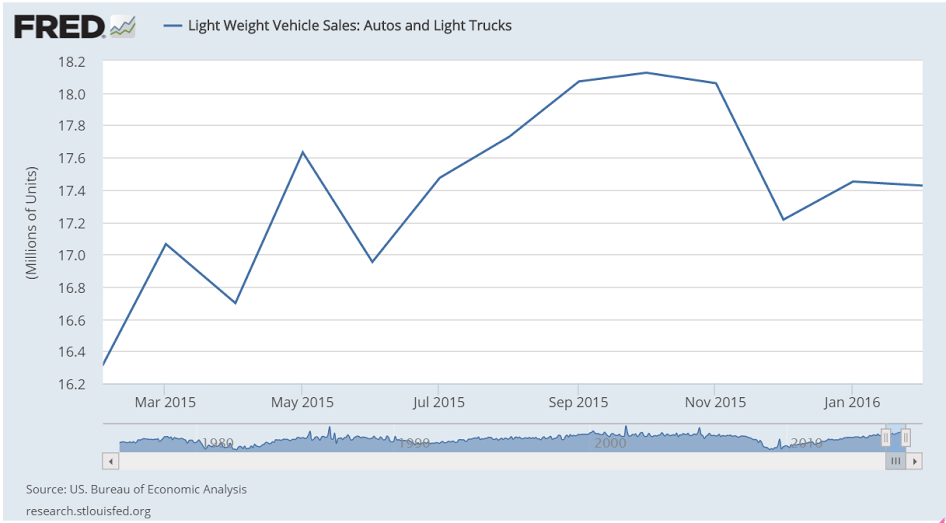

Ward’s Auto’s estimate is for a continuation of the flattening of the seasonally adjusted annualized rate of sales from prior higher levels:

The report puts the seasonally adjusted annual rate of sales for the month at 17.3 million units, below the 17.4 million SAAR from the first two months of 2016 combined, but well above the 17.1 million SAAR from same-month year-ago.

Looks to me like a deceleration from Q4:

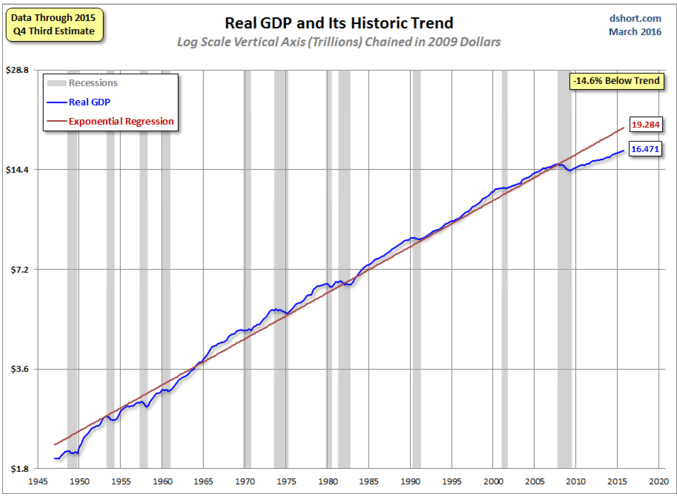

The table below compares the 3Q2015 third estimate of GDP (Table 1.1.2) with 4Q2015 GDP which shows:

- consumption for goods and services declined

- trade balance degraded

- there was inventory change removing 0.22% from GDP

- there was significantly slower fixed investment growth

- there was reduction in government spending

Rail Week Ending 19 March 2016: Rail’s Slide Into The Abyss Worsens

Week 11 of 2016 shows same week total rail traffic (from same week one year ago) declined according to the Association of American Railroads (AAR) traffic data. All rolling averages are negative and in decline.

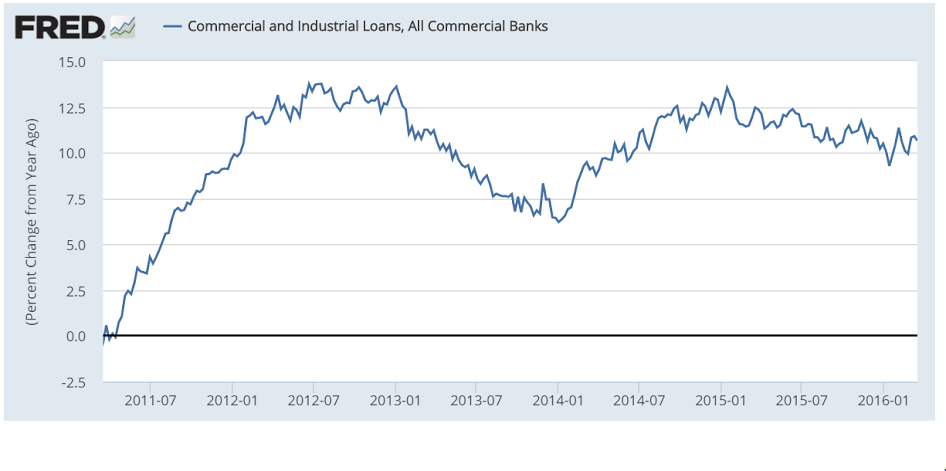

Gradual deceleration of rate of growth: