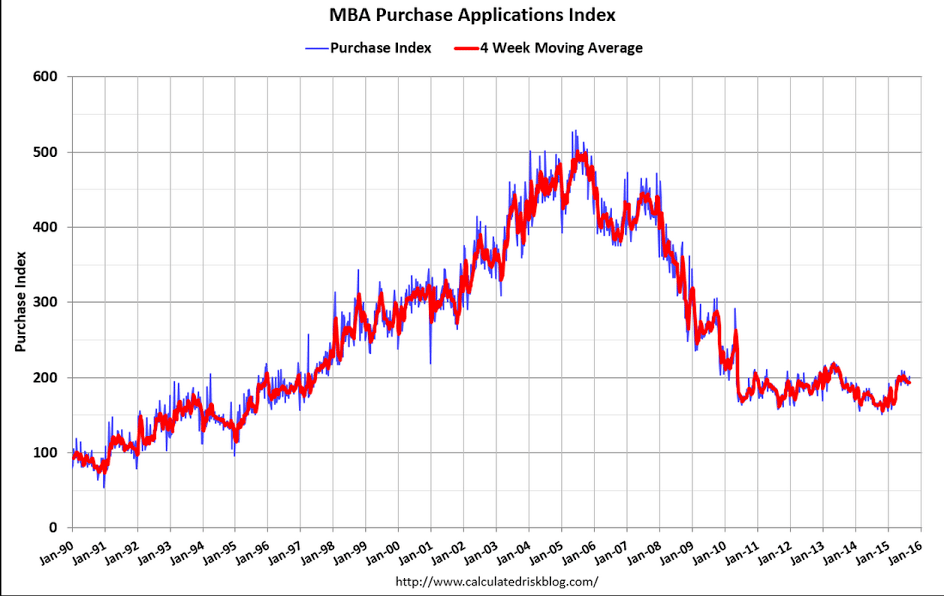

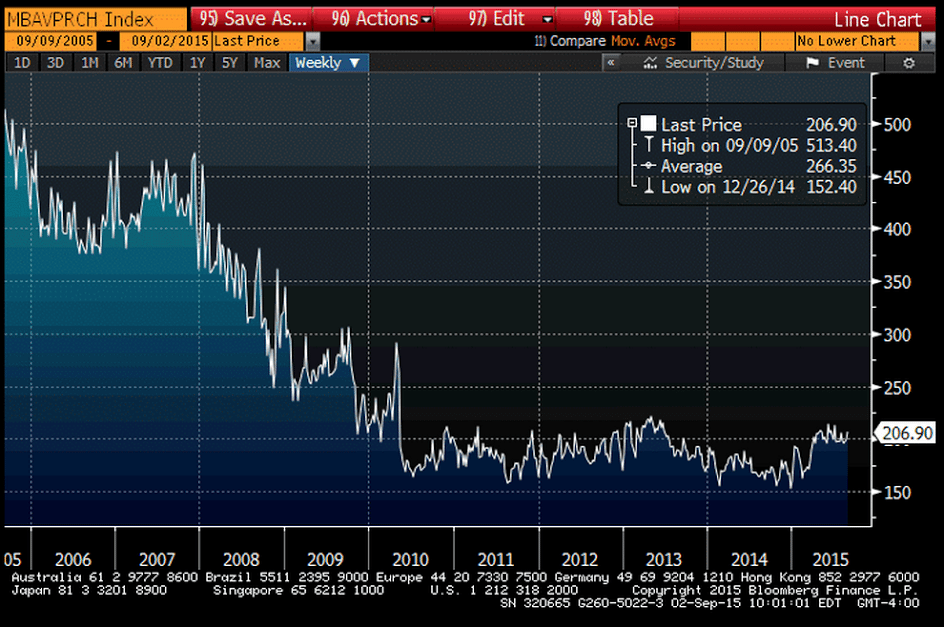

Nice jump in front of what is perceived as a near certain rate hike. However pending home sales didn’t show much of a jump in sales:

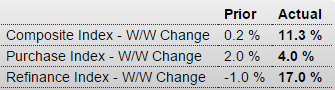

States : MBA Mortgage Applications

Highlights

A sharp drop in Treasury rates early in the August 28 week, tied to the global stock market rout, triggered a surge of mortgage applications. The refinance index jumped 17 percent in the week while the purchase index rose 4.0 percent. The latter is up 25 percent year-on-year. Rates backed up later in the week to end unchanged for the 10-year yield at 4.08 percent. The gain in the purchase index is another strong positive for housing strength going into year end.

You can see it’s up a large % from some very low prints last year this time, but more recently the 4 week moving average seems to have peaked and in general remains at historically very low levels:

This is from last week:

From the NAR: Pending Home Sales Inch Forward in July

The Pending Home Sales Index, a forward-looking indicator based on contract signings, marginally increased 0.5 percent to 110.9 in July from an upwardly revised 110.4 in June and is now 7.4 percent above July 2014 (103.3). The index has increased year-over-year for 11 consecutive months and is the third highest reading of 2015, behind April (111.6) and May (112.3).

This was below expectations of a 1.0% increase.

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in August and September.

Lower than expected and last month’s lower than expected print revised down some:

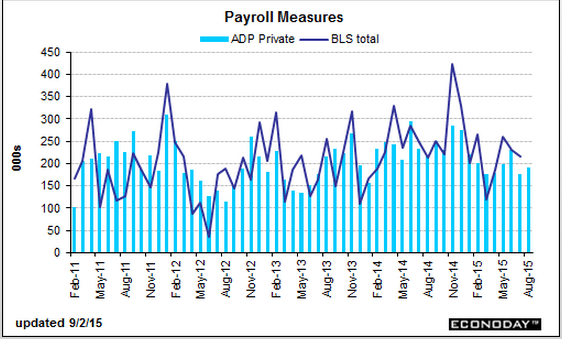

August 2015 ADP Job Growth at 190,000 – Below Consensus Expectations

By Steven Hansen

ADP reported non-farm private jobs growth at 190,000. The rolling averages of year-over-year jobs growth rate remains strong but the rate of growth continues in a downtrend.

States : ADP Employment Report

Highlights

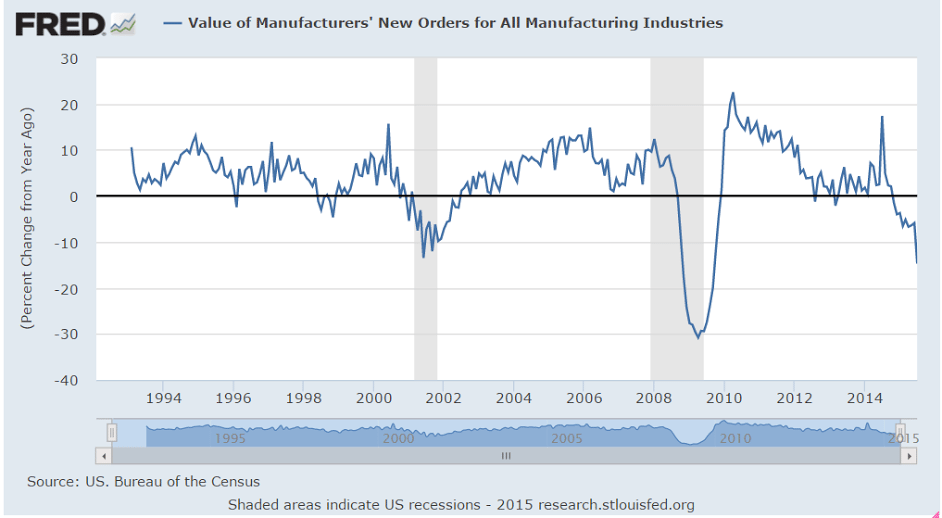

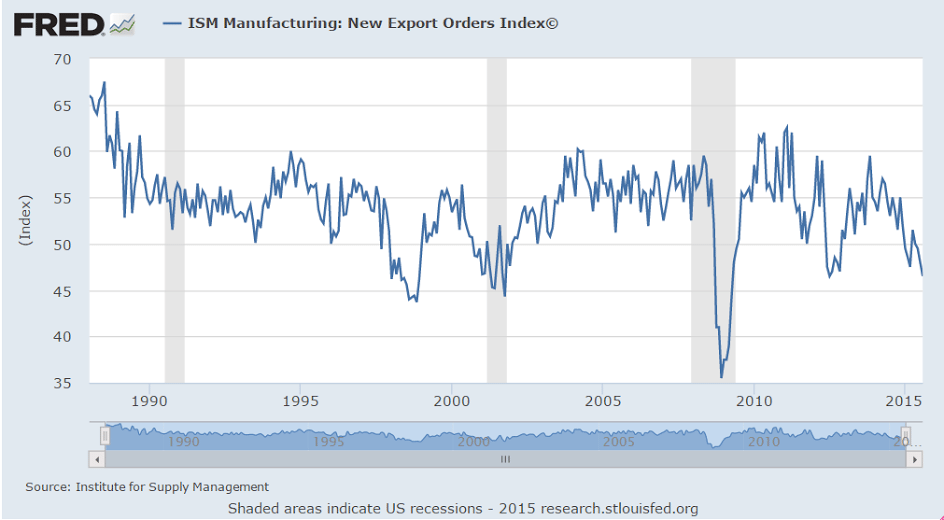

ADP, like it did for the July employment report, is calling for a sub-200,000 flop on Friday. ADP sees private payrolls rising 190,000 which is a sizable 20,000 below the Econoday consensus and right at the low estimate. ADP is revising down its July call even further lower and farther away from the government’s initial reading, to 177,000 vs ADP’s initial call for 185,000. The government’s private payroll reading was 210,000 in July and is expected to come in at 211,000 in August. However spotty ADP’s record is, today’s result is very likely to raise talk of a lower-than-expected report on Friday and a December, not a September, FOMC rate hike.This chart looks to me like it peaked back in November, about when oil prices collapsed, and has been continuously working it’s way lower subsequently:

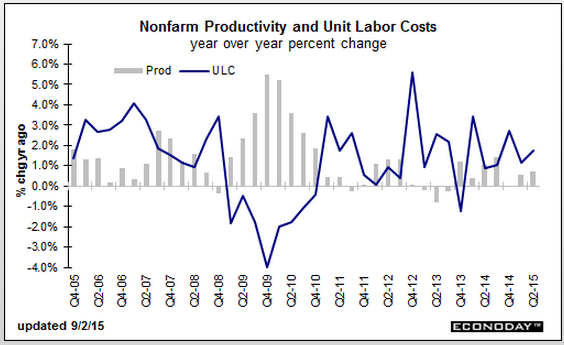

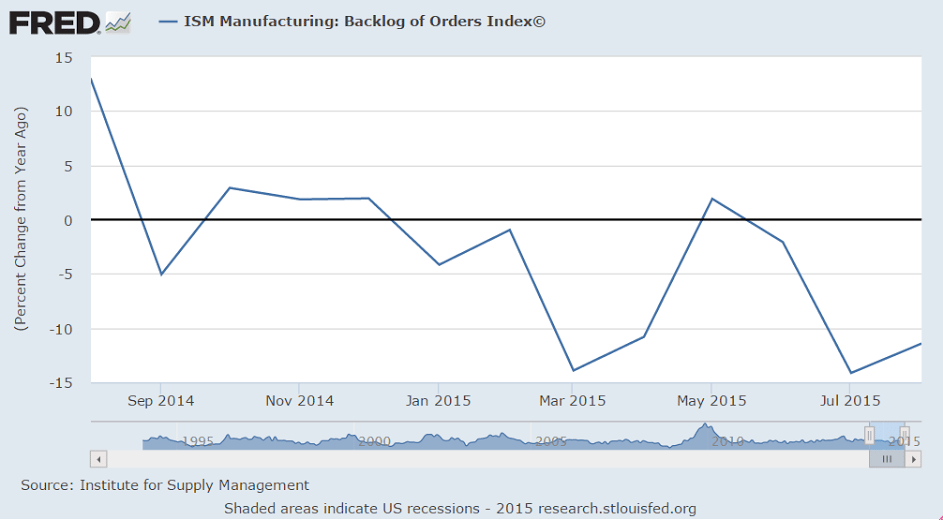

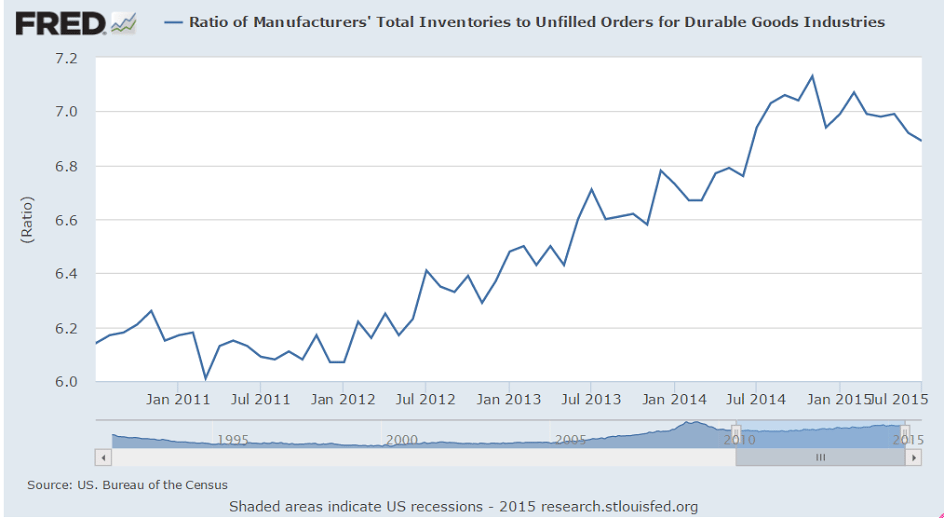

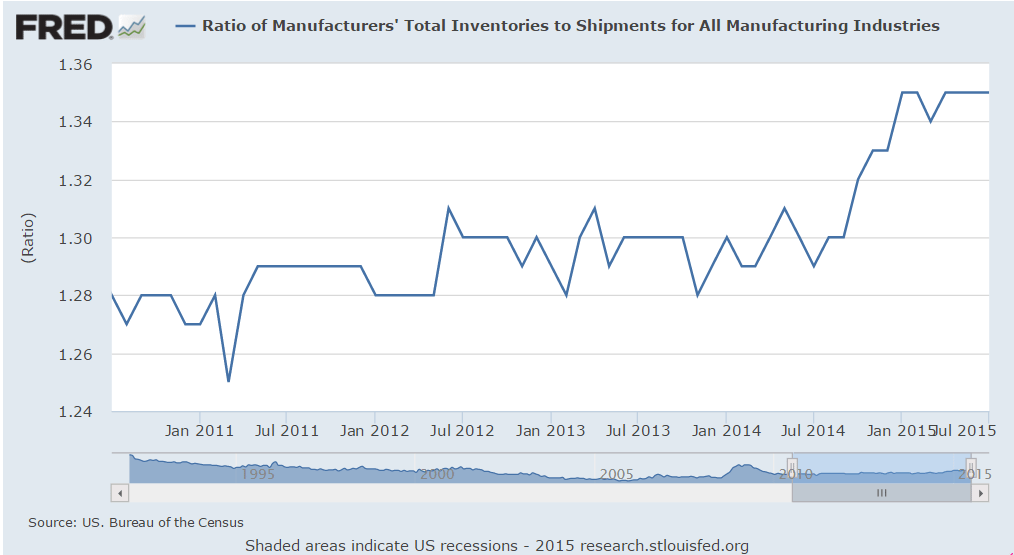

The low productivity and somewhat elevated unit labor costs tell me business has ‘over hired’ in relation to sales, which is in sync with the declining growth in employment, as well as with the higher reported inventories and declining industrial production and weak regional Fed surveys previously reported.

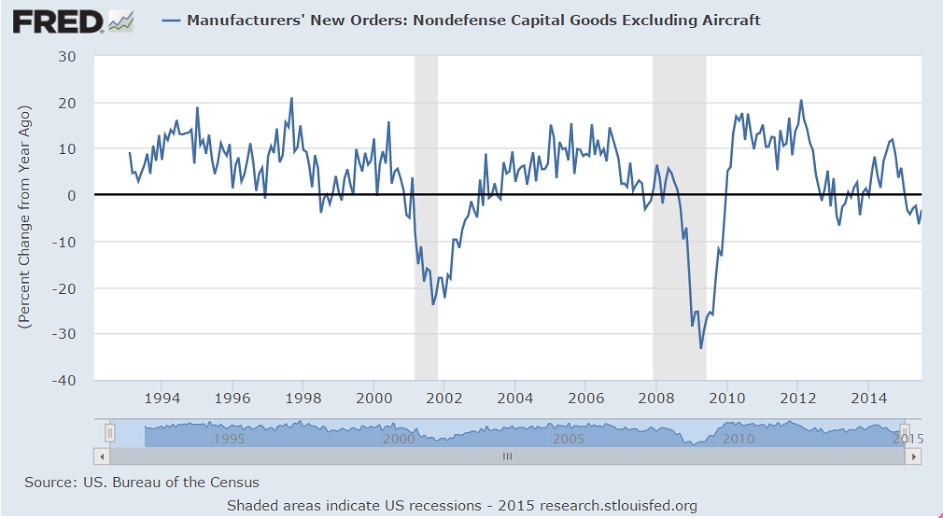

United States : Factory Orders

Highlights

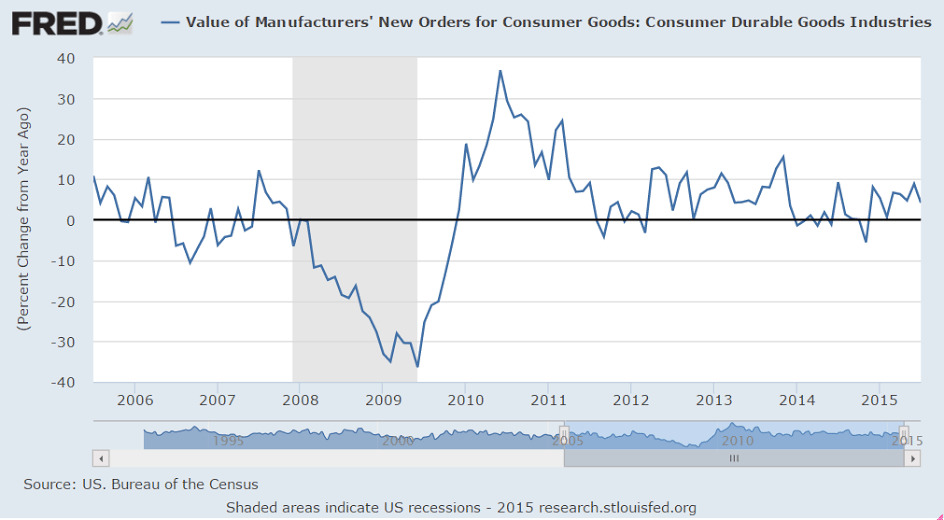

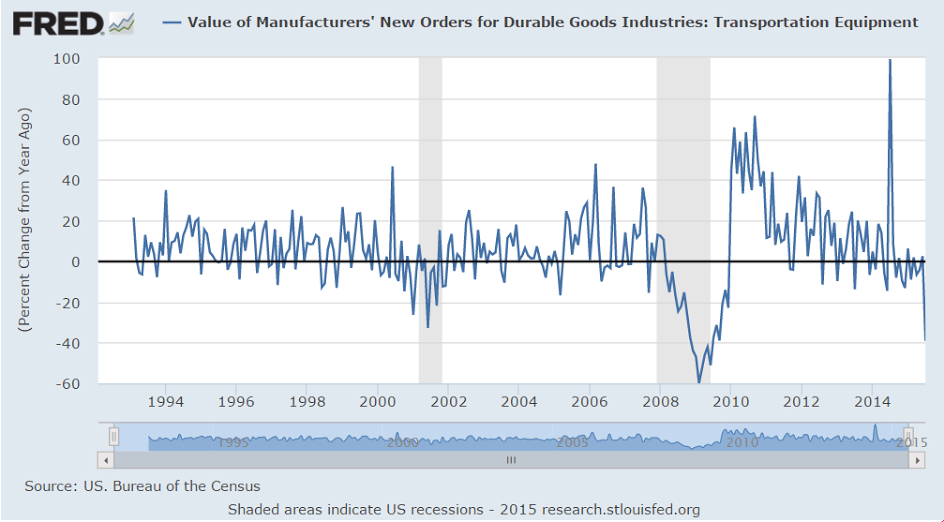

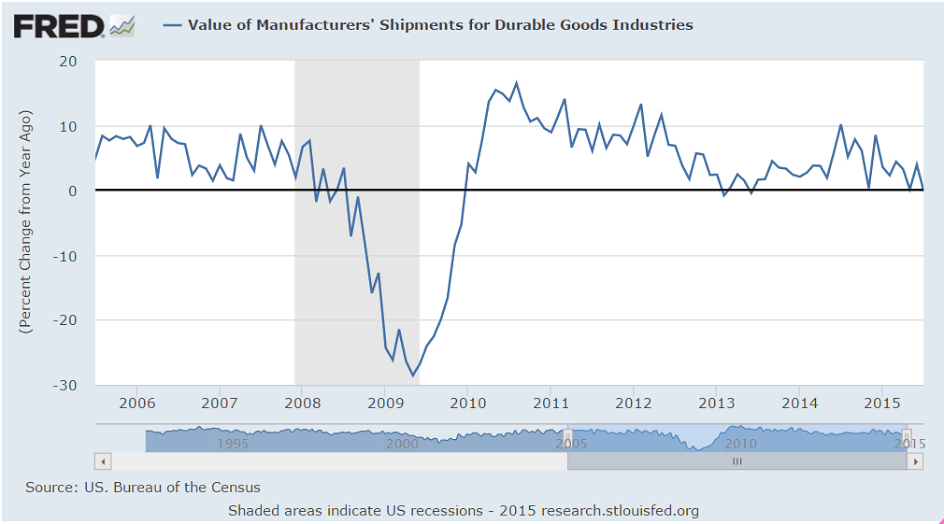

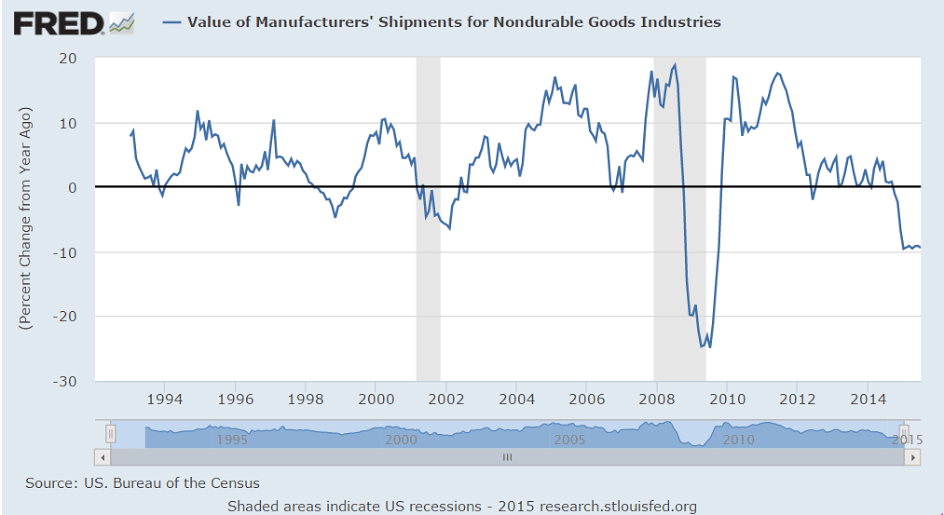

A lower-than-expected headline gain of 0.4 percent in July reflects price-related weakness in energy products and masks significant underlying strength in factory orders. Pulled down by petroleum and coal products, orders for non-durables fell a sharp 1.3 percent, offsetting a very strong and upward revised jump of 2.2 percent in durable goods orders (initially plus 2.0 percent as posted in last week’s advance durable goods report). The gain in durable goods was driven by gains in motor vehicles and includes strong gains for capital goods which indicate, at least it did as of July, rising business investment and rising confidence in the overall outlook.

Orders for vehicle bodies, parts & trailers jumped 4.0 percent in July after rising 1.2 percent in June. Orders for ships & boats have been on a special tear, up 19.5 percent following gains of 28.0 and 11.0 percent in the two prior reports. And the July report would have been even stronger if not for a 6.1 percent downswing in commercial aircraft orders that followed June’s 70 percent surge. Excluding transportation equipment, factory orders actually fell in July, down 0.6 percent following a 0.6 percent rise in June.

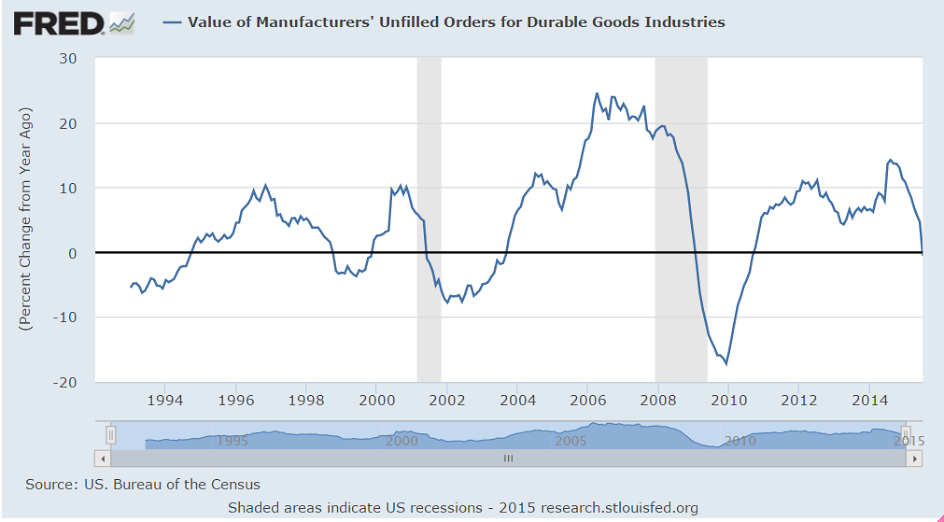

Turning to details on capital goods, core orders, that is nondefense goods excluding aircraft, jumped 2.1 percent on top of June’s 1.5 percent gain. Shipments for this reading, which are part of nonresidential fixed investment in the GDP report, rose 0.6 percent in July and 1.0 percent in June. Note that the 0.6 percent gain in July is unrevised which should not affect ongoing third-quarter GDP estimates.

Total shipments, again reflecting weakness in non-durables, slipped 0.2 percent in July. Unfilled orders rose 0.2 percent with inventories slipping 0.1 percent. The slip in inventories did not change the inventory-to-shipments ratio which is stable at 1.35.

Global volatility is a negative that hit in August and that may or may not weigh on the nation’s factory sector which, in the strength of the auto sector, enjoyed strong domestic-based demand in June and July. And given the strength of yesterday’s motor vehicle sales, the factory sector looks to get a continuing boost from the auto sector.