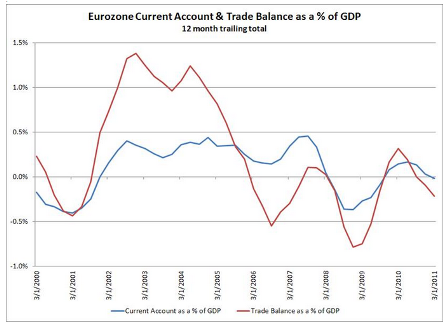

So looks to me that China shifted to buying more euro just as the trade flows were turning the other way and might have otherwise been weakening the euro.

This means that when they stop buying there could be serious gap down until it gets to where it would have gotten had China not been buying. (Kind of like taking your finger out of the hole in the dam.)

Which is maybe what happened when it peaked a few weeks ago at the time of Bernanke’s first strong dollar speech?

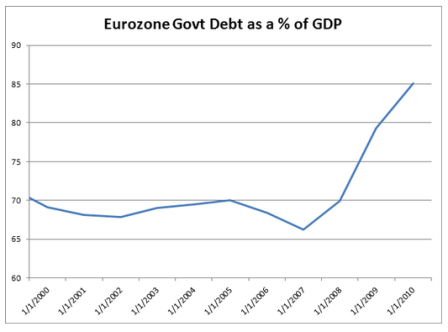

And the rising euro zone debt to GDP ratio (which is only through 2010 on the below chart) though falling some this year with austerity, may now be rising again due to new weakness created by that same austerity.

It’s all starting to look a lot like the beginnings of the traditional banana republic model- high unemployment, high ‘bad’ deficits from weak economies, and a falling currency that keeps debt to gdp ratios capped as ‘inflation’ floods in through the fx window.