Lots of up and down right now.

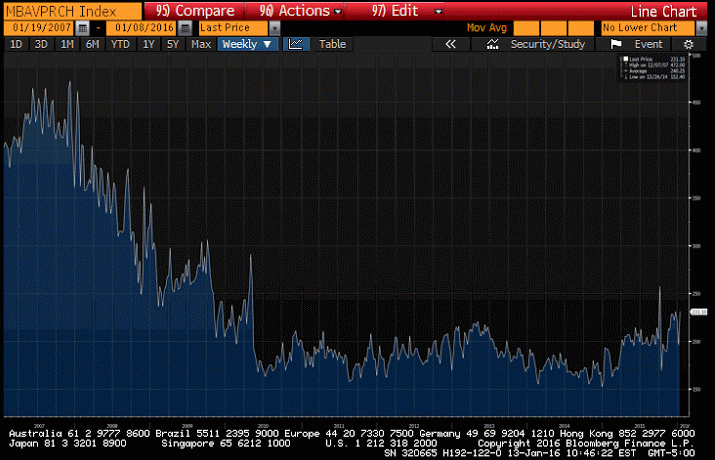

The chart indicates purchase apps may be up a bit but still depressed historically.

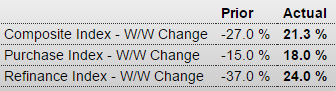

MBA Mortgage Applications

Highlights

The new year is seeing a surge in mortgage activity reflecting a strong jobs market and low rates, according to the Mortgage Bankers Association’s weekly report. Purchase applications surged 18 percent in the January 8 week with refinancing applications up 24 percent. These gains, however, also reflect volatility in weekly measures and largely reverse giant swings in the prior week’s data. The average rate for conforming loans ($417,000 or less) fell 8 basis points in the week to 4.12 percent.

This shows the 3 month moving average in orange for just the last year:

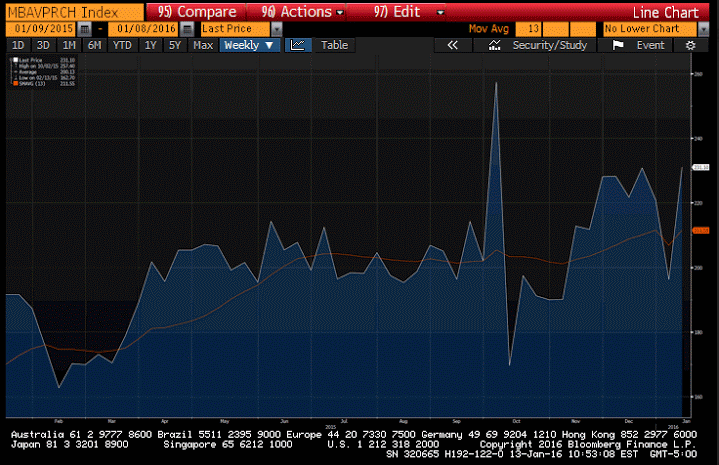

This kind of trade surplus ultimately supports the currency, though FDI flows can can and have been much larger recently as previously discussed:

China Trade Surplus Widens in December

China trade surplus increased to USD60.09 billion in December of 2015 from USD49.61 billion reported a year earlier and beating market consensus, as exports and imports fell much less than expected. Year-on-year, outbond shipments declined by1.4 percent to USD224.19 billion, the sixth straight month of fall and the smallest drop since June. Imports dropped by 7.6 percent to USD164.10 billion, the 13th consecutive month of contraction, as a result of declining commodity prices and weak demand.