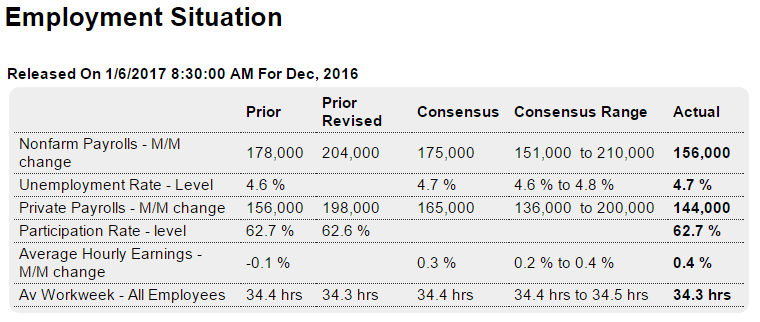

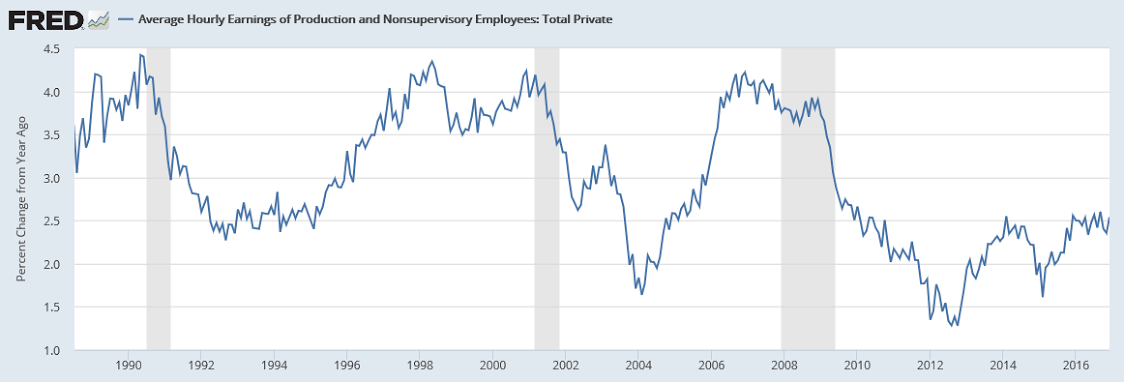

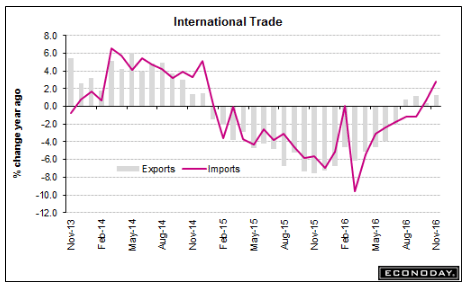

The year over year chart continues its 2 year deceleration unabated. No telling where it ends but the end will coincide with increased deficit spending, private or public:

Highlights

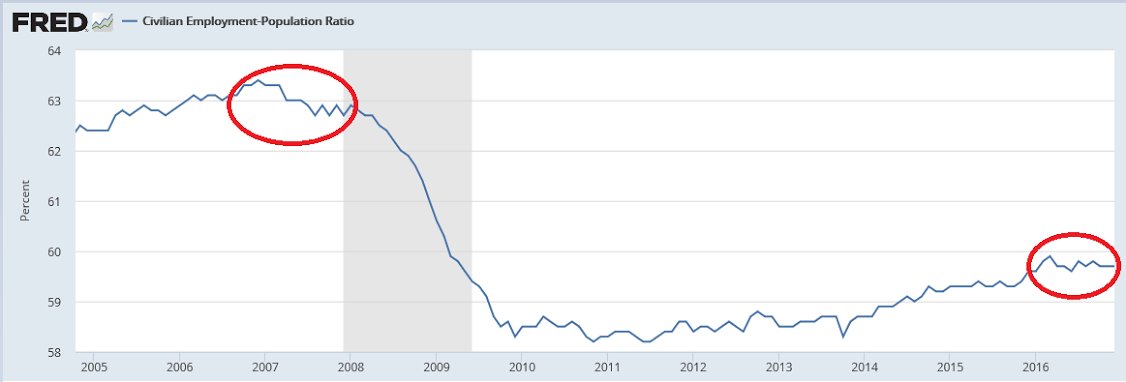

Job growth may be the new economic policy but wage inflation may be the risk. Nonfarm payrolls rose a lower-than-expected 156,000 in December but, in an offset, revisions added a net 19,000 to the two prior months (November now at 204,000 and October at 135,000).

But the big story is another outsized 0.4 percent rise in average hourly earnings, the second such gain in three months. The year-on-year rate is now at 2.9 percent which is a cycle high. A 3 percent rate and above is widely seen as feeding overall inflation.

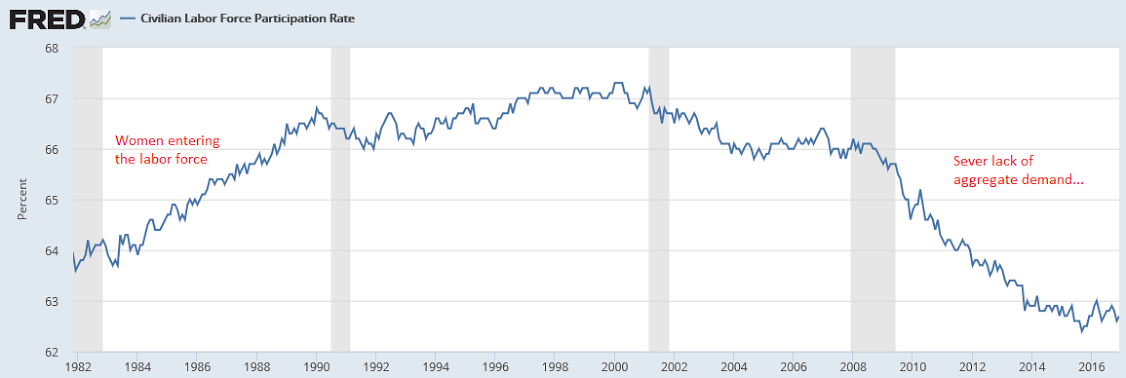

The unemployment rate is very low though it did tick up 1 tenth to 4.7 percent. Keeping the rate down is low labor participation, at 62.7 percent with the prior month revised down 1 tenth to 62.6 percent.

Sector payrolls show another sizable gain for trade & transportation, up 24,000, and a rare gain for manufacturing, up 17,000. Government added 12,000 jobs while a 15,000 rise for professional & business services is not only on the low side for this reading but includes a 16,000 decline in temporary help, a subcomponent that is especially sensitive to changes in labor demand.

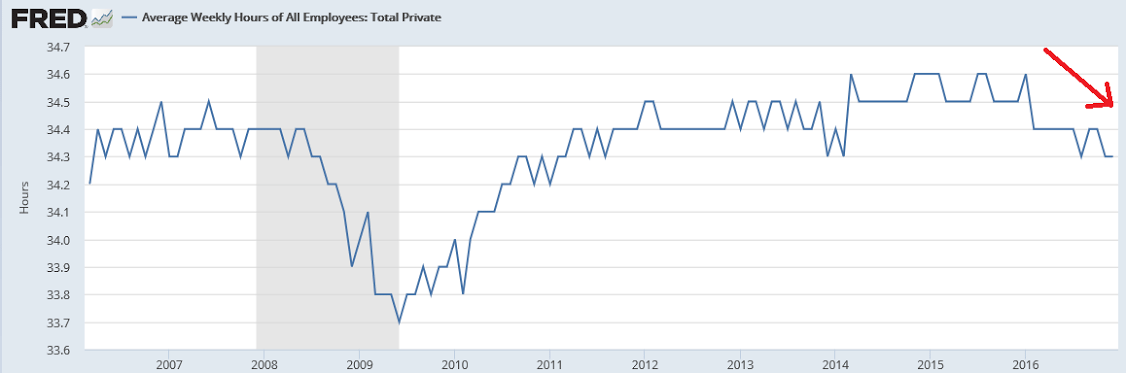

There are hints of slowing job growth in this report but the wage pressure underscores the Federal Reserve’s expectations for three rate hikes during the year and raises the question whether the labor market, even before new stimulus under the incoming administration, is at an inflationary flashpoint. Other details include a lower-than-expected workweek, at 34.3 hours in December which is unchanged from a downwardly revised November.

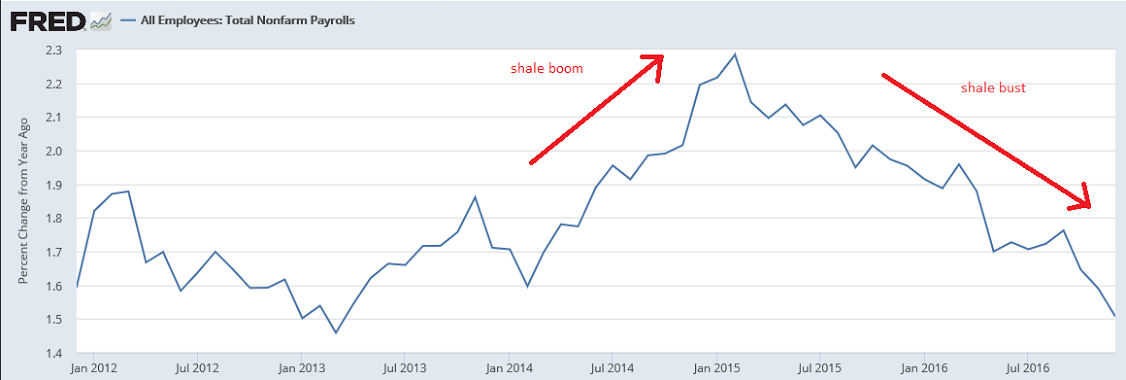

Jobs no longer exceeding up with population growth:

