More of same pro cyclical pressure:

France slammed by IMF for record-high spending

By Holly Ellyatt

May 20 (CNBC) — The International Monetary Fund (IMF) has warned France that it must reduce government spending and debt levels, as well as tackling its sticky unemployment rate.

The IMF said in its latest economic outlook on France, published on Tuesday, that although it sees a “solid short-term recovery (in France), structural rigidities continue to weigh on medium-term prospects.”

“Continued efforts are needed to tackle France’s fundamental economic problems: high structural unemployment, low potential growth, and record-high public spending,” the group added.

Indeed, the IMF noted that high and rising government spending has been “at the heart” of France’s fiscal problems for decades.

Trucking Tonnage Index Slumps in April 2015. Lowest Level In One Year.

Econintersect: The American Trucking Associations’ (ATA) trucking index declined 3% following an downwardly revised improvement of 0.4% in March. From ATA Chief Economist Bob Costello:

Still headed south. Maybe just a few more rate cuts…

New export orders declined means exporters putting more pressure on the govt to buy its euro back…

:(

China : PMI Flash Mfg Index

Highlights

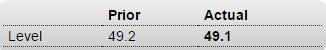

May’s flash manufacturing PMI remained mired in contraction with a reading of 49.1 which was an improvement over April’s reading of 48.9. The output index which was at the breakeven point between growth and contraction in April, skidded to a reading of 48.4. New orders decreased at a slower rate while new export orders declined after increasing in April. Five sub-indexes decreased but at a slower rate. These included employment, output and input prices, backlogs of work and stocks of purchases.

A bit of hope here as weak currency/lower relative wages drives a few export orders:

Japan : PMI Manufacturing Index Flash

Highlights

Japanese manufacturing returned to growth in May with its best performance since February. Japan’s flash May manufacturing PMI reading was 50.9, up a full point from the April final of 49.9. A reading above 50 signifies growth. The flash output index climbed to 51.7 from 49.3 in April. Along with these readings, new orders increased, changing direction. Both export orders and employment increased at a faster pace in May. However, backlogs decreased at a faster rate. Both the stocks of purchases and finished goods changed direction and decreased. The readings, if confirmed when the final PMI is released for May is a favorable sign that points to stabilization in the economy.