Not good again.

Looks like more than a ‘soft spot’ as so far no improvement for Q2:

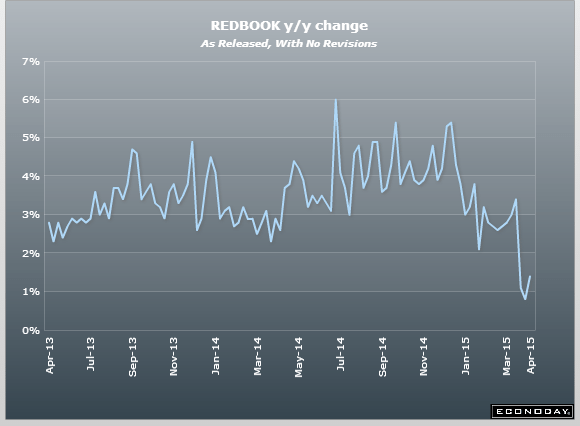

Redbook

Highlights

It’s hard to make heads or tails of weekly retail sales data surrounding Easter and its shifting comparisons. Redbook’s same-store year-on-year sales tally came in at a very weak plus 1.4 percent in the April 25 week which however is up from plus 0.8 percent in the prior week but well down from the plus 3.0 to 3.5 percent underlying trend. This trend, or somewhere close to it, is likely to re-emerge in next week’s report when Easter calendar distortions are no longer in play. Behind the distortions, however, Redbook does note that the overall performance is below plan though warmer weather did help seasonal sales in the latest week.

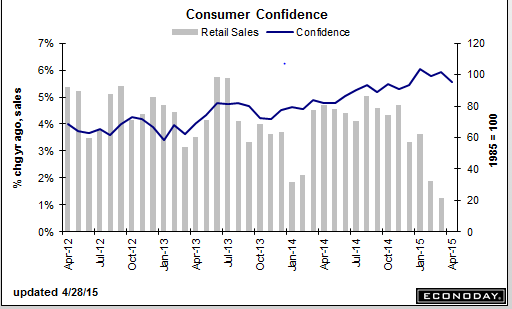

United States : Consumer Confidence

Highlights

Consumer confidence has fallen back noticeably this month, down more than 6 points to a much lower-than-expected 95.2. This compares very poorly with the Econoday consensus for 103.0 and is even far below the Econoday low estimate of 100.5. The weakness, ominously, is the result of falling assessments of the jobs market, both the current jobs market and expectations for the future jobs market. The second quarter, which is expected to be much stronger than the weather-depressed first quarter, isn’t likely to get off to a fast start, at least as far as this report goes.

Richmond Fed Manufacturing Index

Recent History Of This Indicator

The Richmond Fed manufacturing index in March fell into contraction, to minus 8 vs zero in February. Order readings, both for new orders and backlogs, were down substantially as were shipments and the workweek. Hiring, however, remained respectable, at least for now. Price readings showed only the most marginal pressure.