First, thanks to all for contributing to the record $41 million raised this year for Dana Farber by the PMC!!!

This all directly funds the discretionary research that makes Dana Farber what they are- the best!

If you are looking for good news on the economy don’t read the rest…

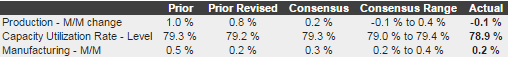

Industrial Production

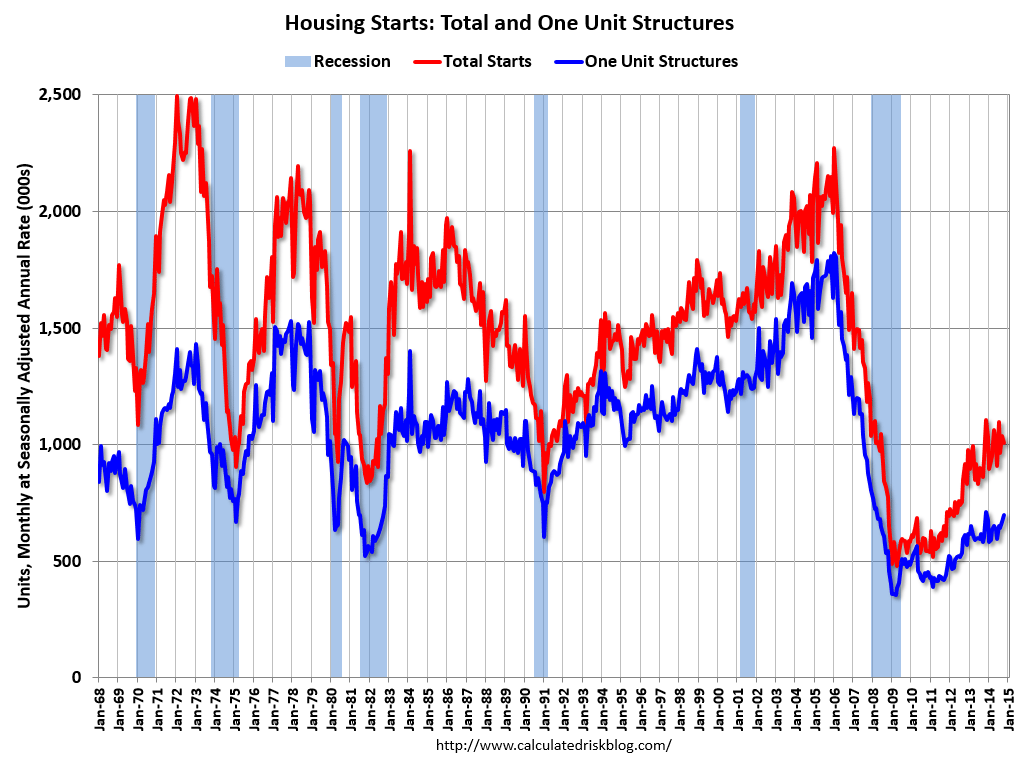

The builders may be a bit more optimistic than before, and there are fewer of them, but housing starts and sales remain weak a about half the usual rate for this point in the cycle,

and a higher % are the smaller/cheaper multifamily units:

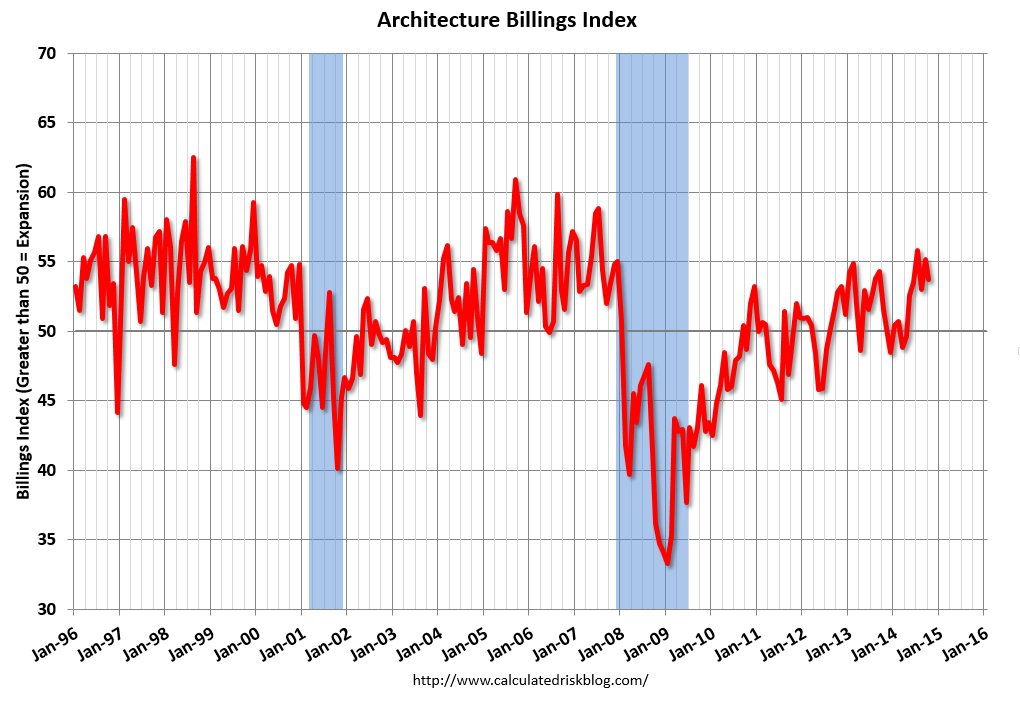

The architectural index slowed some and remains at relative weak levels:

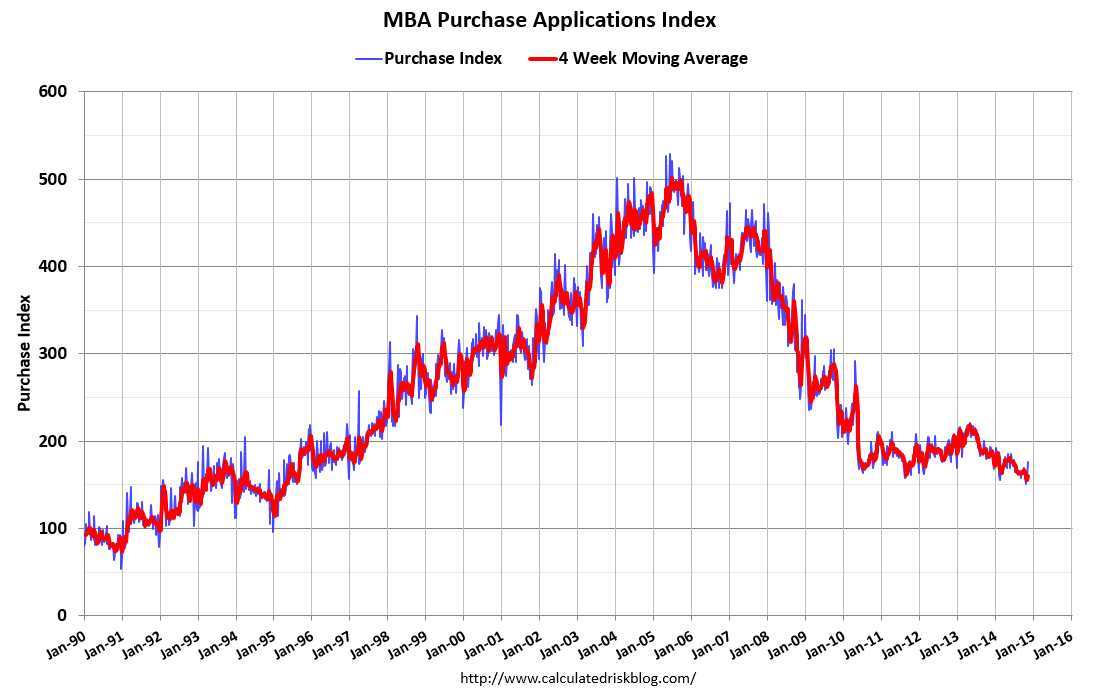

And mtg purchase apps were up some due to seasonal adjustments but remain down 6% year over year:

Again, seems nothing is growing faster this year vs last year, which as a point of logic means overall growth is less than last year.

And reports of capital spending cuts on energy related investments continue to be reported, while money saved by consumers at the pump is not yet

translating into spending elsewhere.

Exports remain under pressure as well, including reports of containers for export at Long Beach way down, etc.

Q3 GDP had two ‘suspect’ prints that added 2% to Q3’s 3.5% GDP print- an outsized export increase and an outsized govt spending increase, both of which historically ‘mean revert’ with the subsequent report. So excluding those two, Q3 would have only grown by 1.5%, and Q4, if anything, is so far slowing some since Q3. So if the two suspect releases do revert, Q4 could easily be negative.