It’s going to take more than two weak prints to sway the Fed…

I see the odds of this expansion cycle being over increasing with each release, as the drivers of H2 continue to fade- housing, cars, income, inventory, and, at least for now, jobs.

And the federal deficit- the economy’s ‘allowance’ from Uncle Sam- is no longer enough to offset the demand leakages/unspent income inherent in the institutional structure.

That is, we’re flying without a net.

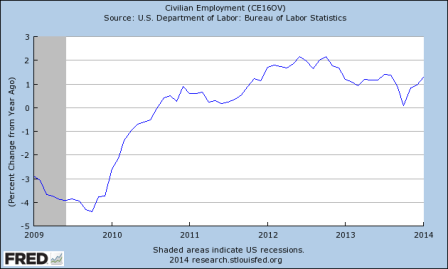

*note that the household survey was about 1 million jobs short of the payroll survey over the last year and routinely dismissed as an inferior indicator, and the rate of growth remains well below the Nonfarm Payroll report even after today’s release:

Full size image

The jump in productivity is making the rounds. It takes a lot more top line growth to need 200,000 new employees every month with this kind of productivity growth. Could be the ‘extra’ jobs we’ve seen, implying much lower productivity increases, were due to getting ‘over lean’ during the recession, and that ‘deficiency’ may now be behind us.

And note that the lower average job growth as per the household survey has been more in line with productivity over the last year.

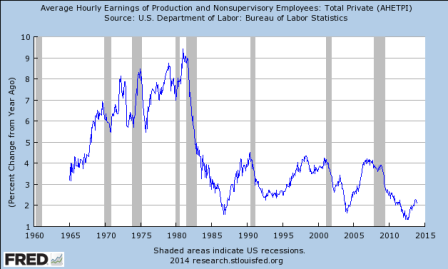

I’m also thinking those with expiring benefits suddenly willing to take lower paying jobs will simply displace others already working in those job, which will work to keep hourly wages lower than otherwise.

Not updated for today’s yoy print of +1.9%:

Full size image