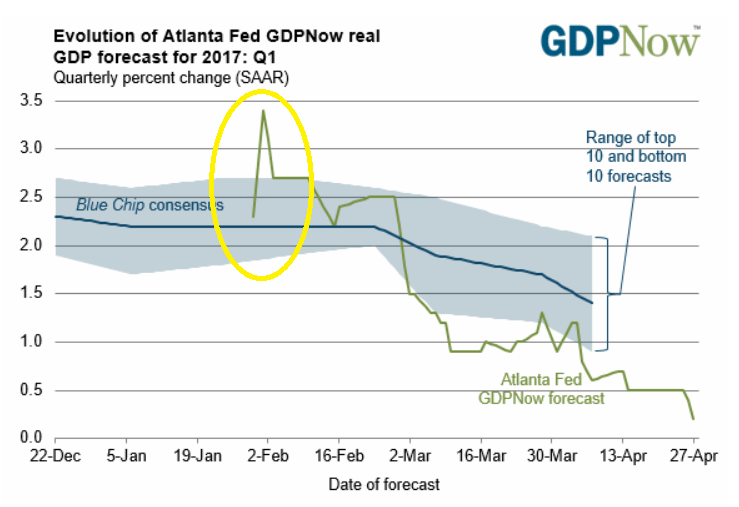

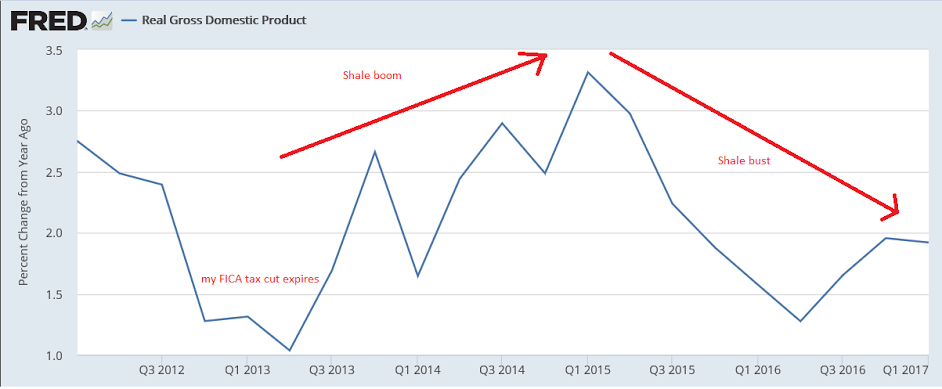

A very low initial print, with inventories down as expected as was consumption growth. And the investment data that did grow strongly is volatile and subject to reversal which would limit q2 growth as well. Expectations have come off some but remain trumped up, even as the hard data shows ongoing weakness.

And note how q2 forecasts are now starting up where q1 forecasts were this time 3 months ago:

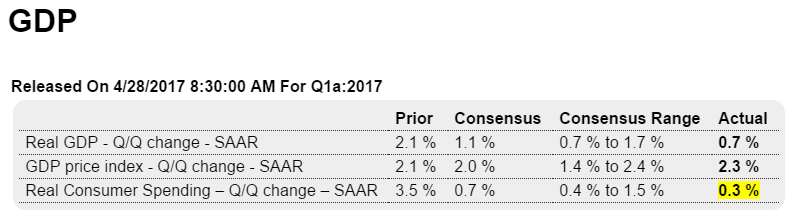

Highlights

The weakest showing since the last recession for consumer spending held down first-quarter GDP which could manage only a 0.7 percent rate of annualized growth. Consumer spending rose at only 0.3 percent which is by far the worst showing since no change in fourth-quarter 2009.

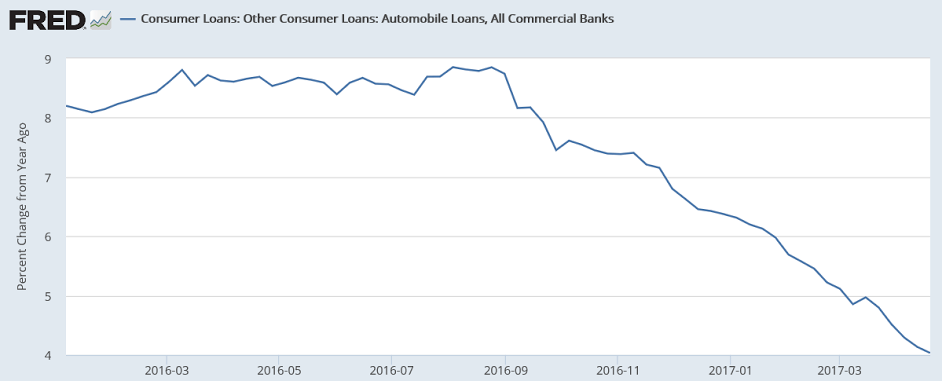

Weak vehicle sales are a major negative in the quarter’s consumer breakdown, pulling durables down at a 2.5 percent rate and offsetting a 1.5 percent rise in non-durables and a slow 0.4 percent showing for services.

Weakness in consumer spending is strongly associated with recession but not other data in the report. At a 13.7 percent pace, residential investment posted a second straight very strong quarter. And in a rare show of strength, nonresidential investment, which has been subdued, jumped at a 9.4 percent rate with both structures and equipment showing unusual strength. A surge in mining investment is a standout of the report.

The net export gap narrowed slightly which was a small plus for the quarter while a drop in government purchases was a negative. A sizable negative for the quarter was a slowing in inventory build, pulling GDP down by 0.9 percentage points but also keeping in check what may be unwanted stock given the weakness in consumer spending. Looking at final demand, which excludes the inventory effect, final sales rose 1.6 percent which is an improvement from the fourth quarter’s 1.1 percent.

This is a mixed report with the weakness in consumer spending not fitting with the strength in investment. Still, all the sky high confidence readings in the quarter did nothing to help actual spending. In other data, prices show pressure with the GDP price index at 2.3 percent for a 2 tenths gain and the core also at 2.3 percent for a 5 tenths gain.

As previously discussed, it may bring in a few tax $ but it has no effect on the economy:

The last time companies got a break on overseas profits, it didn’t work out well

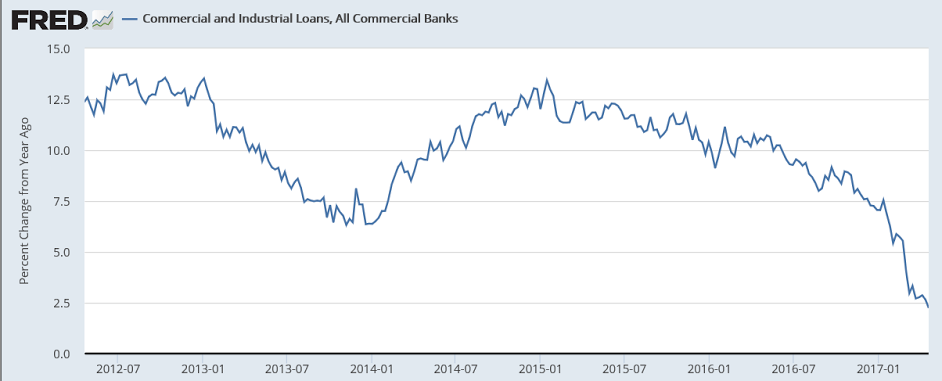

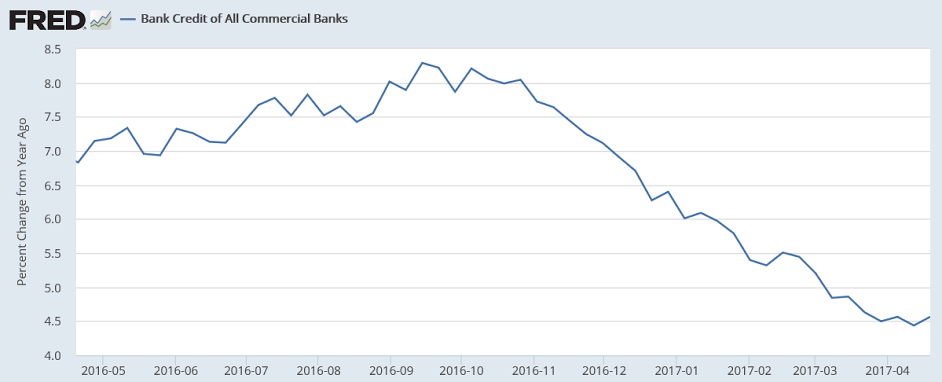

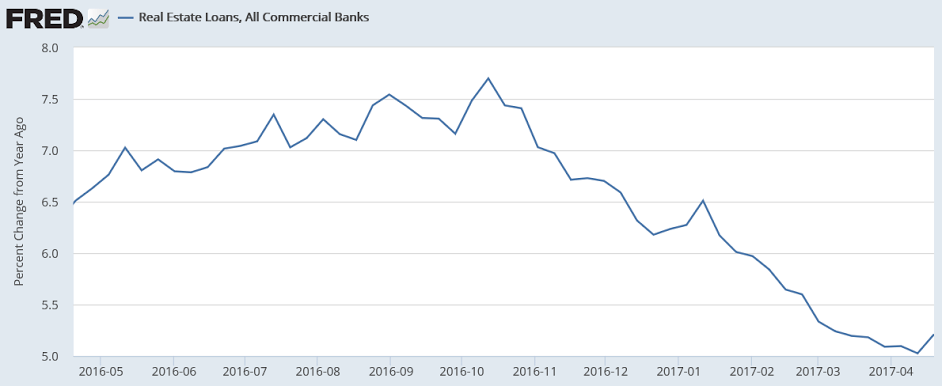

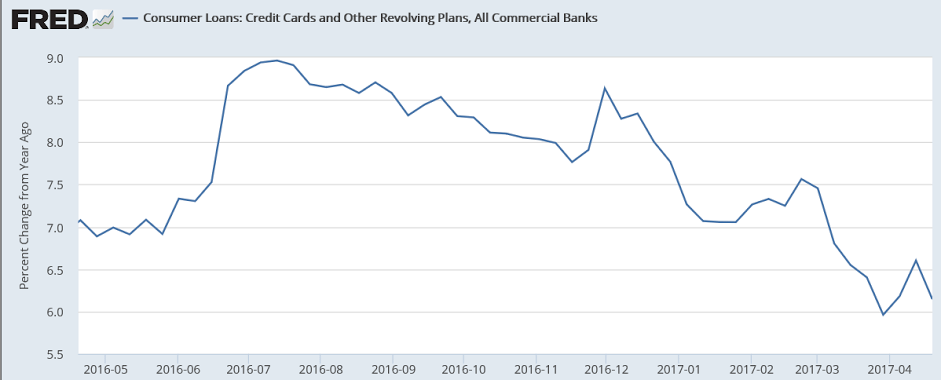

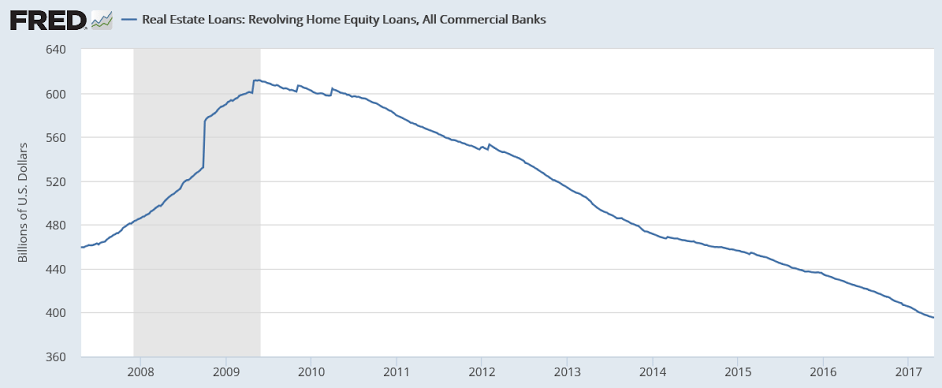

Meanwhile, this is still flashing red: