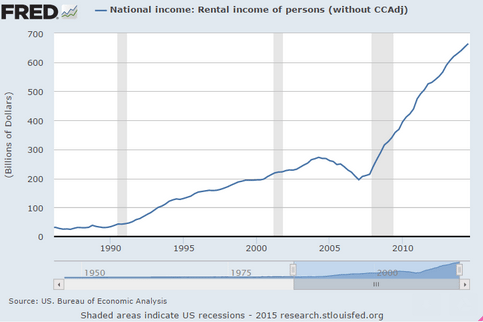

Looks to me like about $200 billion of annual income comes from increased oil and gas revenues over the last few years, just looking at the change in ‘slope’ and the difference between where it is now and where it would have been had the prior slope continued.

And I also suspect most of that increase is in the process of vanishing…

From the BEA:

Rental income of persons with capital consumption adjustment is the net income of persons (except those primarily engaged in the real estate business) from the rental of real property, the imputed net rental income of owner occupants of dwellings, and the royalties received by persons from patents, copyrights, and rights to natural resources.

ADDITIONAL NOTE:

I just got a note from a friend who did a lot more work on this than my simple extrapolation and he believes oil and gas revenue increases added about $65 billion last year. Still a very substantial figure but short of my $200 billion guestimate. He attributes much of the difference to an increase in owner equiv. rent, which I had simply assumed would grow as indicated by the prior slope, as anecdotally home building has remained depressed and the increases in owner equiv. rents used in the CPI calculations have been relatively small.