Full size image

Full size image

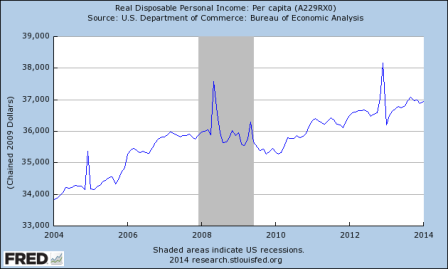

Mind the gap:

Full size image

This is below prior recession levels!

Full size image

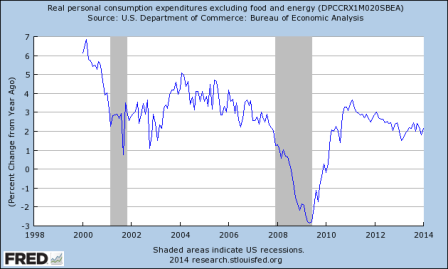

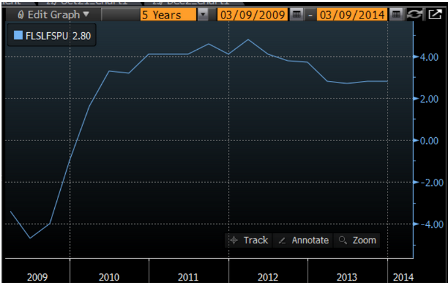

This is year over year growth in consumption of domestic product, which is GDP less capex less exports.

It shows how much ‘the consumer’ is spending on domestically produced goods and services:

Full size image

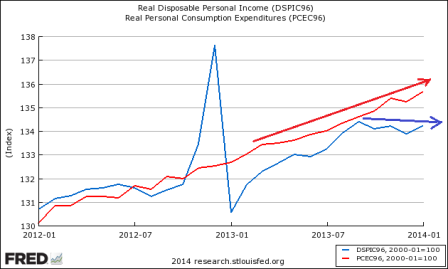

The underlying narrative is that proactive austerity damages income growth and thereafter requires a ‘jump’ in ‘borrowing to spend’/reduction in savings’ to sustain the prior levels of growth.

When growth itself brings the govt deficit down via the auto fiscal stabilizers, the needed credit growth/savings drop to replace the lost govt deficit spending is ‘already there proactively’ as it’s what drove the growth in the first place. So while the credit expansion/savings reduction needs to continue to grow to support GDP growth, the credit expansion/savings reduction doesn’t need to ‘spike up’ proactively as it does when the fiscal tightening is proactive.

So note that q3’s higher GDP growth included over 1% from additions to inventories. That represents a reduction in corporate savings from what it would have been if they had not net added to inventories. That is, consumers didn’t ‘jump the gap’ created by the ongoing increase in FICA vs the prior year, and the sequester cuts, that together proactively reduced govt deficit spending by over 1.5% of GDP (with the FICA hike adding to the automatic stabilizers as well). And Q4’s consumer spending on domestic product grew at a lower rate even as capex was higher. Also note that while capex growth for 2014 is forecast at about the same 5% as 2013, even with the high levels of energy investments, ultimately it’s largely a function of top line sales.

The reduction in net imports is a reduction in the growth of foreign savings of $ denominated financial assets, which does ‘make up’ for the reduction in govt deficit spending, depending on foreign demand. But it’s been ongoing and doesn’t look to be ‘jumping the spending gap.’

And note too that the running US deficit of about 3% of GDP is about the same as the euro zone’s and the Maastricht limit. So for me the question is whether this will make our economies converge as US income growth continues to decline?

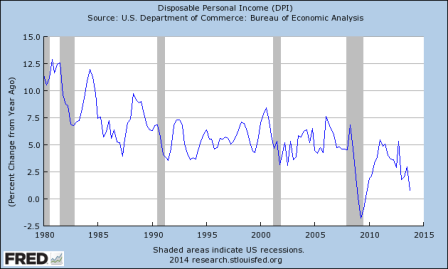

And, as previously discussed, the 0 rate policy has worked to directly bring down personal income. Also note that personal income growth has slowed coincidentally with the approx 200,000/mo additions to total employment.

So seems that the income added by that much new employment isn’t enough to keep overall (after tax) personal income growth positive.