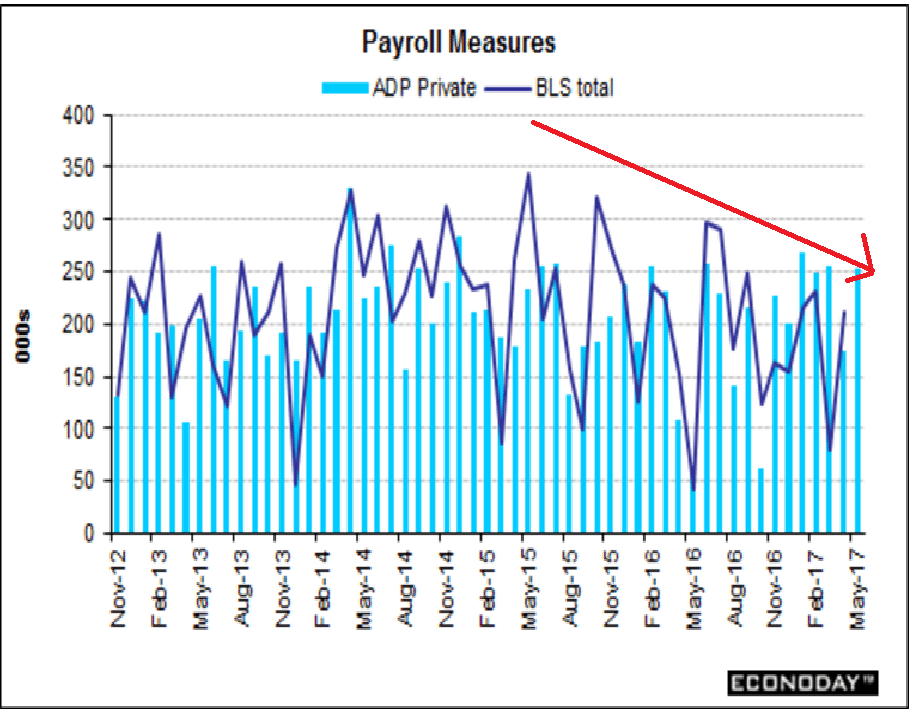

While it did spike up some this week, the downtrend is still intact as per the chart:

Highlights

On the strong side this year, ADP is calling for a resumption of outsized employment gains, at 253,000 for private payrolls in tomorrow’s May employment report vs Econoday’s consensus for 172,000 (Econoday’s consensus has since moved to 173,500 following ADP’s report). ADP has been hitting and missing this year, making remarkably good calls for oversized strength in January and February followed by a very bad call for a third month of strength in March, a month that came up well short. ADP’s call for April was respectably accurate, at 177,000 (now revised to 174,000) vs actual private payroll growth of 194,000.

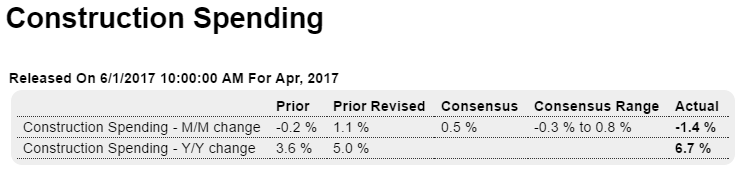

More stats that supported q1 gdp seem to be reversing for q2:

Highlights

Volatility once again hits the construction spending report where an unexpected sharp decline in April, at minus 1.4 percent, is offset by a giant upward revision to March which now stands at plus 1.1 percent vs an initial 0.2 percent dip.

The residential side of the report, at minus 0.7 percent in April, shows the first decline in 7 months, pulled lower by a sharp drop in residential improvements and spending on new condos that offset a solid 0.8 percent gain for new single-family homes.

The non-residential side shows a 0.6 percent decline for private building, hit by contraction for factories and power plants, and a 2.0 percent dip for public building with both highways and education lower.

This report is yet another bad result for April as the upward revision to March pulled spending out of the second quarter and into the first. And it’s the second quarter that is in focus right now and housing, including sales and starts and now construction, have all been disappointing.

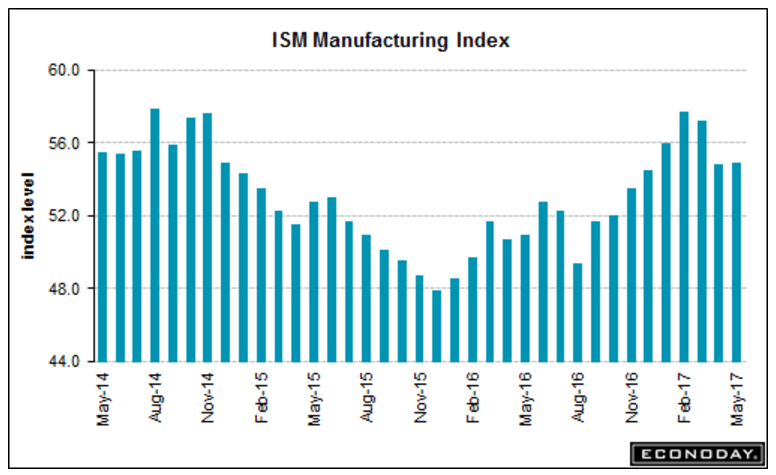

Highlights

Growth in Markit’s U.S. manufacturing sample is as slow as it has been in 8 months, at 52.7 and little changed from the mid-month flash (52.5) and April (52.8). Growth in this sample peaked in January at 55.0 and has been moving lower as new orders, also at an 8-month low, and employment have slowed. Production is steady at a modest level and the sample, in a sign of caution, continues to work down inventories. Other details include slowing in both input costs and selling prices and weakness in export sales. This report, of all the private manufacturing reports, has been signaling the weakest conditions for a factory sector that opened the year with promise which it has yet to fulfill. Watch for the ISM report coming up at 10:00 a.m. ET this morning.

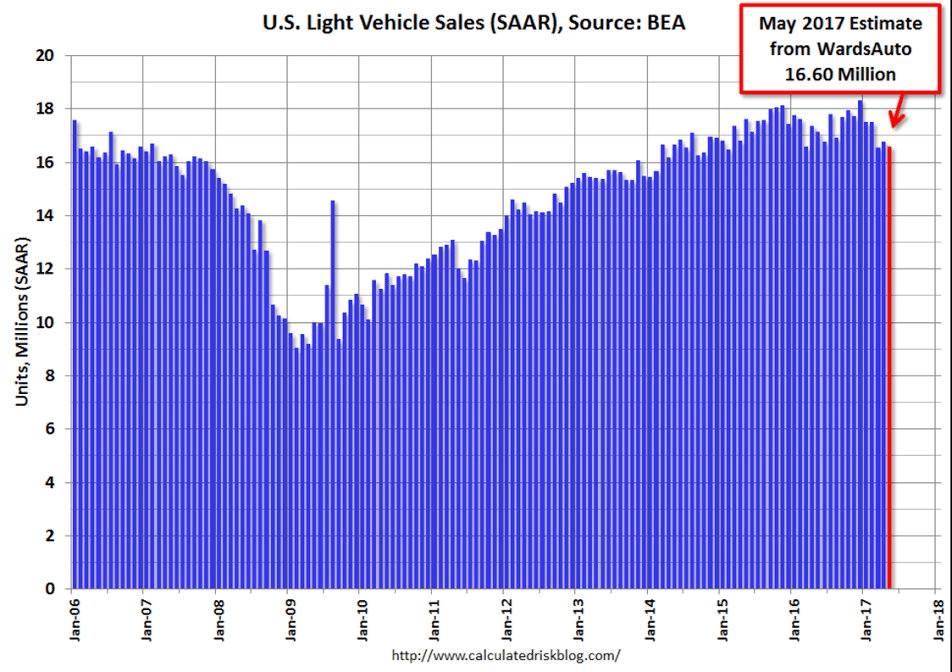

Worse than expected and on the decline. 2017 now forecast to be lower than 2016, all confirmed by the chart showing auto loan growth slowing: