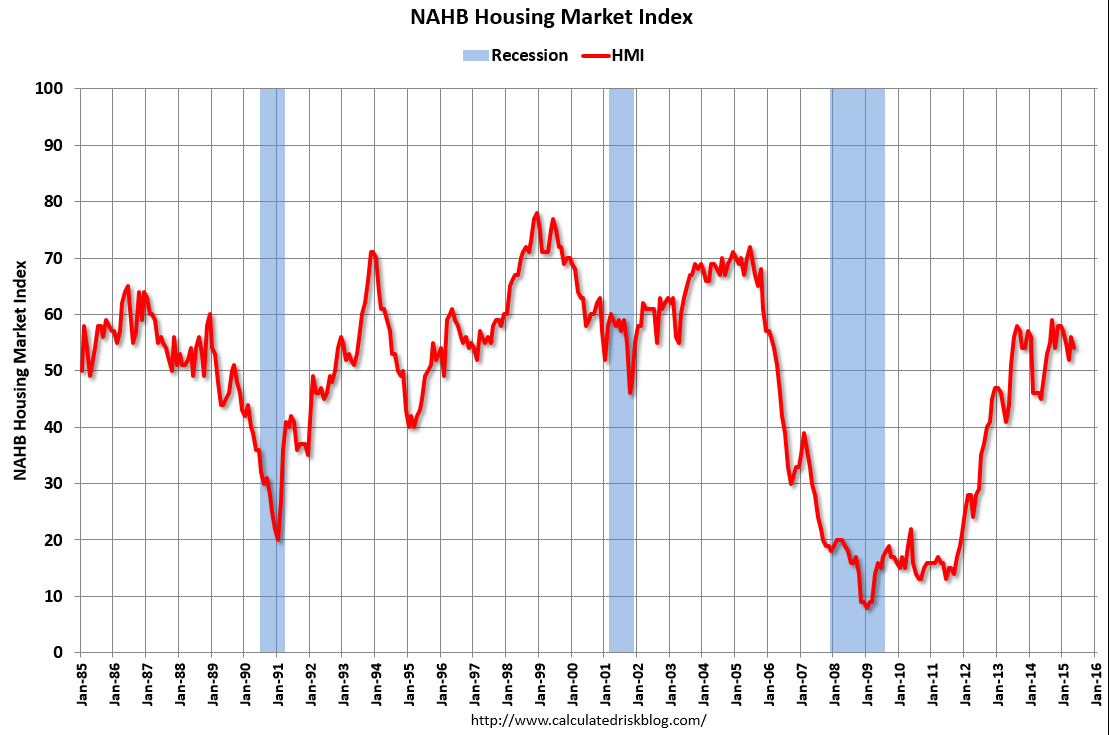

Doesn’t look like Q2 will be any better than Q1:

Housing Market Index

Highlights

The housing market index has long been signaling strength in the new home market that has yet to appear, but the signal is less strong in May. The index fell 2 points from April to 54 which is below the low-end Econoday forecast.

The dip reflects a 2-point slowing in present sales, which however remain well above breakeven 50 at 59, and a 1 point slowing for traffic to a very weak 39. Weakness in traffic has been a major feature of this report, underscoring the lack of first-time buyers in the housing sector. A plus in today’s report is a 1 point gain in future sales, a component that is well out in front at a very strong 64.

Regional trends show the South just out in front, at 57 for the 3-month composite average, vs 55 for both the Midwest and West. The Northeast, at 41, always lags far behind in the new home market.

Despite strength in this report, construction and sales of new homes have been holding down the economy. Housing starts & permits for April, to be released tomorrow, are expected to bounce back from a depressed March.