When it was going up it made headlines.

On the way down not a word…

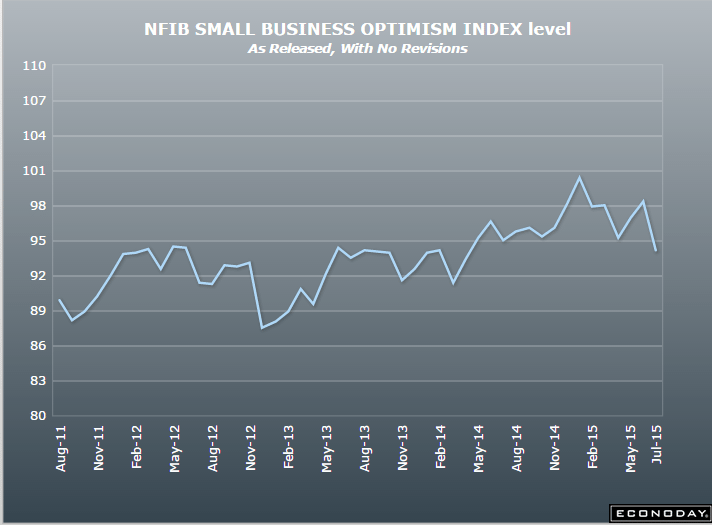

United States : NFIB Small Business Optimism Index

Highlights

Small business optimism fell very sharply in June, down 4.2 points to 94.1 with 8 of 10 components falling and pointing to weakness for the second half of the year. Earnings, which were the big strength in May, fell 10 points followed by current job openings and the outlook for company expansion which both fell 5 points. The only gainer in the month was inventory plans which rose sharply. Today’s report, like the June employment report, could be a surprise signal for slowing ahead.

On track with the general narrative that Q2 isn’t looking any better than Q1, and that we could already be in recession, depending on inventory adjustments and June trade data.

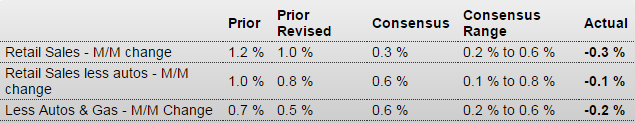

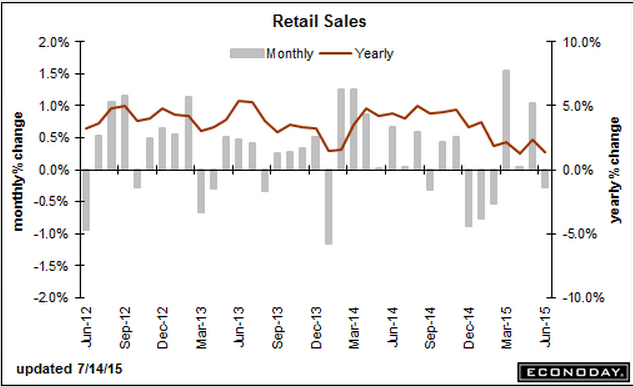

United States : Retail Sales

Highlights

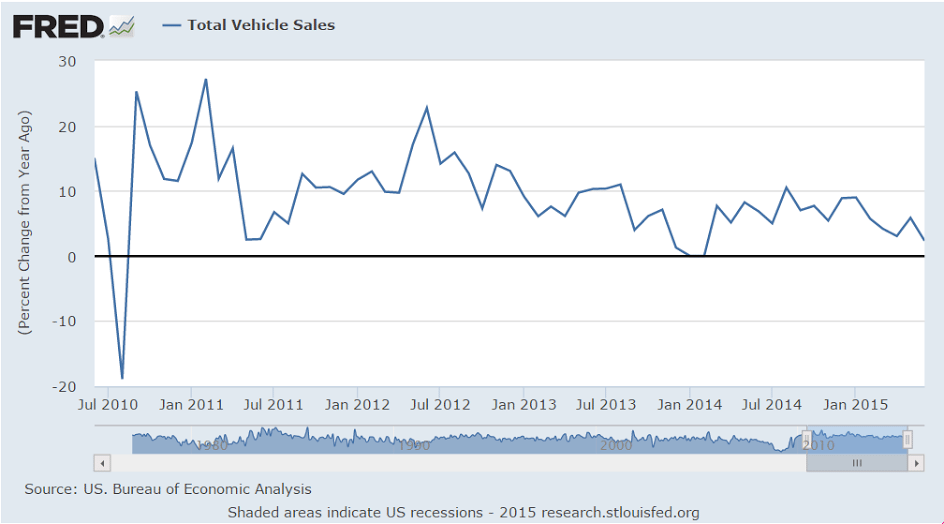

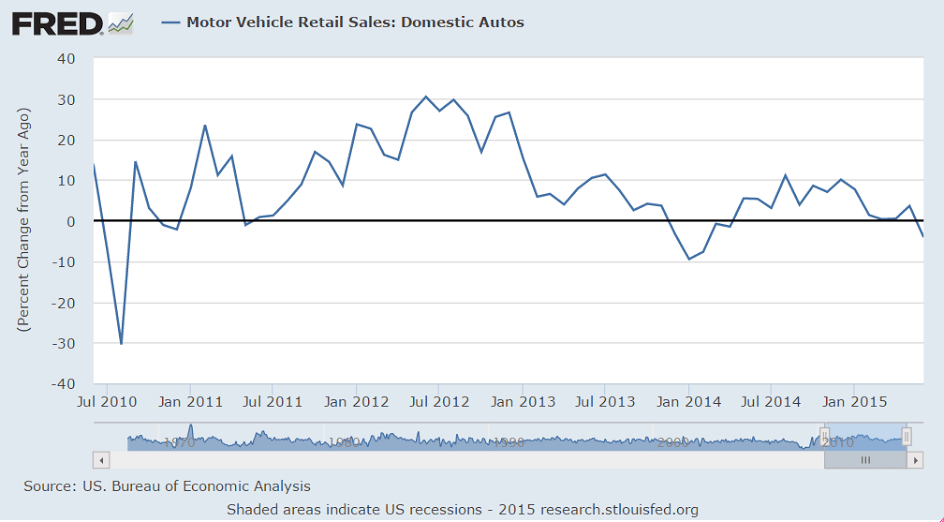

The second-quarter suddenly doesn’t look very strong as retail sales for June, showing broad weakness, came in way below expectations, at minus 0.3 percent. Motor vehicles were part of the reason, excluding which sales came in at only minus 0.1 percent. But excluding both autos and gasoline, core sales fell 0.2 percent.

The bounce back for gasoline prices has given gas station sales a lift the last couple of months, up 0.8 percent in June following May’s 3.7 percent surge. And there’s also two strong gains for the key general merchandise category which is up 0.7 percent and 1.4 percent the last two months. Electronic & appliance stores also show a solid gain, up 1.0 percent in June.

But that’s where the good news stops. Auto sales, though still at strong levels, fell 1.1 percent against an unusually strong May. Furniture sales fell 1.6 percent, apparel fell 1.5 percent, building materials fell 1.3 percent, and restaurants fell 0.2 percent.

The fall in restaurant sales doesn’t speak to the strong levels of consumer confidence that are being reported, readings that the Fed has been pointing to as a future indicator of strength for consumer spending. A look at year-on-year sales underscores the complete lack of consumer punch, at only plus 1.4 percent for total retail sales and only plus 2.7 percent for the core. This is a very disappointing report that will cut second-quarter GDP estimates and that will likely push back the outlook for the Fed’s rate hike from September to December, at least for now.

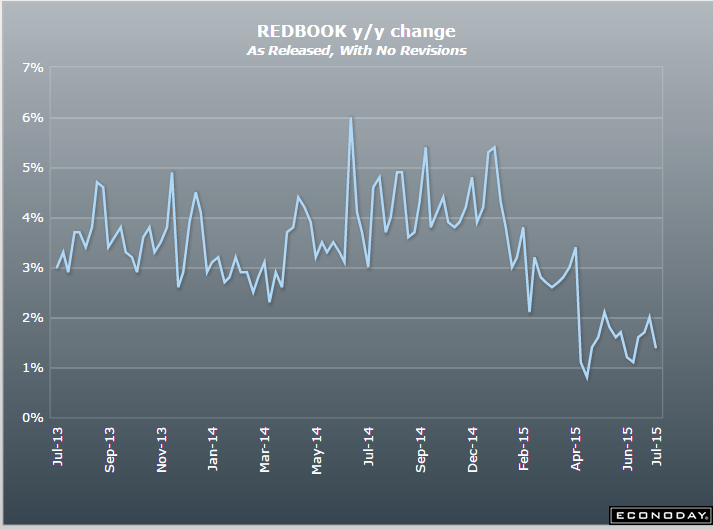

And, coincidentally, the retail sales report’s year over year gain of 1.4% matches the Redbook report:

United States : Redbook

Highlights

This morning’s retail sales report for June was very weak as are Redbook’s early indications for July with same-store year-on-year sales up only 1.4 percent in the July 11 week. Redbook’s sales rate, up until March, had trended in the 3 percent range. Still, Redbook sees sales picking up later this month and sees a slight gain compared to June.