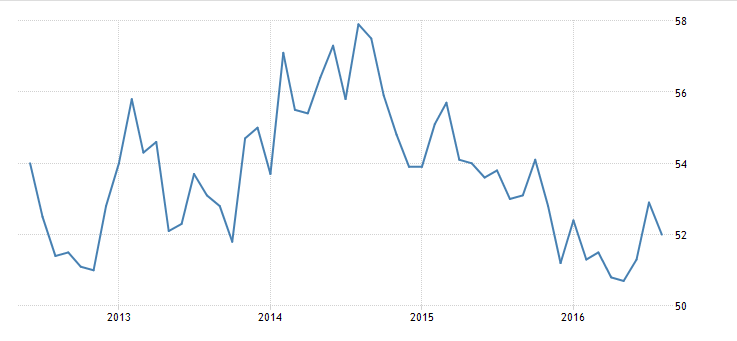

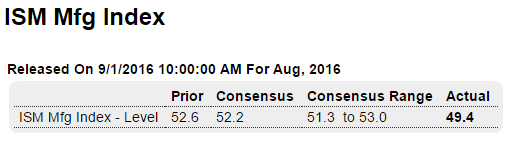

The downtrend looks intact, and on the edge of contraction:

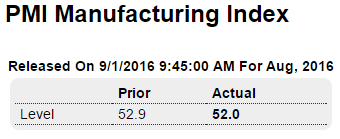

Highlights

Markit’s U.S. manufacturing sample continues to report month-to-month growth but slow growth. The PMI for August came in at 52.0 which is only modestly above the 50 level that divides monthly growth from monthly contraction. Growth in new orders slowed which is a key negative in the report, along with slowing in employment. The sample is also cutting its inventories which points to lack of confidence in the business outlook. Price data are flat which is yet another indication that demand is soft. But there are positives including strength in production, which however won’t last long if orders remain weak. And there’s an important indication of strength in orders as new export orders posted a rare gain. This report in sum points to no better than flat conditions ahead for manufacturing.

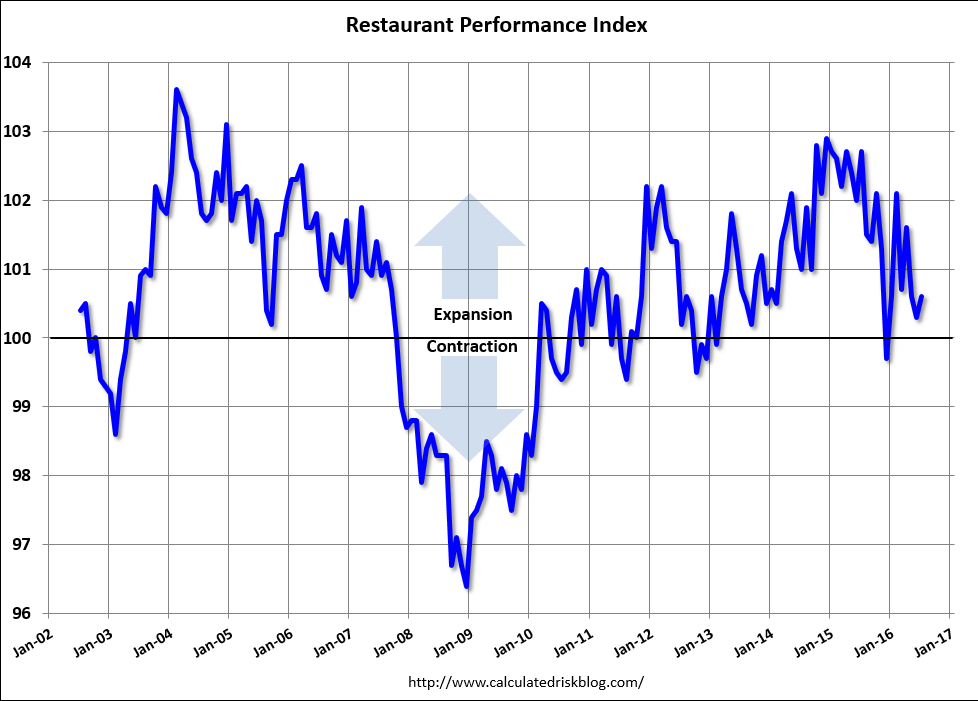

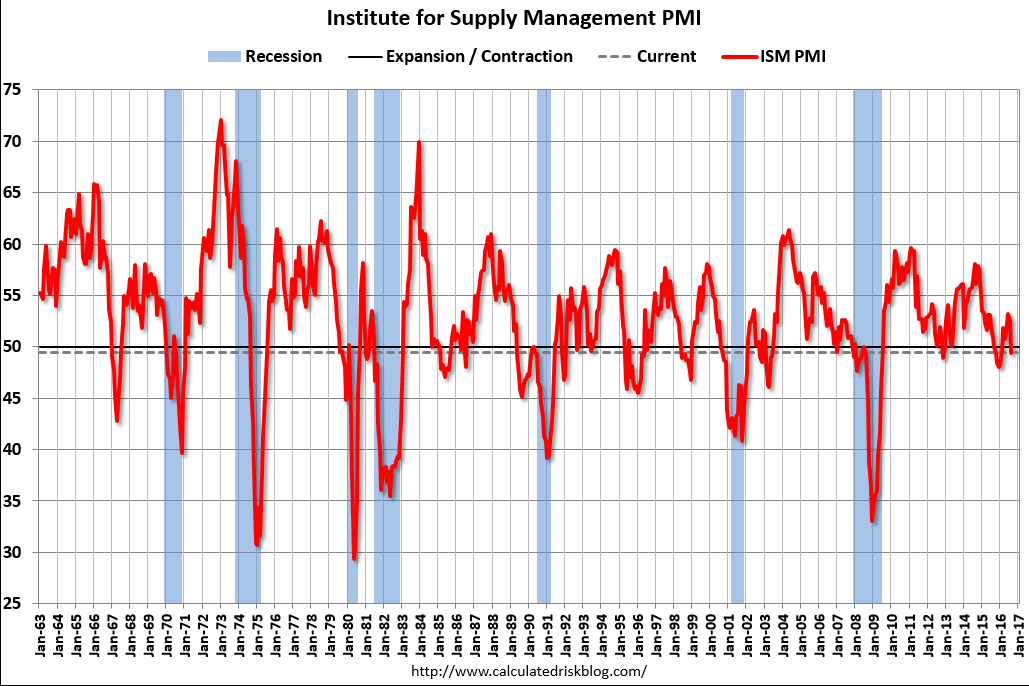

This one went negative:

Highlights

August was a disappointingly flat month for ISM’s manufacturing sample where the composite index posted its first contractionary sub-50 reading since February, at 49.4 for a more than 3 point decline.

Details are likewise soft including new orders which, after a long solid run, fell nearly 8 points to 49.1 for their first sub-50 score since December. And backlog orders are in deepening contraction, at 45.5 for a 2.5 point decline. Production is just below 50 as are inventories and also employment, which at 48.3 is under 50 for the eighth time in nine months.

This report has been very solid in recent months especially new orders, important considerations that limit August’s negative indications. Factory data have been struggling all year and this report takes some of the shine off very solid government reports in July when both industrial production and durable goods orders posted good gains. Watch for July factory orders on tomorrow’s calendar.

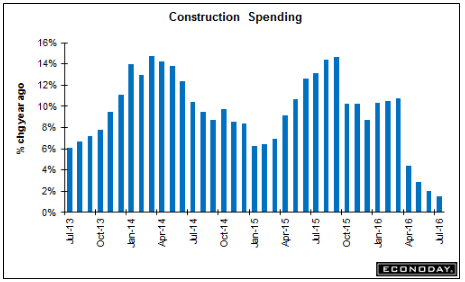

The deceleration is obvious: