This includes home owners and renters, and includes rent as a financial obligation.

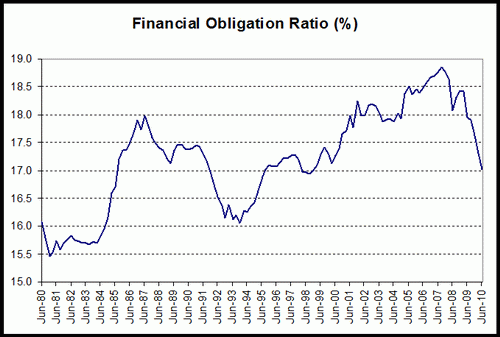

And it’s gone down further since the June data point as the Federal budget deficit remains at around 9% of gdp.

The general drift higher over time is probably due fewer ‘no debt’ people rather than people with debt getting over extended, so I expect this to turn up well before it gets to the 16% level.

So looks to me like consumer batteries are very close to recharged which will be evidenced by this ratio moving sideways for a while before again turning up in the later stage of what will someday be later called the Obama boom, if they don’t do something stupid like a major deficit reduction program or a trade war. And just as interesting is what they then attribute the boom to. In the Clinton years it was the surplus (which actually ended the boom) and, of, course the Fed always gets most of the credit. But never the deficit that preceded all of our expansions.