(an email exchange)

>

> On Sun, Jul 20, 2008 at 10:46 PM, Russell wrote:

>

> Brad Setser, at Follow the Money, presents a couple of graphs on changes in

> oil export revenue: The Oil Shock of 2008.

>

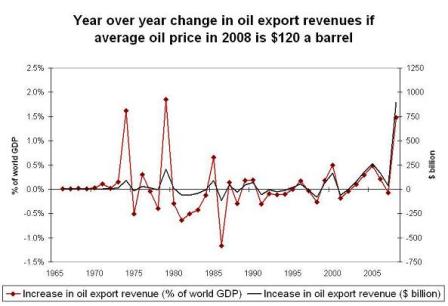

> The following graph shows the Year-over-year change in oil exports as a

> percent of world GDP (and in billions of dollars).

>

>

>

> Year-over-year change in oil exports

>

> This calculation assumes that the oil exporters will export about 45 million

> barrels a day of oil.

>

> Each $5 increase in the average price of oil increases the oil exporters’

> revenues by about $80 billion, so if oil ends up averaging $125 a barrel this year

> rather than $120 a barrel, the increase in the oil exporters revenues would be

> close to a trillion dollars.

>

> Assuming oil prices average $120 per barrel for 2008, the increase in 2008 will

> be similar to the oil shocks of the ’70s.

>

>

Right, the notion that oil is a smaller % of GDP and therefore not as inflationary was flawed to begin with and now moot.

Two more thoughts for today:

First, the second Mike Masters sell-off may have run its course. The first was after his testimony in regard to passive commodity strategies which I agree probably serve no public purpose whatsoever. The second was last week as markets expect Congress to act to curb speculation this week, which they might. Crude isn’t a competitive market (Saudi’s are the swing producer) so prices won’t be altered apart from knee jerk reactions, but competitive markets such as gold can see lower relative prices if the major funds back off their passive commodity strategies.

Second, just saw a headline on Bloomberg that inflation is starting to hurt the value of some currencies.

Third, the Stern statement will continue to weigh on interest rate expectations up to the Aug 9 meeting.