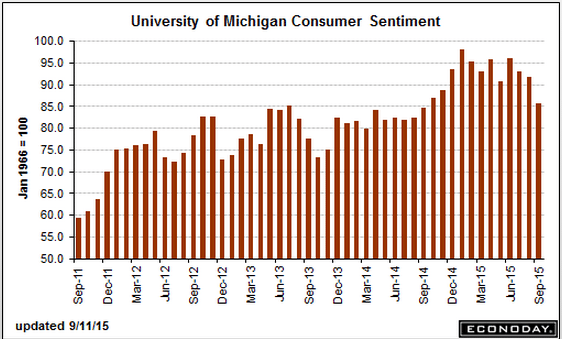

Down again, and not wrong to say it peaked shortly after oil prices collapsed. See chart below:

United States : Consumer Sentiment

Highlights

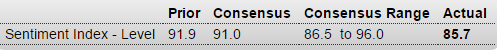

Just when you think you’ve gotten through the week, consumer sentiment dives and, perhaps, tips the balance against a rate hike. The mid-month September flash for the consumer sentiment index is down more than 6 points to 85.7 which is below Econoday’s low-end forecast. The index is now at its lowest point since September last year.

Weakness is centered in the expectations component which is down more than 7 points to 76.4, also the lowest reading since last September. Weakness in this component points to a downgrade for the outlook on jobs and income. The current conditions component also fell, down nearly 5 points to 100.3 for its weakest reading since October. Weakness here points to weakness for September consumer spending. Inflation readings are quiet but did tick 1 tenth higher for both the 1-year outlook, at 2.9 percent, and the 5-year, at 2.8 percent.

New York Fed President William Dudley himself has said he is focused on this report as an early indication of how U.S. consumers are responding to Chinese-based market turbulence. These results offer a rallying cry for the doves at next week’s FOMC meeting.

Low euro helping Italy:

Italy : Industrial Production

Highlights

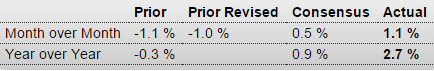

The goods producing sector comfortably exceeded expectations in July. A 1.1 percent monthly increase in output ex-construction followed a minimally smaller revised 1.0 percent drop in June for annual workday adjusted growth of 2.7 percent, up from minus 0.3 percent at the end of the second quarter. The monthly profile remains volatile but the trend at least appears to be mildly positive.

July’s monthly bounce, the sharpest since June 2014, was reassuringly broad-based. The erratic energy subsector (7.1 percent) led the way but there were tidy gains too in consumer goods (1.0 percent), capital goods (0.3 percent) and intermediates (0.6 percent).

July’s data put overall industrial production (ex-construction) 0.7 percent above its average level in the second quarter when it climbed 0.5 percent versus the January-March period. Moreover, while August’s manufacturing PMI (53.8) saw its lowest level since April, it still indicated further healthy increases in both output and, importantly, new orders. Accordingly it looks as if goods production should provide useful support to third quarter GDP growth. That said, the sector still has a long way to go to get anywhere near its pre-Great Recession peak in April 2008. Compared with then, output is still down some 24 percent.