I may have mentioned that for the size govt we have we are grossly over taxed?

;)

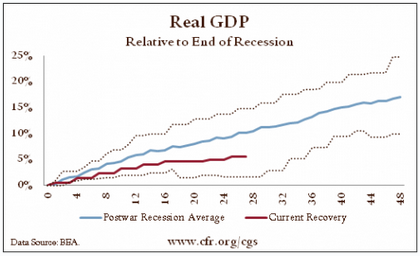

Real GDP is growing, but weakly compared with the postwar average recovery.

The recovery from the 1980 recession was even weaker at this stage, but that reflected a double-dip recession in 1981.

The economy would have to grow at a 7.6 percent annualized rate in order to catch up with the average postwar recovery by the end of 2012.

The consensus forecast for 2012 growth as reported by Bloomberg is 2.1 percent, up just slightly from a forecast of 2.0 percent as of last October.

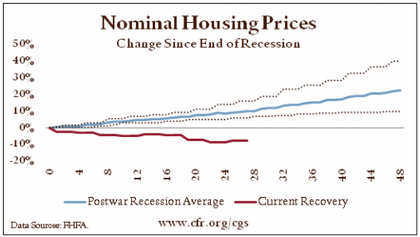

Soft home prices have been central to the weakness of the recovery.

The continued weakness of nominal home prices is a postwar anomaly.

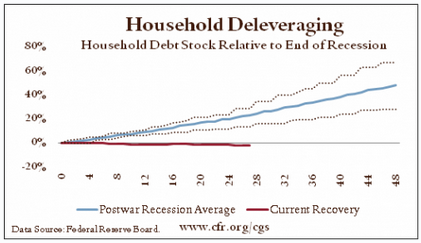

In every previous postwar recovery, the stock of household debt has risen as the recovery has begun.

In the current recovery, the collapse in home prices has severely damaged household balance sheets. As a result, consumers have avoided taking on new debt.

The result is weak consumer demand and, hence, a slow recovery.

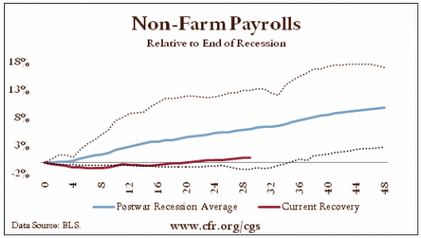

The slow recovery is obvious in the labor market, where job growth remains painfully sluggish compared to the average recovery.

The recent uptick at the end of the Current Recovery linev(red) is the result of encouraging payroll data announced on January 6th 2012.

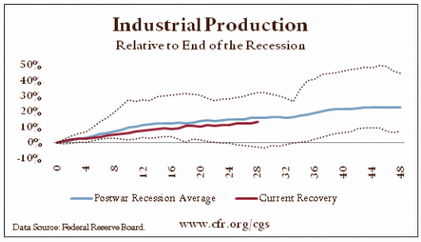

Because of the depth of the recent recession, one might expect stronger-than-average improvement in industrial production.

Despite the predicted snapback, the increase in industrial production during this recovery is actually slightly slower than in the average postwar case.

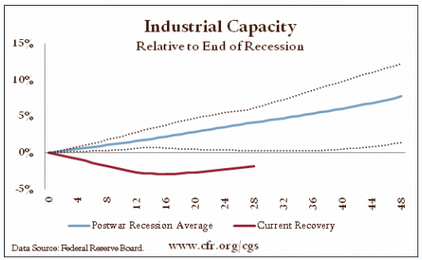

Capacity in manufacturing, mining, and electric and gas utilities usually grows steadily from the start of a recovery.

However, during the current recovery, investment has been so low that capacity is actually declining. Plants and machinery are depreciating faster than they are being installed.

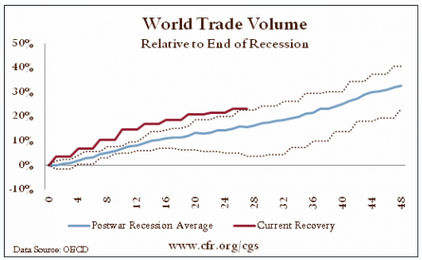

The growth in world trade exceeds even the best postwar experiences.

However, this reflects the depth of the fall during the recession.

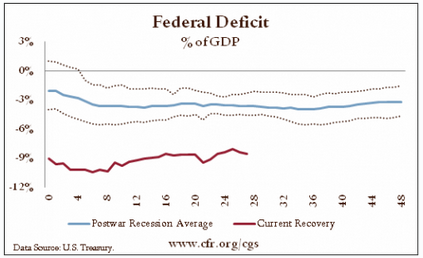

The federal deficit since the start of the recovery has been much higher than in previous postwar cases.

Although the deficit has shrunk slightly, its level creates significant challenges for policymakers and the economy.

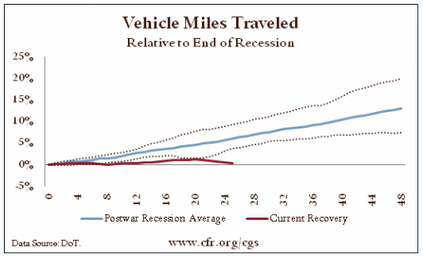

The traditional American enthusiasm for the road has been dulled by a combination of weak recovery and high fuel prices.

When compared to other postwar recessions, total vehicle miles traveled in this current recovery has not only lagged the average, but has registered no growth whatever.