The Saudis set prices via discounts to benchmarks, which will trigger either price appreciation or depreciation, or, if they happen to get the discounts ‘exactly neutral,’ at least near term stability.

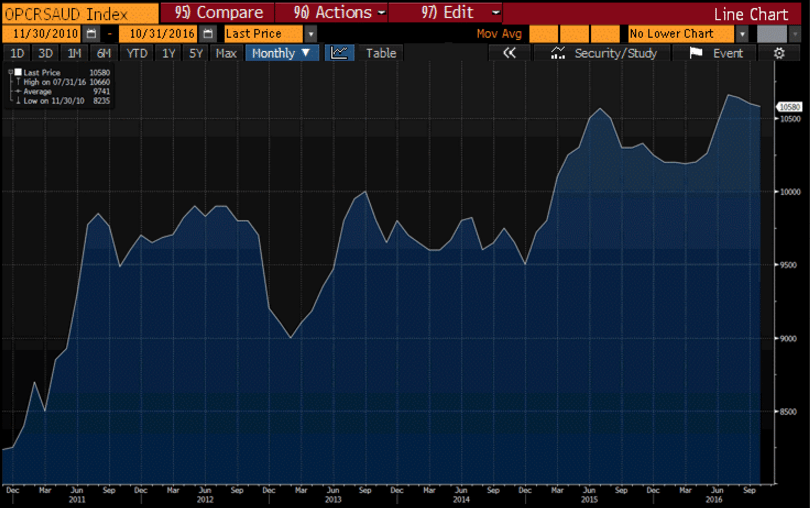

They then allow their clients, who are all refiners, to buy all they want at the posted prices. To date the total purchased has been less than their presumed 12 million barrel per day production capacity. the chart shows that the price cut a couple of years ago, from over $100 to under $50, has resulted in increased sales of about 1 million barrels per day, and that sales remain well below presumed capacity. That could be due to increased total demand for crude oil, or output reductions of other producers:

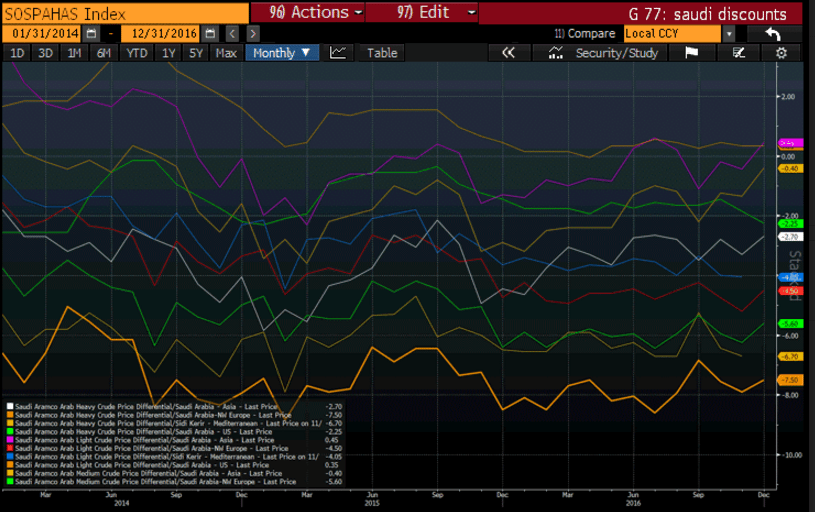

This is the most recent chart of Saudi pricing. Note that in general discounts to benchmarks have been reduced, which works to firm prices, which tells me they are looking to keep prices stable at maybe $50/barrel, probably because they are concerned that if prices are any higher than that global development and output would increase. And note that US inventories, excess or otherwise, do not ultimately alter price: