Highlights

Frigid weather in January didn’t help the factory sector where orders fell 0.7 percent following a downwardly revised 2.0 percent decline in December. Also revised lower is the ex-transportation reading for January, to a slim plus 0.2 percent vs an initial reading (in last week’s durable goods report) of plus 1.1 percent. Non-durables are the new data in today’s report which show a 0.4 percent decline on weakness in chemical products.

Orders for primary metals show a third month of contraction, at minus 1.2 percent in January, with transportation equipment a second month of contraction, at minus 5.7 percent vs a 12.1 percent plunge in December. The bulk of the weakness in transportation is tied to the ups and down of commercial aircraft orders but also to motor vehicles, where orders fell 0.9 percent following December’s 1.2 percent decline. Machinery also shows a decline in January along with electrical equipment and furniture, the latter two of which are tied to housing. The plus side shows a big gain for fabricated metals, one however that follows a big loss in December, and a gain for computer equipment that doesn’t offset a much larger December decline.

Shipments fell 0.3 percent for a second month in a row while inventories rose 0.2 percent, a moderate build but enough, given the weakness in shipments, to raise the inventory-to-shipments ratio one notch to the heavy side to 1.30. Unfilled orders were unchanged in the month.

There is a positive in the report and that’s capital goods orders excluding aircraft, a core reading on business investment that rose 1.5 percent. Still, the gain isn’t enough to offset a 1.6 percent decline for this reading in the prior month.

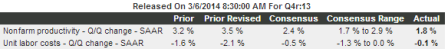

Factory orders are a choppy series, sometimes up and sometimes down, but the trendline has been flat at best. Anecdotal indications on February point to another month of weakness for shipments, weakness tied to heavy weather, but, in what hopefully points to a bounce back for the spring, respectable strength for orders.

Chart looks like the weather turned bad in May:

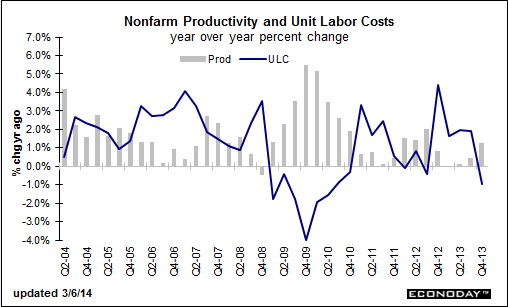

Lots of talk about ‘wage inflation’ but not showing up for real so far:

Highlights

Productivity in the fourth quarter rose a revised1.8 percent after a 3.5 percent boost the prior quarter. Expectations were for 2.4 percent increase. Unit labor costs declined an annualized 0.1 percent, following a decrease of 2.1 percent in the third quarter. The market forecast was for a 0.5 percent decline.

The rise in productivity reflected a 3.4 percent jump in non-farm output, following a boost of 5.4 percent in the third quarter. Hours worked increased 1.6 percent in the fourth after rising an annualized 1.9 in the third quarter. Compensation firmed to a 1.7 percent rate after rising 1.3 percent in the third quarter.

Year-on-year, productivity was up 1.3 percent in the fourth quarter versus up 0.5 percent in the third quarter. Year-ago unit labor costs were down 0.9 percent, compared to up 1.9 percent in the third quarter.