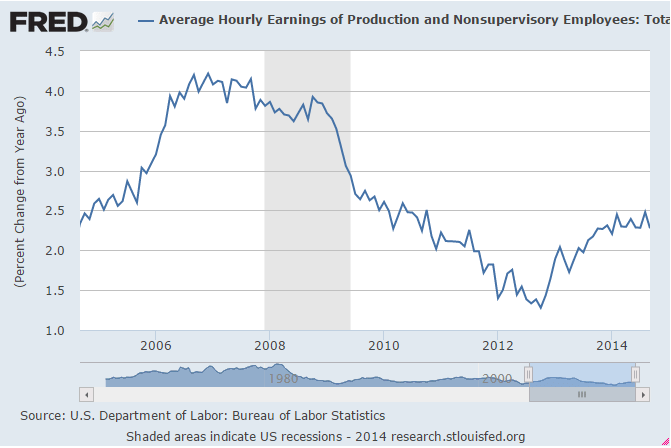

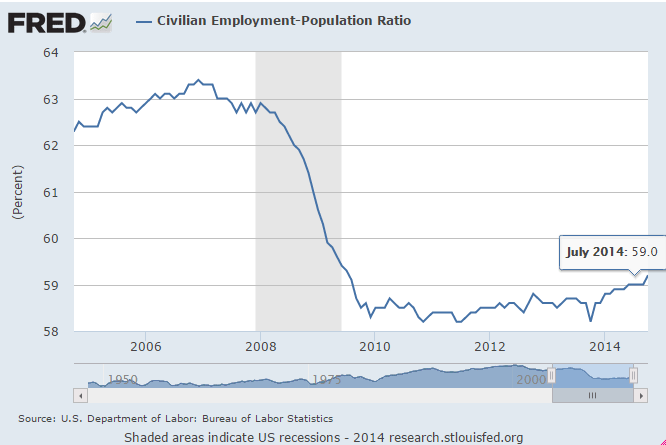

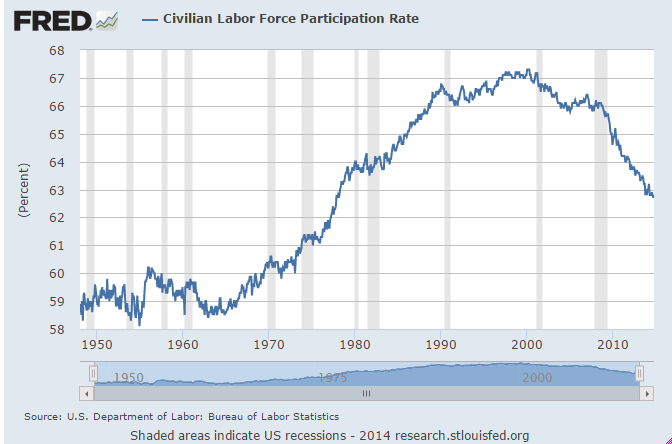

Seems universally agreed the labor market is ‘improving’ even as the jobs chart has been downward sloping since the peak in April, wage growth has softened from relatively low levels, and the work week fell back some.

It’s all screaming ‘lack of aggregate demand’ in no uncertain terms. That is, the deficit is too small. And the new Congress is heck bent on deficit reduction and the majority supports the balanced budget amendment to the constitution that needs only a few more states to pass.

So the recent data shows export growth fading, credit expansion fading, housing soft and housing prices in decline, car sales past their peak, retail sales fading, and even industrial production fading.

Not to mention the Saudi price cutting that could easily wipe out the energy related investment component of GDP.

Highlights

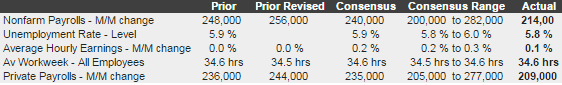

The October employment situation was mixed. Payroll jobs advanced but below expectations. The unemployment rate ticked down again. But wages remained soft. The data will let the Fed remain loose.

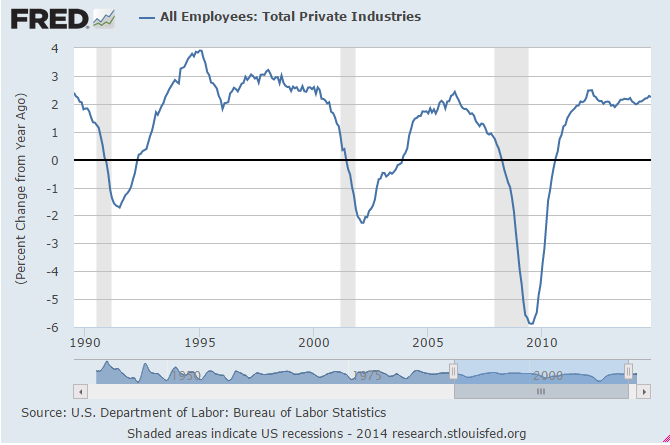

Nonfarm payroll jobs advanced 214,000 in October after gaining 256,000 September and 203,000 in August. Net revisions for August and September were up 31,000. The median market forecast for October was for a 240,000 boost.

The unemployment rate dipped to 5.8 percent in October from 5.9 percent in September. Expectations were for 5.9 percent.

Going back to the payroll report, private payrolls grew 209,000 after advancing 244,000 in September. Analysts projected 235,000.

Average hourly earnings edged up 0.1 percent after no change in September. Market forecasts were for 0.2 percent. Average weekly hours ticked up to 34.6 hours versus 34.5 hours in September. Projections were for 34.6 hours.

Essentially, the labor market is improving but slowly and remains soft. Based on today’s data and unless the numbers strengthen faster the Fed likely will not rush increases in policy rates.