Real consumer spending revised up a bit, and not to forget that includes health care premiums, and q2 now looking a lot worse than previously expected:

Highlights

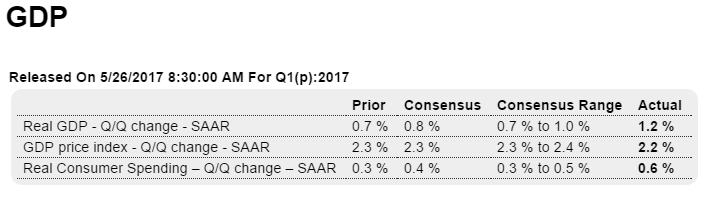

First-quarter GDP gets a small but much needed upgrade, now at a 1.2 percent rate of annualized growth which is nearly double the advance estimate. The gain is centered where it is best, in consumer spending where the rate did double to 0.6 percent. This is still slow but is an improvement with durable goods, at minus 1.4 percent, showing less contraction and services showing greater growth, at 0.8 percent.

Boosted by strong and sudden acceleration in both structures and equipment, nonresidential fixed investment is also upgraded, to 11.4 percent for a 2 percentage point gain. Government purchases are also upgraded, down 1.1 percent for a 6 tenths improvement that pulls less on GDP. Other readings are stable with a slowing build in inventories still a major negative (a negative for GDP but not for the second-quarter outlook).

But the second-quarter outlook, which was once very positive, is mostly in question following a run of weak data for April including this morning’s durable goods report. And the first-quarter is a little less of an easy comparison now for the second quarter where early estimates, once as high as 3 and 4 percent, have been coming down to the 2 percent area.

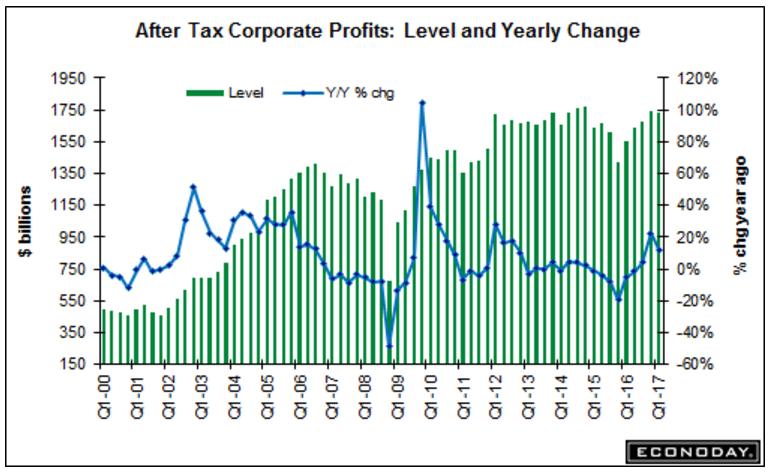

Should muddle through at modest levels of growth:

Highlights

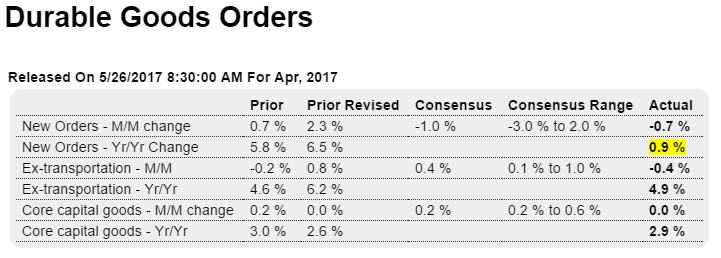

Yet another piece of the second-quarter puzzle is not favorable. Durable goods orders, down 0.7 percent in April, do not confirm the month’s big jump in industrial production nor all the strength in the regional factory reports. Aircraft is not a factor in today’s report as the ex-transportation reading is also negative, at minus 0.4 percent which is well below Econoday’s low estimate. Also below the estimate are orders for core capital goods (nondefense ex-aircraft) which came in unchanged following a downward revised unchanged reading in March.

Manufacturing output soared in the industrial production report but shipments in this report fell 0.3 percent and follow March’s 0.1 percent decline. Shipments of core capital goods, which are an important input into second-quarter GDP, also fell 0.1 percent. And the weakness in capital goods orders does not point to shipment strength in June or July.

Inventories edged only 0.1 percent higher but, given the decline in shipments, the inventory-to-shipments ratio moved one notch higher to a less lean 1.69. A plus in the report is unfilled orders which, after long contraction, have put together two straight positive months, at 0.2 and 0.3 percent.

Another positive is an upward revision to March, but that was back in the first quarter which was already weak anyway. There really aren’t a lot of positives in today’s report. The nation’s factory sector, despite recovery in energy equipment, is not showing the promise indicated by sentiment reports. Weak foreign demand remains a likely suspect for the struggling performance.