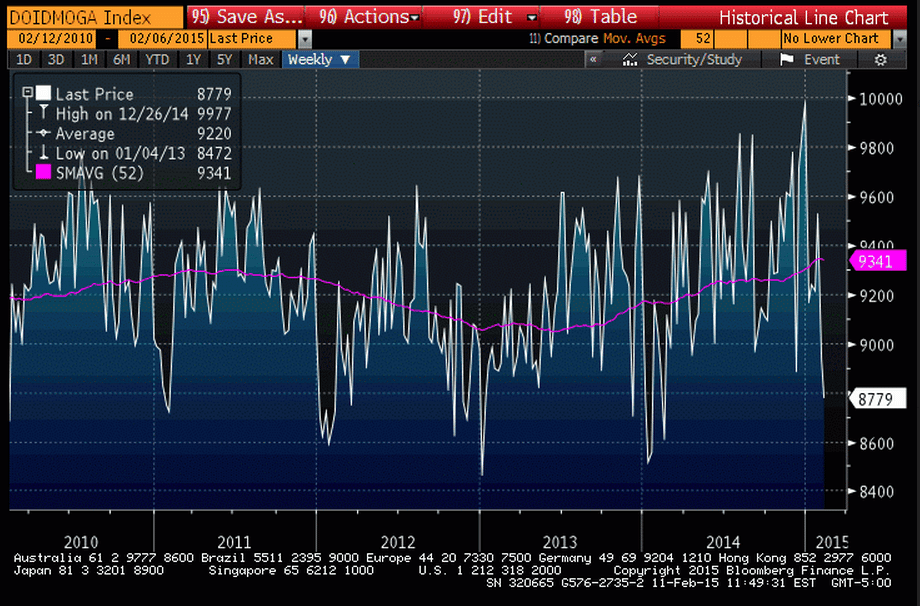

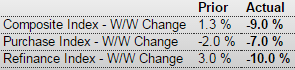

Not good. Purchase apps back down to depressed levels after a dip in front of govt mortgage fee cuts followed by a small blip up after the cuts, and up only 1% from last year’s cold winter depressed levels:

MBA Purchase Applications

Highlights

The purchase index fell 7.0 percent in the February 6 week for the 4th straight fall but still remains in the plus column on a year-on-year basis, but only by plus 1.0 percent. The refinance index, which unlike the purchase index has been showing life, fell back 10.0 percent in the week. Rates have been very low but did move higher in the week, up 5 basis points to an average 3.84 percent for conforming loans ($417,000 or less).

4Q14 earnings season is winding down and growth is slowing. After running close to +5% on a YoY basis, S&P operating earnings growth is now down to 3.5% and revenue growth is down to 1.3%

Gasoline demand down this week but may be moving up slightly vs last year but hard to say underlying demand is higher given last year’s extra cold winter