Looks to me like this business cycle is over?

This is a lack of demand story.

The FICA hike in Jan 2013, followed by the sequesters in April, and the aggressive automatic fiscal stabilizers doing their thing to reduce govt net spending add up to the walls coming in on the economy:

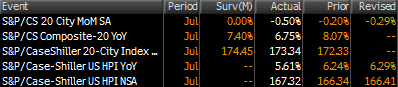

S&P Case-Shiller HPI

Highlights

Home prices were contracting sharply in July, down 0.5 percent for the third straight decline and the steepest monthly decline in Case-Shiller 20-city seasonally adjusted data going all the way back to November 2011. The reading is below the low end of the Econoday consensus and far below the 0.1 percent gain that was expected. The year-on-year rate, which has been coming down steadily all year from the low double digits, is at plus 6.7 percent for the lowest reading since November 2012 and down sharply from 8.0 percent in June.

Fourteen for the 20-city sample show declines in the month with Chicago and Minneapolis showing the most severe declines, at minus 1.6 percent in the month. Three cities show no change leaving three with gains led by Las Vegas at only plus 0.3 percent.