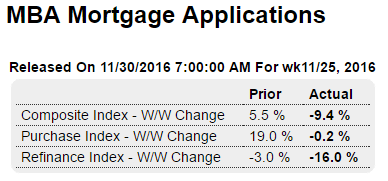

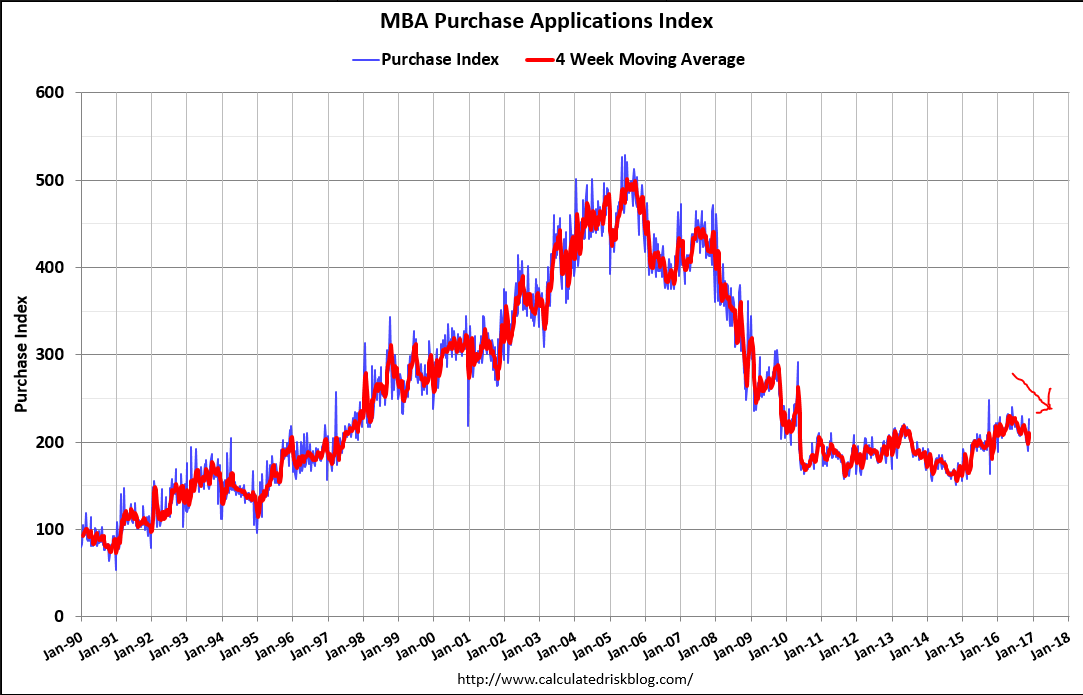

So mortgage applications for purchases rose during the first half of the year, then reversed and are looking to be at best flat vs the year before come year end:

Highlights

Purchase applications for home mortgages fell just 0.2 percent on a seasonally adjusted basis in the November 25 week following the prior week’s outsized 19-percent increase. But applications for refinancing were down 16 percent from the prior week, as the sharp post-election increase in interest rates continues to muffle mortgage activity among homeowners seeking to refinance at lower rates. The weekly drop took the purchase index to just 3 percent above the level a year ago, far less than the double-digit gains seen earlier this year, which in March reached more than 30 percent. Mortgage rates continued their climb higher during the week, with the average interest rate on 30-year fixed-rate conforming mortgages ($417,000 or less) moving up 7 basis points to 4.23 percent.

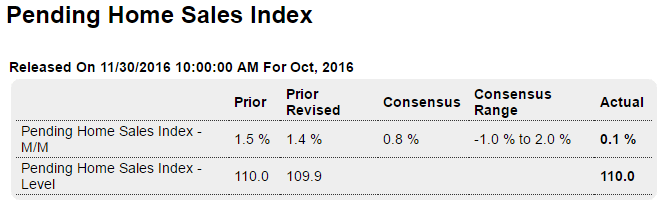

Pending home sales aren’t doing any better than mortgage purchase apps, so looking like a no growth year for housing and cars:

Highlights

Pending sales of existing homes rose only 0.1 percent in October, pointing to flat results for the rest of the year in final sales. Pending sales in October were held down by weakness in the South that offset gains elsewhere. The resale market has been soft in contrast to new homes which are having a good year.

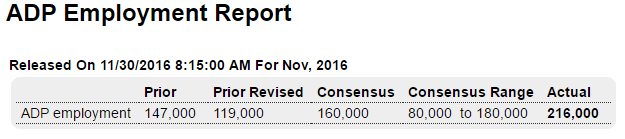

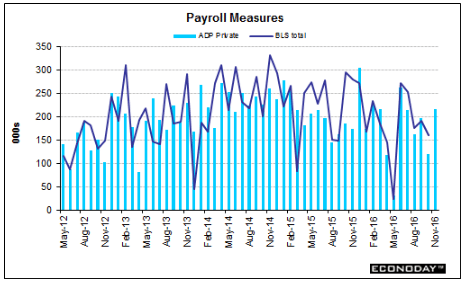

This is their forecast for tomorrow’s number. Note the large downward revision to last month’s release, which continued the downtrend as shown on the chart. Two things- First, this month’s number is subject to the same kind of revision. Second, the average of the last two months as reported today is just over 160,000 which keeps the pattern of deceleration intact:

Highlights

ADP has had a good year forecasting private payroll growth and its November estimate is very strong, at 216,000 which is far above Econoday’s consensus for 160,000. The 216,000 is nearly double ADP’s revised estimate for October of 119,000. Econoday’s consensus for Friday’s private payrolls is 155,000 with total nonfarm payrolls expected at 170,000.

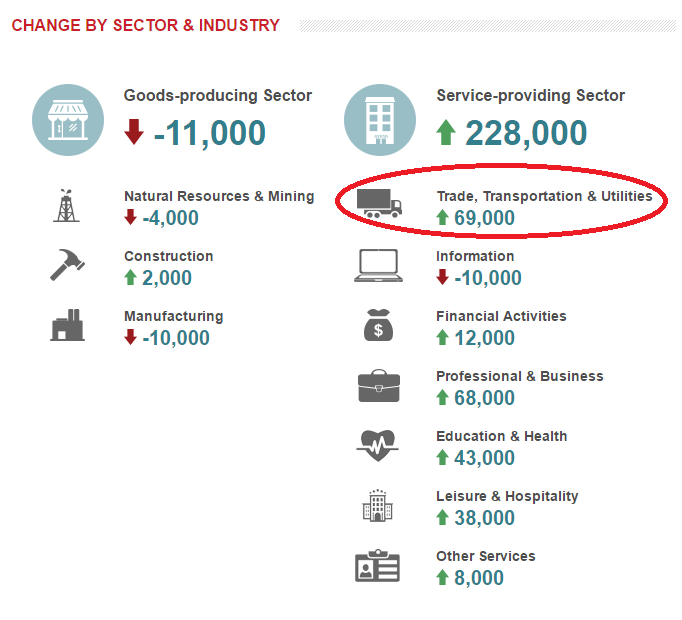

And the jump in trade, transportation, and utilities looks a bit suspect as well:

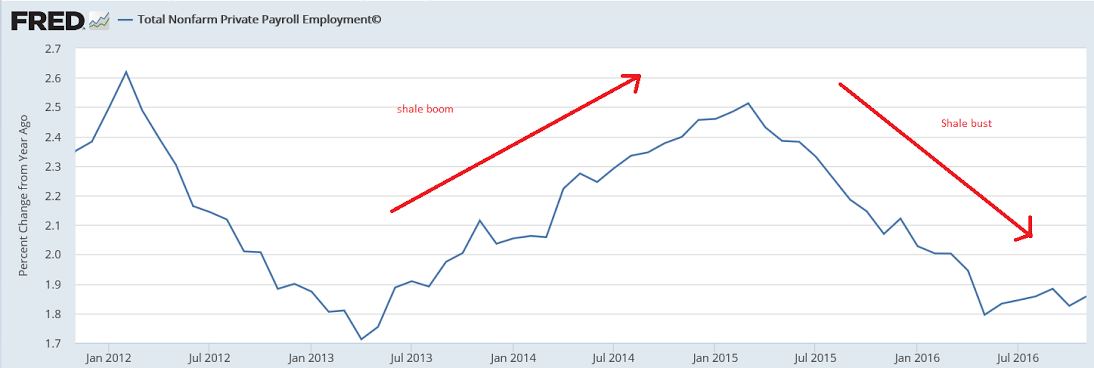

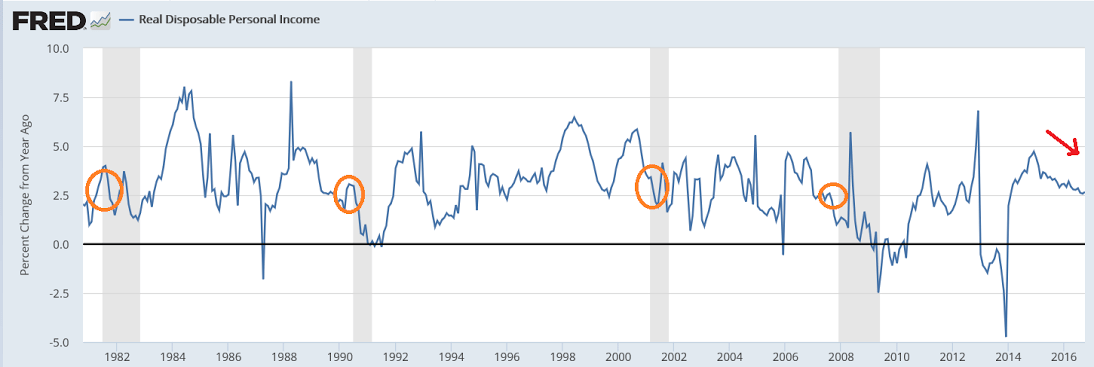

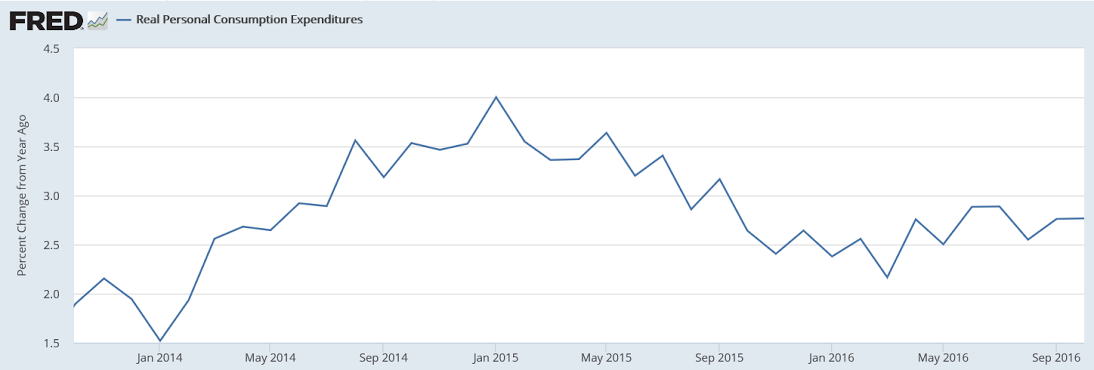

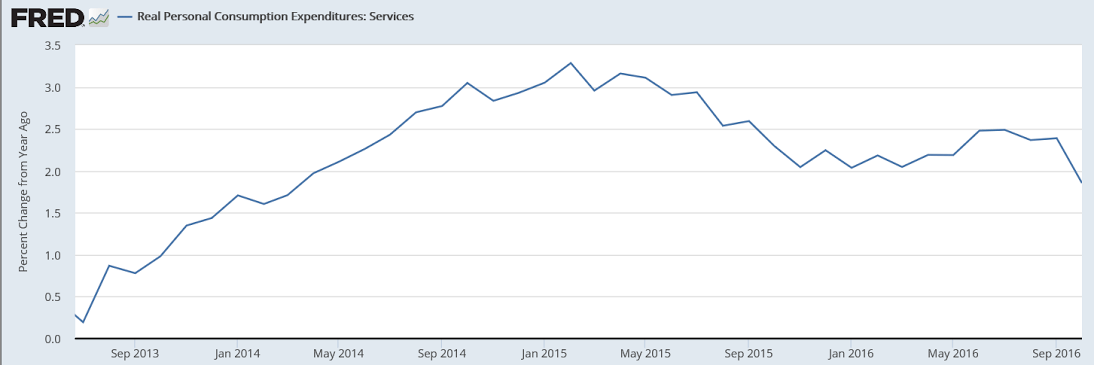

Here it’s the income side that seems a bit suspect, especially with last month’s jobs report just getting revised lower. But in any case it continues to decelerate on a year over year basis. Also note the relative weakness in spending on services. As previously discussed, I expect goods will muddle through reasonably well from this point, as the macro weakness works its way through the service sector:

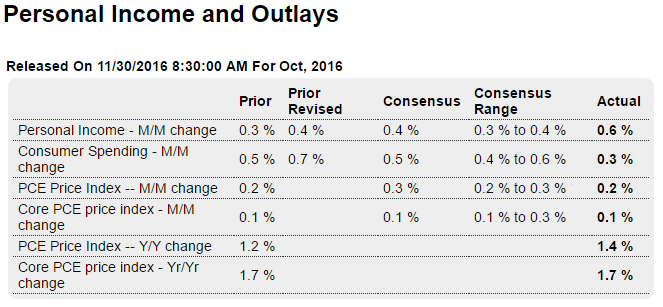

Highlights

A decline for services held down consumer spending in October, coming in at plus 0.3 percent vs Econoday’s consensus for 0.5 percent. Strong spending gains of 1.0 percent for durables (auto related) and 1.4 percent for nondurables (gasoline related) compare with a 0.2 percent decline for services. A partial offset is an upward revision to September’s consumer spending which now stands at a very strong 0.7 percent.

The income side is the best news in the October report, rising 0.6 percent to beat expectations by 2 tenths. An upward revision to September, now at plus 0.4 percent, is another positive. The wages & salaries component shows back-to-back gains of 0.5 percent which is very solid. And October spending would have been greater if not for savings as consumers moved their money into the bank with the savings rate up a sharp 3 tenths in the month to 6.0 percent.

Inflation data are showing some life with the total price index, boosted by energy, up 0.2 percent in the month with the year-on-year rate moving to a two-year high at 1.4 percent. But the core rate shows less life, up only 0.1 percent with the year-on-year rate unchanged at 1.7 percent.

Though the spending headline softens the look, the meat of this report is very solid as the strong jobs market is making for increasingly strong income gains and continued strength in spending.

Real disposable personal income continues to decelerate and has reached ‘stall speed’ vs prior recessions:

A bit of Trumpet blowing here, but note that employment went negative:

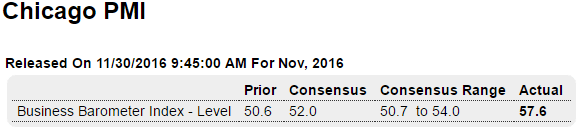

Highlights

The Chicago Fed’s business barometer is showing its volatility once again, surging 7 points in November to 57.6 to signal the strongest rate of monthly growth in nearly two years (since January 2015). New orders, as they have been in other early reports on November, are the center of strength with backlogs, which are often in contraction, once again building. Up-and-down is the theme of the report and a negative is employment which is back in reverse. Volatility aside, the report’s overall message is consistent with other advance data this month, that is a significant upturn in activity has followed the November 8 election.