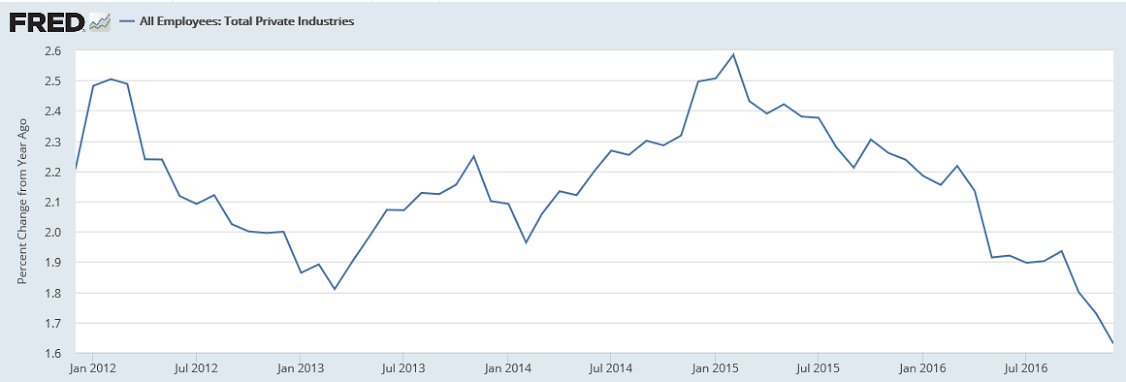

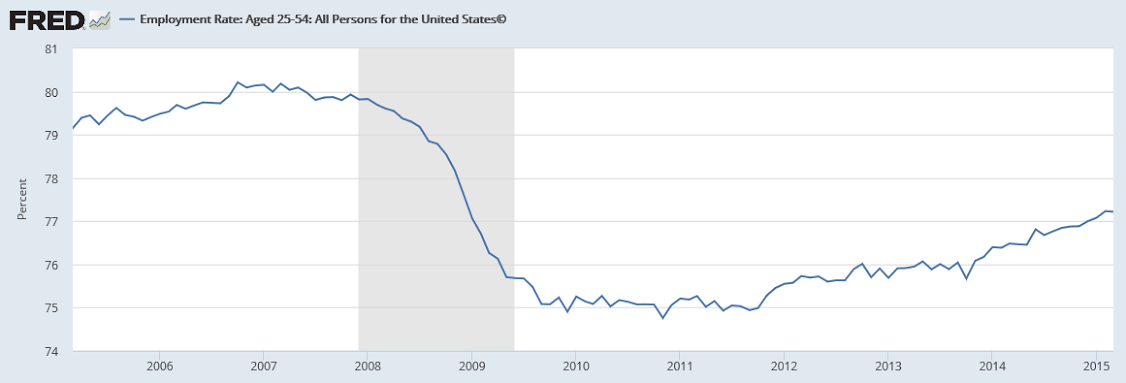

Fewer ‘demographic’ effects here, though the average age of this group has gone up some over time:

You can see that historically wage growth remains depressed, and in any case increased wages are more likely to reduce gross profit margins than to increases consumer prices:

Decelerating back to recession levels:

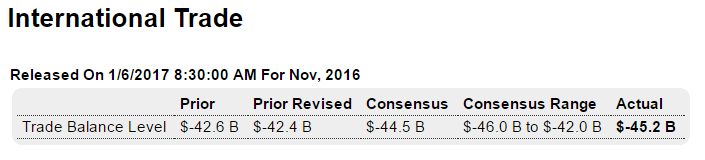

And, as previously discussed, I expect this get a lot more negative:

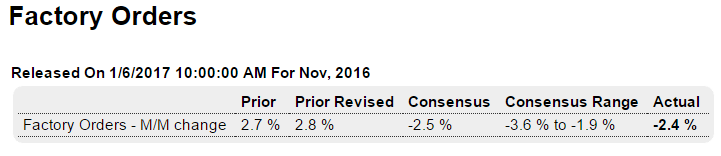

Highlights

The nation’s trade deficit widened sharply in November, to a higher-than-expected $45.2 billion and well up from a revised deficit of $42.4 billion in October. Exports fell 0.2 percent in November while imports rose 1.1 percent.

The import side shows a significant rise in oil imports, up nearly $1 billion in the month to $9.9 billion (reflecting both an increase in volume and price). Petroleum is a key element for industrial supplies where imports rose $2.3 billion. Other readings are little changed with capital goods imports ticking lower and underscoring the nation’s lack of investment in new equipment.

And capital goods lead the downtick in exports, down $1.8 billion to underscore the lack of global investment in new equipment. Exports of civilian aircraft, which are a subcomponent of capital goods, fell $1.3 billion in the month. Exports of cars and of food products also moved lower, offset by a petroleum-related rise in industrial supplies.

By country, the deficits with Canada (-$2.6 billion) and the EU (-$14.8 billion) both widened sharply while the deficits with China (-$30.5 billion) and Mexico (-$5.8 billion) both narrowed. The deficit with Japan (-$5.9 billion) was little changed.

Today’s report represents a downgrade for fourth-quarter GDP which more and more will depend on how strong consumer spending was during the holidays. Watch next Friday for the retail sales report and the first definitive indication on December consumer spending.

Retail sector tanks as Macy’s and Kohl’s get crushed by weak holiday sales

By Fred Imbert

Jan 5 (CNBC) – Average Boston-area rent falls for the first time in almost 7 years