Just hit an all time low yield as markets anticipate a weakening economy will lead to lower rates from the Fed:

Crude oil demand is falling with the weakening global economy. While oil producers in general sell their entire output at market prices, the Saudis are the ‘swing producer’, setting price and letting the quantity they sell to their clients vary with demand. Therefore, a drop in global demand results in reduced Saudi production and sales, while prices remain at levels fixed by the Saudis.

Most recently, the Saudis have been cutting prices, presumably hoping to either increase global demand, or to reduce global supply by forcing higher cost producers to stop producing.

If, however, there is some minimum level of Saudi production- perhaps 5 million bpd – where production can’t be cut without incurring substantial costs, so if global demand falls sufficiently the Saudis will be forced to sell their output at market prices, at which the price falls to the point where others cut production or demand increases sufficiently to stabilize prices. Last time around in the mid 1980’s that price was about $10 per barrel:

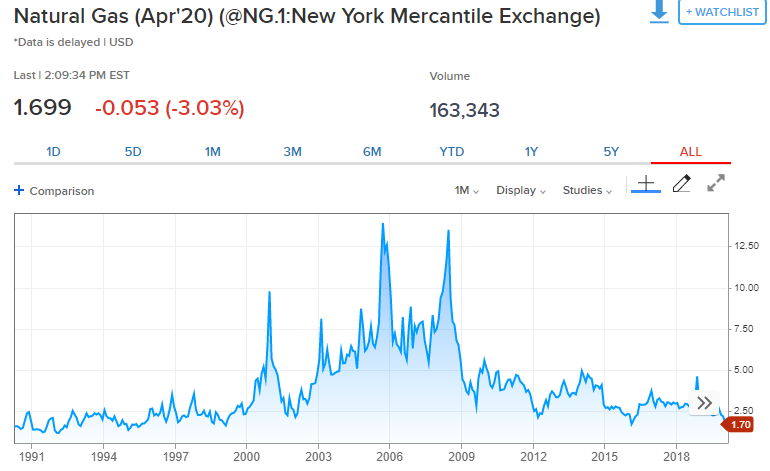

Natural gas prices are also falling as the economy has weakened since the tariffs. This is a deflationary bias for economy much the same as falling oil prices, bringing down the cost of production and the cost of living, while at the same time lower production prices reduce GDP and energy related investment:

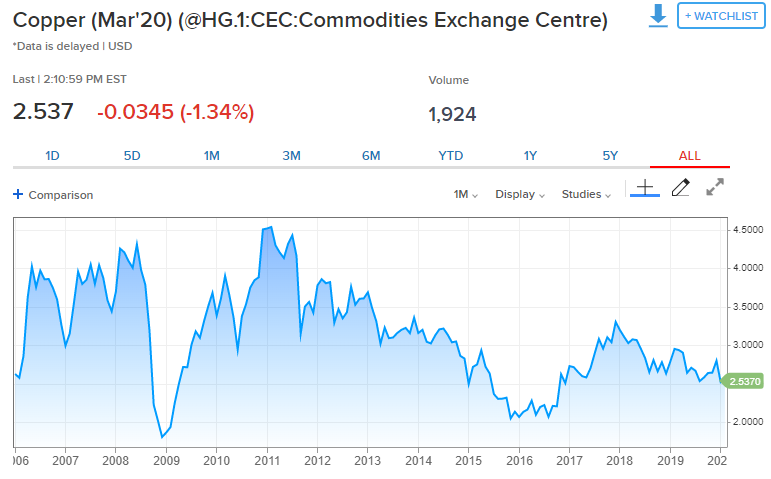

Copper has historically been a pretty good indicator of the strength of the economy, and it’s been weakening steadily particularly since the tariffs kicked in: