Also note that long term forecasts continue to assume ‘appropriate monetary policy’

This means the forecasts contain the assumption that the Fed can hit it’s long term goals for inflation and unemployment by adjusting ‘monetary policy’

In other words, the presumption of being able to hit their targets means the longer term forecasts are nothing more than the their targets.

This is in contrast with non Fed forecasters, who attempt to forecast actual results, which while they do incorporate assumptions about monetary policy, do not necessarily assume those Fed policy adjustments will be successful.

Karim writes:

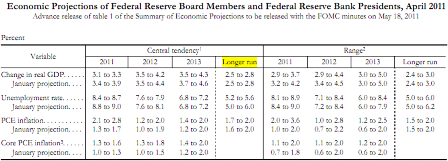

- Mid-point of 2012 Core PCE forecast now 1.55%! Rates wont be 25bps in that event

- 2011 GDP growth shaved lower by 0.3% (now 3.25%)

- 2012 GDP growth lower by 0.1% (now 3.85%)

- Unemployment rate lower by 0.35% in 2011 (now 8.55% by Q4) and lower by 0.1% next year (now 7.75%).

LAST STATEMENT (MARCH) AND FORECASTS (JANUARY)

Federal Reserve Press Release

Release Date: March 15, 2011

For immediate release

Information received since the Federal Open Market Committee met in January suggests that the economic recovery is on a firmer footing, and overall conditions in the labor market appear to be improving gradually. Household spending and business investment in equipment and software continue to expand. However, investment in nonresidential structures is still weak, and the housing sector continues to be depressed. Commodity prices have risen significantly since the summer, and concerns about global supplies of crude oil have contributed to a sharp run-up in oil prices in recent weeks. Nonetheless, longer-term inflation expectations have remained stable, and measures of underlying inflation have been subdued.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Currently, the unemployment rate remains elevated, and measures of underlying inflation continue to be somewhat low, relative to levels that the Committee judges to be consistent, over the longer run, with its dual mandate. The recent increases in the prices of energy and other commodities are currently putting upward pressure on inflation. The Committee expects these effects to be transitory, but it will pay close attention to the evolution of inflation and inflation expectations. The Committee continues to anticipate a gradual return to higher levels of resource utilization in a context of price stability.

To promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to continue expanding its holdings of securities as announced in November. In particular, the Committee is maintaining its existing policy of reinvesting principal payments from its securities holdings and intends to purchase $600 billion of longer-term Treasury securities by the end of the second quarter of 2011. The Committee will regularly review the pace of its securities purchases and the overall size of the asset-purchase program in light of incoming information and will adjust the program as needed to best foster maximum employment and price stability.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels for the federal funds rate for an extended period.

The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to support the economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate.