Highlights

Slowing growth is the signal from Markit’s US manufacturing sample where the final composite score came in at 53.9, down from November’s 54.8. The flash reading for December was 53.7. New business gains and output both slowed in the month which respondents tied to uncertainty over the global economic outlook. Export orders did rise but weak demand was noted in the euro area and emerging markets. The news on hiring is downbeat with growth the slowest since July. A negative for employment is a marked slowing in backlog accumulation. Inventory data look lean the price data subdued. Coming up next will be the ISM’s manufacturing report at 10:00 a.m. ET.

The index was down and below expectation and note the fall in export orders. Part of the downside of low oil prices could be a drop in exports to producing nations experiencing sharp declines in oil revenues.

Highlights

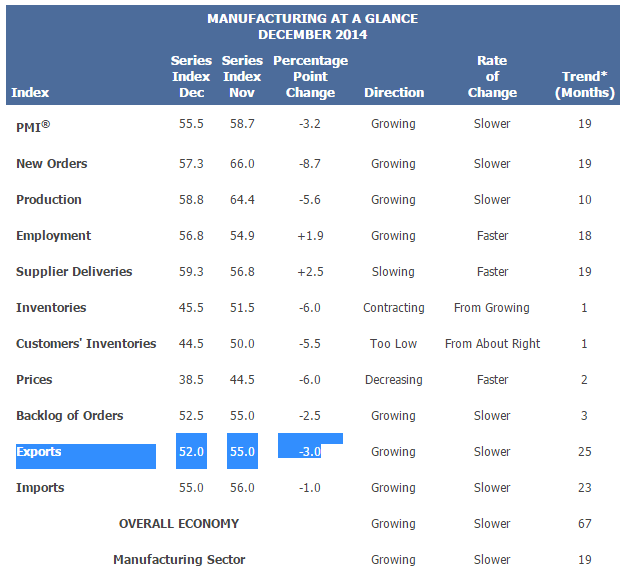

The ISM report had been running hot compared to many other measures of the manufacturing sector which should help limit the impact from the slowdown in today’s report. The ISM composite index came in at 55.5, down a sizable 3.2 points from November for the slowest rate of monthly growth in six months.

Growth in new orders slowed substantially, to 57.3 from November’s exceptionally strong 66.0, while backlog accumulation also slowed, to 52.5 from 55.0. Production slowed to 58.8 vs 64.4.Highlights

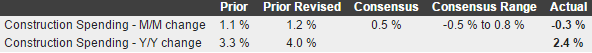

Construction outlays slipped 0.3 percent in November after a sharp 1.2 percent rebound in October. Market expectations were for a 0.5 percent gain.November’s decrease was led by public outlays which fell 1.7 percent after a 2.8 percent jump in October. Private residential spending rose 0.9 percent, matching the pace the month before. Private nonresidential construction spending dipped 0.3 percent in November after edging up 0.1 percent in October.

On a year-ago basis, total outlays were up 2.4 percent in November compared to 4.0 percent in October.

The construction sector is slowing, tugging down on fourth quarter GDP.