I like this report.

The overnight data does still look to me like there are signs of it all stabilizing

but it also seems like that will only bring more fiscal tightening to ensure the output gap remains wide.

Poor Macro Money Data, Eurozone

First a quick point on our asset allocation biases. We are still Risk OFF, despite the over 3% decline on the Eurostoxx and the 1.70% hike on the Bund since we issued our recommendation. The reasons for this Risk Of remain valid and the presentation of the new Spanish government budget yesterday does not change our opinion. I consider the macroeconomic forecasts on which it is based to be unrealistic. Both the hoped for 3.8% hike in tax receipts and the projection that unemployment has peaked this year appear very optimistic in such a depressive context!

The earlier examples of “adjustments” imposed by the Troika in eurozone countries who agreed to these bailout plans only demonstrate that the application of harsh austerity treatment in the midst of a severe recession is counterproductive. The decline in the Debt/GDP denominator accelerates the flight of private capital, thereby making the country’s economy all the more vulnerable to “negative disequilibria”.

The repetition last Friday morning by Herr (Darth) Schäuble of the main points made in the letter he signed with the Dutch and Finnish finance ministers (legacy assets, etc) highlights how the reticence of eurozone “creditors” is threatening the hopes raided by the European summit of June 29th.

However, let’s take a look at the eurozone macro monetary figures published Thursday and Friday because they show that the ECB must remain on high alert since they show a continuous worsening of monetary conditions, despite the measures already taken.

And yet, when I see the alarmist statements by Mr Weidmann on the dangers of inflation created by the OMT or those made by Mr Asmussen warning that the ECB would intervene immediately in case of a spike in inflationary risk, I wonder on what planet they are living!

I understand these statements are motivated by domestic political consideration: i.e. the need to reassure savers frightened by a reduction in purchasing power stemming from real negative interest rates, especially since these savers mainly vote for Chancellor Merkel’s party, given that they are made up of retirees and others from comfortable segments of society.

But a comparison of this approach with that of the Fed, which instead is doing all it can to revive inflationist expectations by using precisely these expectations to contend with “0% Lower Bound”, is more than a bit worrisome.

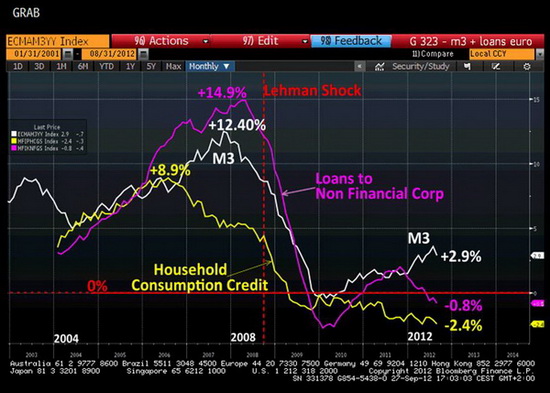

Here are my favorite two graphs updated to included data from August.

M3 and Core CPI

As readers know, I am anything but a hardcore monetarist, because I consider that the ratio emphasized by the fans of the “Quantity of Money” theory does not account for changes in money velocity (the V in MV=PQ). These monetarists have a “vertical”conception of money in which the central bank is the sole agent of money creation. But M3 is in reality the consequence of the “horizontal” nature of money, i.e. its creation by private-sector banking (Loans make Deposits). The money verticality that does exist is of a totally different nature since it relates to budget deficits whereby the state injects financial assets into the private sector (treasuries) to finance spending. However, the graph above shows just how much the M3 curve has changed since the outbreak of the Great Financial Crisis, with a decline in annual growth from over 8% between 2001 and 2008 to a miserable 1.05% since then.

Some people claim that a certain amount of inflation paranoia is validated by the CPI published Friday morning, +2.7% annually, given that the consensus was looking for +2.4%, i.e. higher than the target set by the ECB. Maybe we would be treated to a new hike in key interest rates if Mr Trichet were still head of the ECB. But I think that those currently in charge of monetary policy are conscious of the temporary nature of the effect of indirect tax and commodity price rises and that the inflation index could fall below the ECB target in H2 2013.

M3, and loans to businesses and households

Much more relevant than M3, and perfectly consistent with our report on money velocity, these two statistics (loans to consumers and non-financial businesses) paint a much grimmer picture of the monetary situation in Europe.

Down -2.4% yoy at 31 August, consumer loans are declining at their steepest rate since this figure began publication! The decline has been continuous since the beginning of 2009, which compares to nearly 9% annual growth in mid-2006.

No matter how big the interest rate cuts, none of them will persuade people to spend more when they are worried about losing their job and about the possible implosion of the eurozone. In that context, I am utterly baffled when I hear Mr Asmussen declare, as he did just a few minutes ago, that banks are at fault because they are not lending out their surplus reserves!

Remember, banks do not lend their reserves (Loans make Deposits). At best, they can lend to banks short of reserves! In fact, that would reduce the central bank’s balance sheet which continues to play its role as intermediary on the still nonexistent interbank market. This highlights the need to give priority to the recapitalization of struggling banks in the system, even if we have to override the opposition of certain northern country finance ministers.

From a qualitative viewpoint, the ECB also released its monthly Euro Money Market Survey Friday morning, i.e. liquidity circulation within the banking system (V).

And here too, the picture is frightening.

The spot (next day) market has contracted 50% in the past year.

On the unsecured market, transactions in Q2 2012 plunged by about an annual 35%, while the secured market declined 15% !

Moreover, the ratio for these latter transactions, compensated by a counterparty clearinghouse (Cedel, Clearnet, etc.), now stands at 55%.

This highlights the degree of distrust in the interbank system. So I will end this letter today with the ECB staff’s own conclusion!

The qualitative part of the survey shows that efficiency in the unsecured market was deemed to have worsened markedly in comparison with 2011. Liquidity conditions were also perceived to have deteriorated. As regards the secured segment, the number of respondents giving a positive assessment of the market’s efficiency increased, although liquidity conditions were perceived as being worse than in 2011. For most other market segments, the perception of efficiency was more positive in 2012, whereas it was generally felt that liquidity conditions had deteriorated.

Between monetary verticality in free fall (generalized austerity) and evaporated horzontality (nonexistent interbank market), is there still hope?

Central banks cannot solve these problems all by themselves.