Bill McBride and I agree this is the key takeaway.

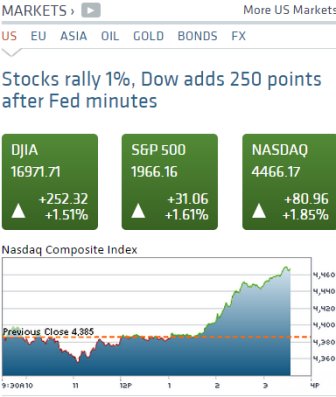

That is, the Fed still sees the risks as asymmetrical and therefore prefers to err on the side of ease. So stocks soar on the belief that low rates from the Fed will support earnings and valuations, as interest rates stay low believing the Fed will keep rates lower for longer.

Theory and evidence, however, continues to support my narrative that 0 rates and QE are deflationary and contractionary biases, and therefore the economy won’t accelerate as hoped for and as forecast by those believing otherwise.

FOMC Minutes: “Costs of downside shocks to the economy would be larger than those of upside shocks”

Note: Not every member of the FOMC agrees, but I think this is the key sentence: “the costs of downside shocks to the economy would be larger than those of upside shocks because, in current circumstances, it would be less problematic to remove accommodation quickly, if doing so becomes necessary, than to add accommodation”.