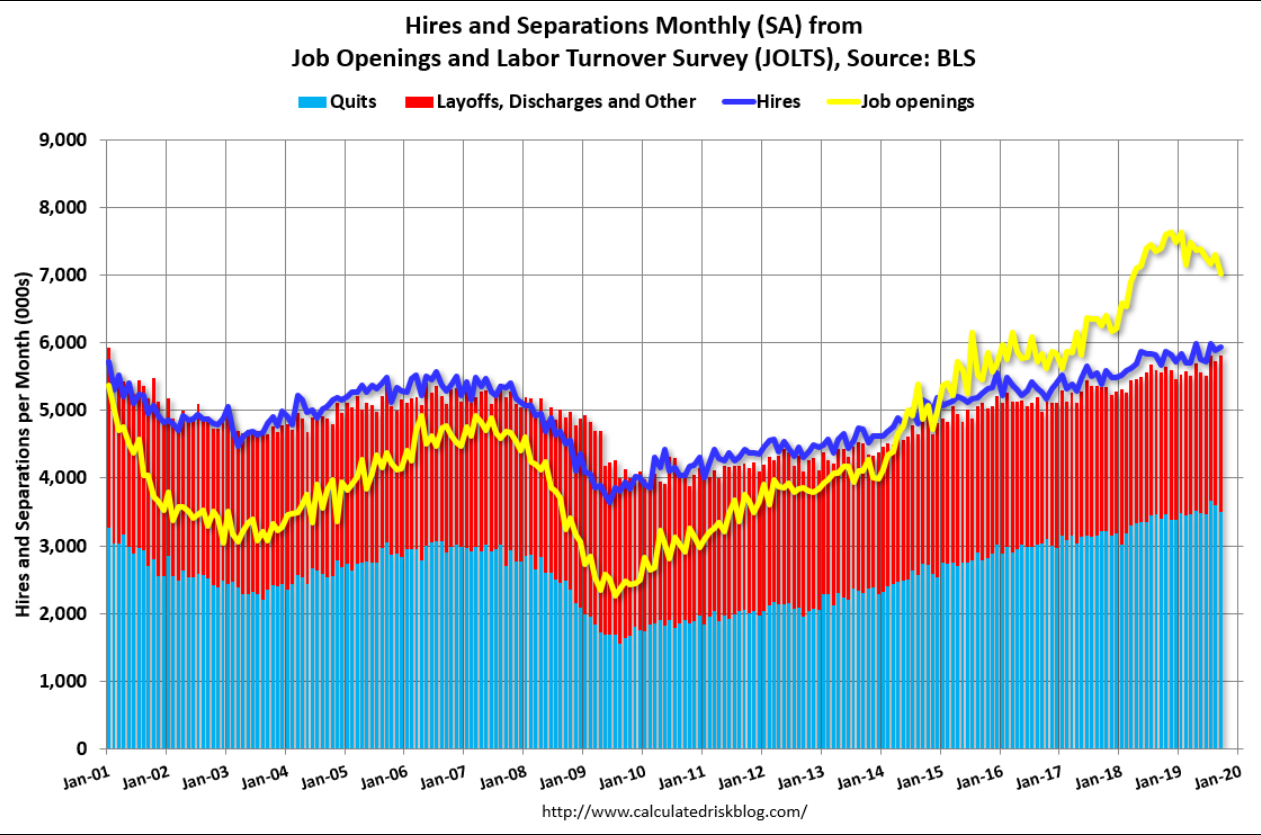

Job openings now in full retreat:

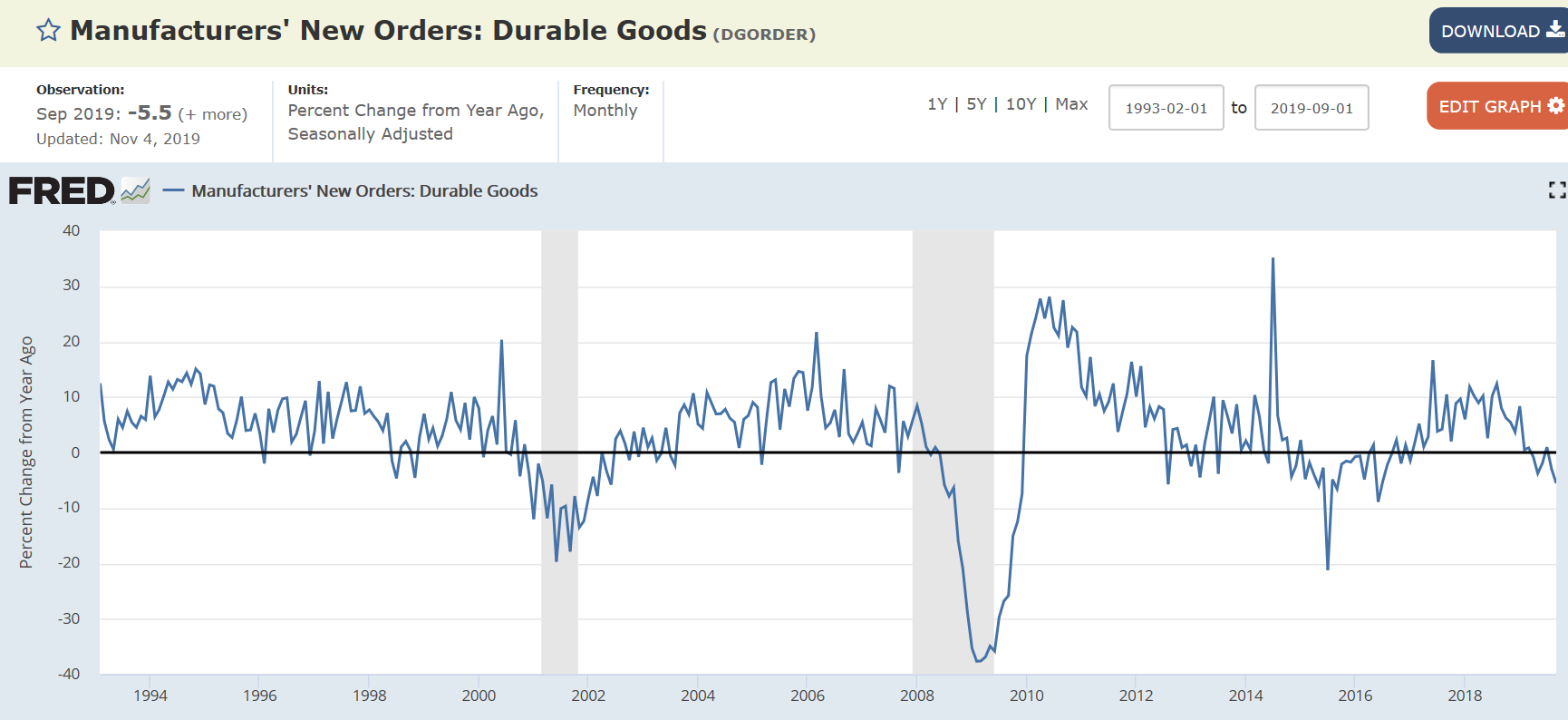

The contraction continues:

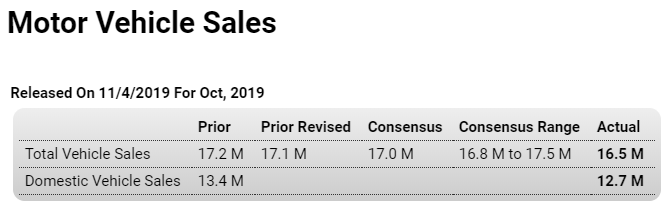

Highlights

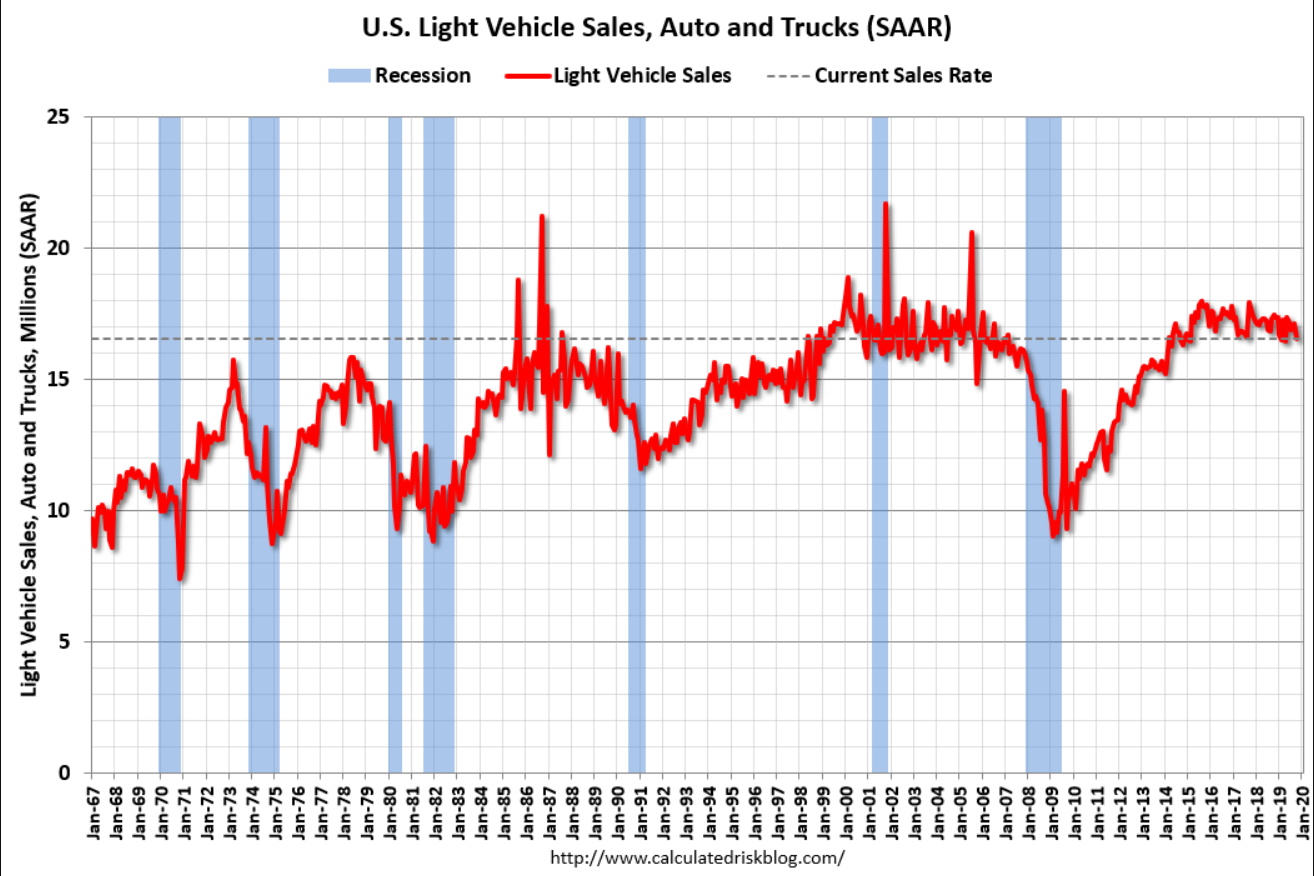

Unit vehicle sales, at a much lower-than-expected annual rate of 16.5 million, proved very soft in October and will lower expectations for next week’s retail sales report. October’s pace is the slowest since April reflecting sharp slowing in light truck sales. Vehicle sales have been soft this year, averaging a 16.9 million pace versus 17.2 million and 17.1 million in the two prior years. Despite this, 2019 has been a good year for overall consumer spending and is the fundamental reason why the Federal Reserve stepped back last week from signaling any further rate cuts.

Typical headlines:

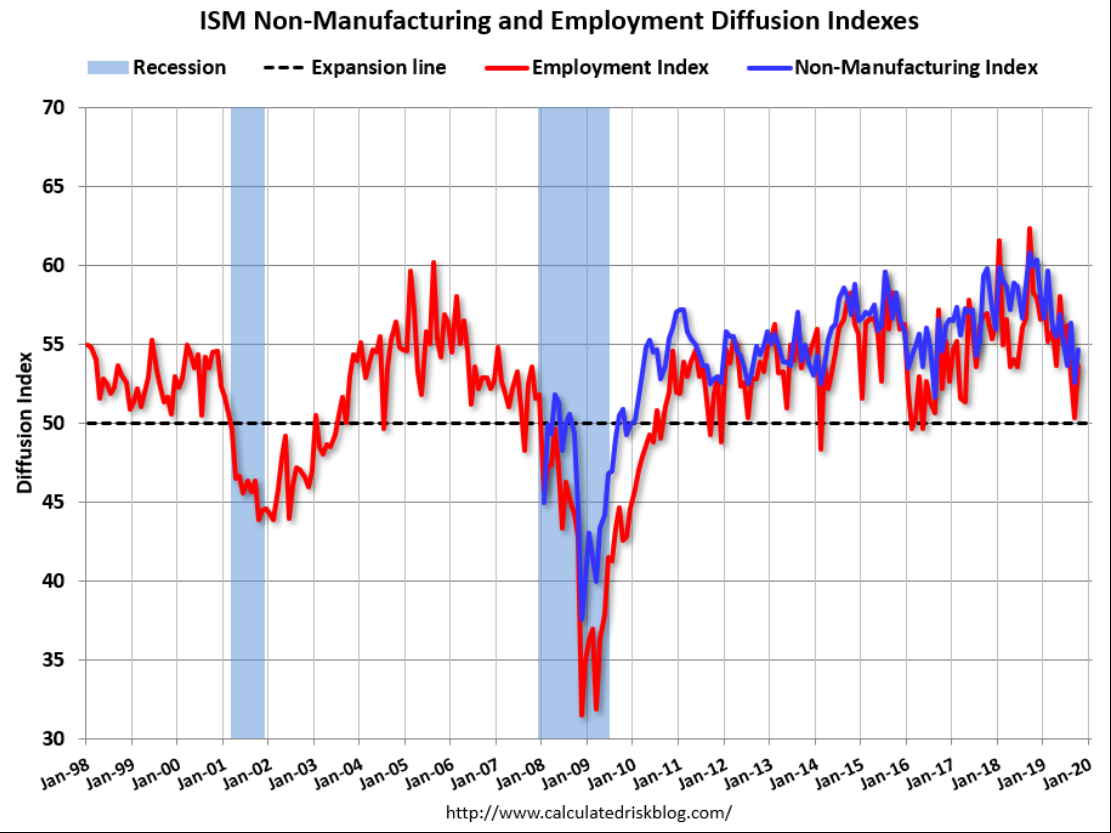

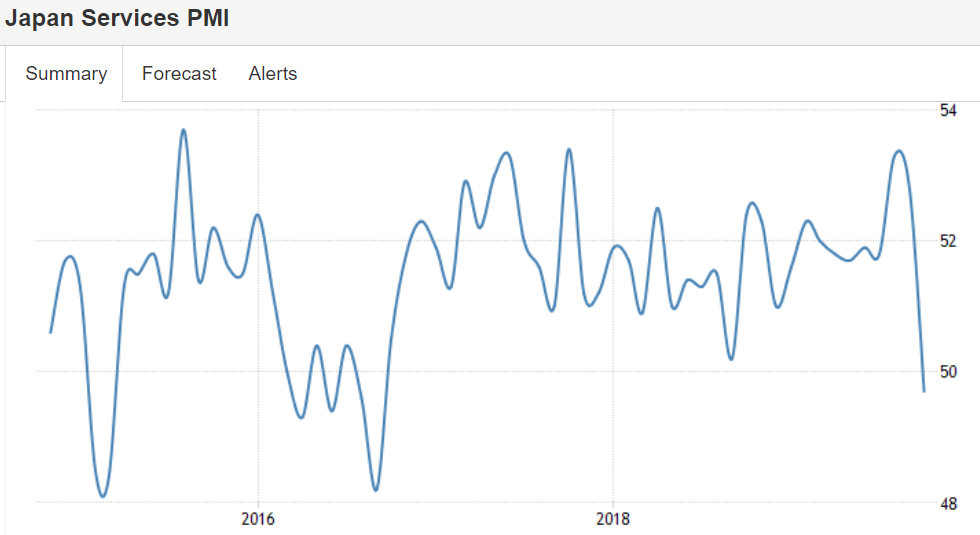

Service sectors following manufacturing into contraction:

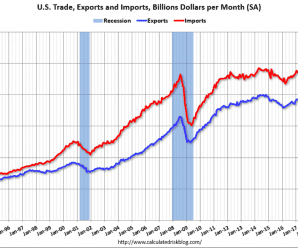

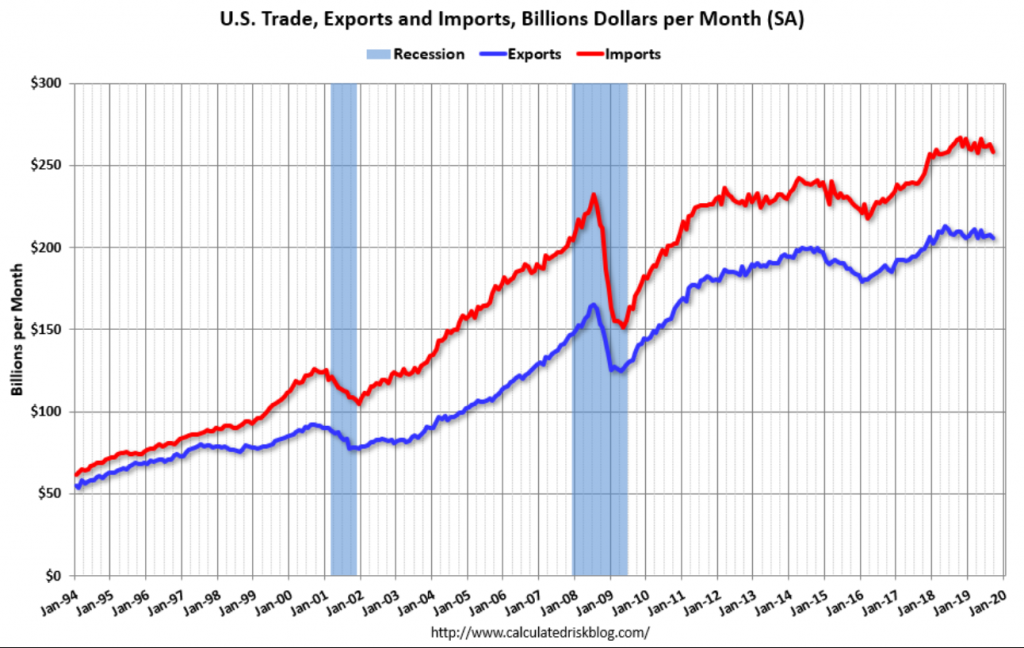

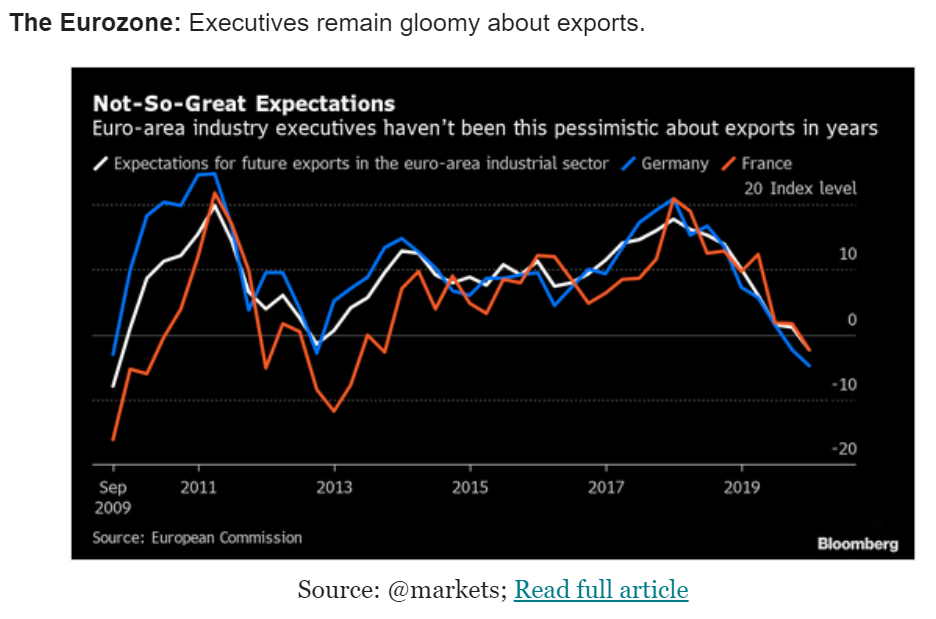

Global trade collapse- imports and exports going down:

Procyclical action underway maybe: