year-on-year 1.4 percent. Profits are after tax without inventory valuation or capital consumption adjustments.

Richmond Fed Manufacturing Index

Highlights

Early indications for the November factory sector are soft right now after Richmond Fed reports a much lower-than-expected minus 3 headline for its manufacturing index. Order data are very negative with new orders at minus 6, down from zero in October, and backlog orders at minus 16 for a 9-point deterioration. Shipments are also in contraction, at minus 2, with the workweek at minus 3. Employment, at zero, shows no monthly change but the declines for backlog orders and the workweek don’t point to new demand for workers. Price data are subdued but do show some constructive upward pressure.

This report along with Empire State, as well as yesterday’s manufacturing PMI, are pointing to a downbeat month for the factory sector which is being held down by weak foreign demand, as evidenced in the decline for goods exports in this morning’s advance release of international trade data.

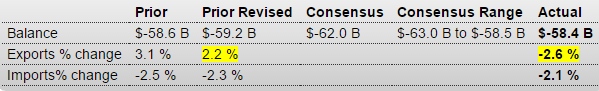

International trade in goods

Highlights

The nation’s trade gap in goods came in at a lower-than-expected deficit of $58.4 billion in October vs $59.2 billion in September. Though the month-to-month comparison points to improvement for the trade deficit, the details are not positive with exports down 2.6 percent and imports, in a sign perhaps of softening domestic demand, down 2.1 percent and following weakness also in September. Weak categories for imports include foods/feeds/beverages, industrial supplies and also capital goods as well as consumer goods with the latter hinting at weak business expectations for the holidays. Export categories showing weakness include foods/feeds/beverages and also industrial supplies.