Might be a reversal in out sized +1.3 contribution to GDP from exports coming?

And EM and yen currency weakness not helping US exports, while US earnings translations also getting hurt.

Highlights

Growth in composite activity slowed a bit last month for Markit’s US manufacturing sample where the PMI posted a final January reading of 53.7, unchanged from the flash reading at mid-month and down 1.3 points from final December.

Weakness in order readings is the key negative in the January report. Monthly growth in new orders slowed 2.1 points from final December to 53.9 which, nevertheless, is a respectable rate. The other two order readings in the sample, however, moved below 50 and into contraction in the month with new export orders at 48.4 for a 3.0 point loss and backlog orders down 3.6 points to 49.2.

Lack of orders points to weakness ahead for output where growth already slowed markedly in January, down 4 points to 53.5. Lack of orders is also a negative for employment which fell 8 tenths to 53.2.

Inventory readings show noticeable draws that suggest manufacturers, looking down the road at weakness in new orders, aren’t actively restocking, while price readings show marginal and easing pressure. The easing in price pressures is important to note at this time of year, suggesting that manufacturers aren’t getting much price traction yet for beginning-of-year price increases.

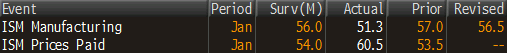

Most readings on manufacturing began to improve until late in the fourth quarter with today’s report not pointing to any rebound at the beginning of the first quarter. Watch later this morning on the Econoday calendar for the closely watched ISM report which has been consistently offering some of the strongest readings of all on the manufacturing economy.

Still positive, but maybe moving back to the ‘pre inventory building’ pace of the last few reports?

The bad news is centered, unfortunately, in new orders which are down a very steep 13.2 points to 51.3. This is one of the largest monthly declines on record. If there is solace, it’s that the plus-50 rate of 51.3 rate still points to monthly growth, just at a much much slower pace than December.

And new export orders fell a point here as well.

Chart looking very tame, even with housing strength which may be the expiring year end tax credit thing:

Strength was in private residential outlays which jumped 2.6 percent in December, following a 1.1 percent rise the month before.

GM car sales down, with GM now estimating only a 15.3 million annual rate of total vehicle sales for Jan vs 15.4 in Dec.

Final numbers later today: