Looks to me like this opens the door to fiscal relaxation!!!

“In an economy with its own fiat currency, the monetary authority and the fiscal authority can ensure that public debt denominated in the national fiat currency is non-defaultable, i.e. maturing government bonds are convertible into currency at par. With this arrangement in place, fiscal policy can focus on business cycle stabilisation when monetary policy hits the lower bound constraint. However, the fiscal authorities of the euro area countries have given up the ability to issue non-defaultable debt. As a consequence, effective macroeconomic stabilisation has been difficult to achieve. Coordinating the fiscal policy of the individual countries around a common euro area, non-defaultable debt instrument would improve business cycle outcomes. Corsetti et al. (2016) describe this proposal in greater detail and discuss possible challenges, including the risk of a restructuring of national public debt”.

Source: https://www.ecb.europa.eu/pub/economic-research/resbull/2017/html/ecb.rb170629.en.html

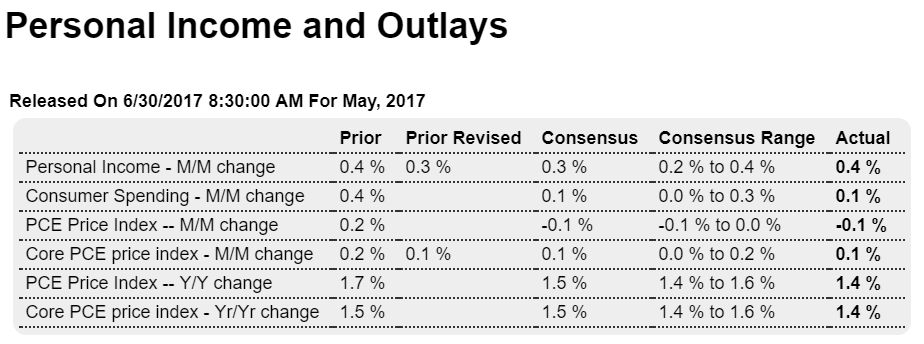

Income a bit better than expected but last month revised down, and the composition of income was not promising. Spending was down as expected, in line with decelerating growth of consumer credit, and price level indicators were very soft as well:

Highlights

May was not a strong month for the consumer. Income did rise 0.4 percent but it wasn’t because of wages & salaries which could manage only a 0.1 percent gain. It was personal income transfers and proprietor income that gave a boost to income which the consumer, however, moved into savings, which rose 4 tenths to a 5.5 percent rate, and not spending which could do no better than expectations, at a 0.1 percent increase.

Spending was weakest in nondurable goods, down 0.5 percent in the month but, in an important note, reflected low energy prices not low demand. But spending on durables was also negative, down 0.3 percent. The positive is a moderate 0.3 percent gain for the biggest category and that’s services.

Price data are very soft, up only 0.1 percent for the core rate (less food & energy) for a year-on-year rate of only 1.4 percent, down 1 tenth in the month. This is the third decline in a row for the yearly rate and the weakest showing in a year-and-a-half. The overall PCE fell 0.1 percent with this year-on-year rate also at 1.4 percent for a 3 tenths decline.

The second leg of the second quarter did not turn out well for the consumer nor for GDP. But the weakness in price data is a more strategic concern for monetary policy makers who may be removing stimulus into inflationary headwinds.

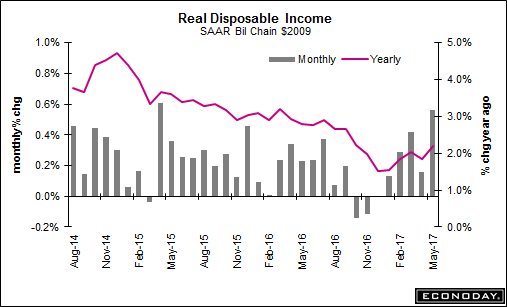

Still on the downtrend line from when oil capex collapsed:

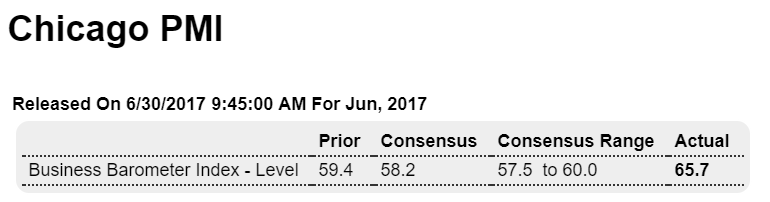

Better than expected survey:

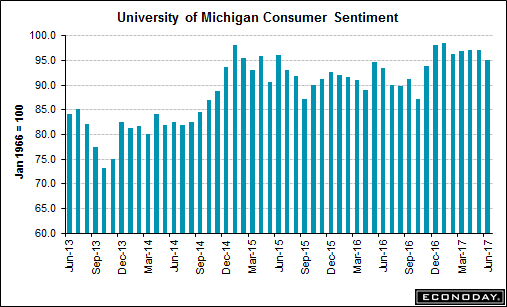

Also a bit better than expected, though expectations continue to revert:

Highlights

The consumer sentiment index regained some momentum in the second half of the month, rising to a final 95.1 that implies a 95.7 or so reading for the second half of June based on the mid-month flash of 94.5. Yet even so, June shows tangibly less strength than the 97.1 in May.