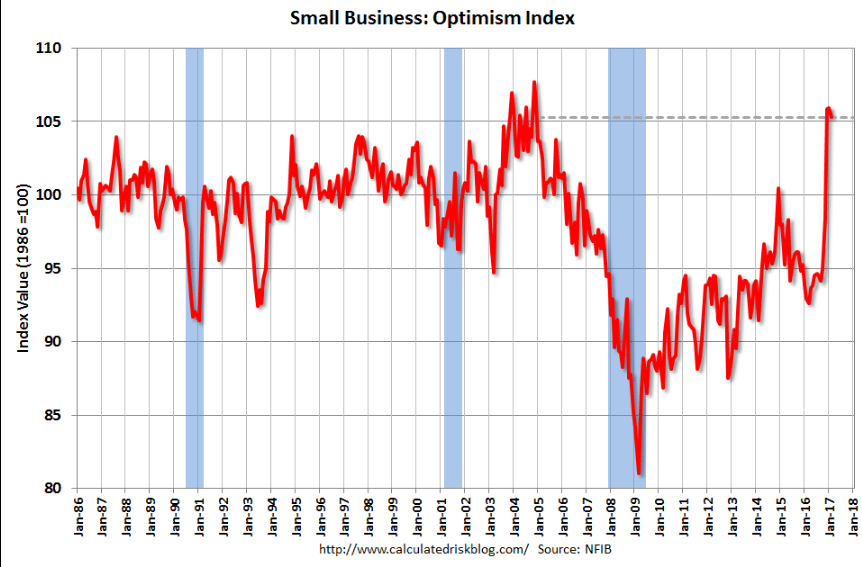

Trumped up expectations falling off some,

and the details don’t look so good:

Highlights

The small business optimism index fell 0.6 points in February to 105.3, retreating slightly from the lofty levels reached in the previous months after the post-election surge in November and the largest increase in the history of the survey in December that shot the index to the highest reading since December 2004. The small decrease was in line with expectations and the fact of the index remaining above 105 for three consecutive months indicates the continuation of a very high level of optimism for small business owners.

Of the 10 components of the index, 3 slightly increased, 6 modestly declined and 1 remained unchanged. Current inventories rose 3 points to minus 2 and plans to increase inventories increased by 1 point to 3. Current job openings also rose by 1 point to 32, the highest level since December 2000. But plans to increase employment fell 3 points to 15, as did expectations of higher real sales, which fell to 26, and the view that now is a good time to expand, which also dropped 3 points to 22.

NFIB noted that business owners are being squeezed, on the one side by historically tight labor markets, where the scarcity of qualified workers pressured 26 percent of owners to raise compensation, the highest reading in 10 years. At the same time, owners are limited in how much they can increase compensation since they are not so confident of their ability to pass on the costs by raising prices for consumers. Although business owners reported higher sales in February, which rose to the first positive reading since early 2015, expectations of future higher sales did fall 3 points. And earnings trends, the outlier negative among the components, remain quite weak and weakened further in the month by 1 point to minus 13.

Though an exceptionally large net 47 percent of small business owners still expect the economy to improve, a decrease of only 1 point from the January survey, the question remains whether small business owners will turn their optimism into action. According to NFIB, this will happen when their two biggest priorities, health care and taxes, are addressed.

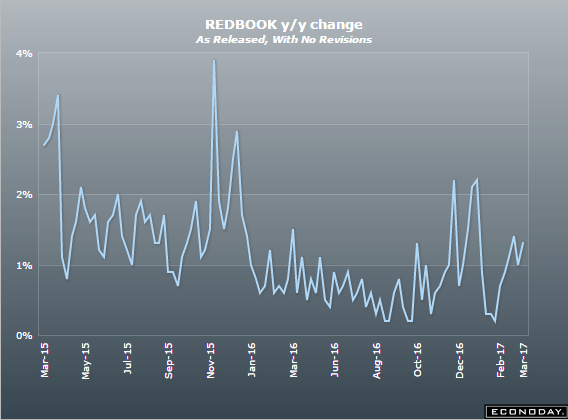

Marginally better but nowhere near the 3-4% gains from before oil capex collapsed:

No telling what they might do next: