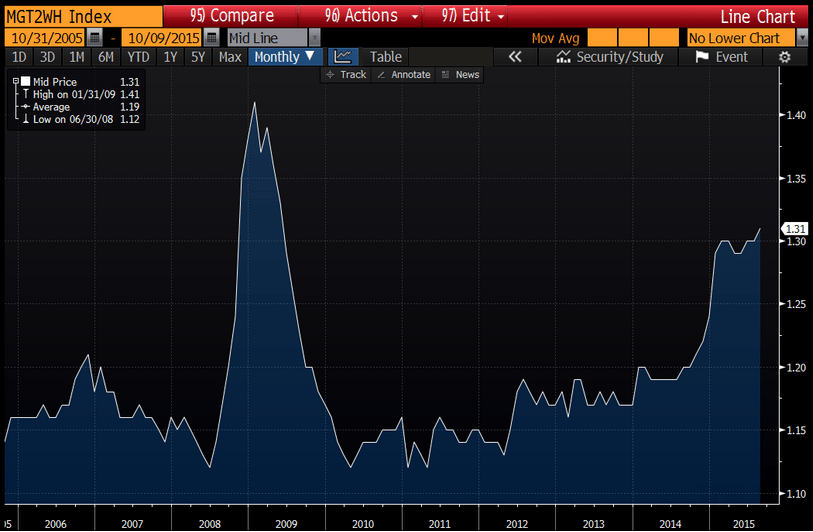

Sales to inventory ratios still looking way high to me, as happens entering a recession:

Highlights

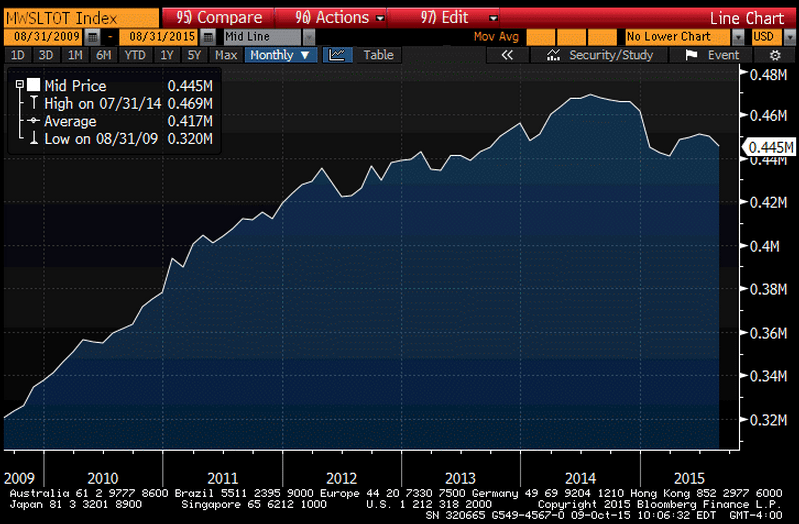

Wholesale inventories look to be pulling down on third-quarter GDP, up only 0.1 percent in August following a downwardly revised 0.3 percent decline in July. But relative to sales, which fell 1.0 percent in August and fell 0.3 percent in July, inventories are looking heavy. The stock-to-sales ratio rose to 1.31 in September from July’s 1.30.

Inventories relative to sales rose in autos which is a plus given how strong auto sales proved to be in September. Inventories of machinery also rose but here sales have been uneven and the build might be unwanted. Metals show a large draw on a bounce back for sales.

As far as GDP goes, inventories are looking to have a neutral effect. Businesses are keeping their inventories in check even as sales remain on the slow side. Watch for the business inventories report on Wednesday.

Wholesale Inventories +0.1% in August

U.S. wholesale inventories rose in August, boosted by larger stocks of computers and professional equipment used by businesses. Inventories are a key component of gross domestic product changes. The component of wholesale inventories that goes into the calculation of GDP – wholesale stocks excluding autos -rose 0.1 percent. Inventories for durable goods climbed 0.3 percent, with computers up 1.9 percent. At August’s sales pace it would take 1.31 months to clear shelves, up slightly from 1.30 months in July. An inventory-to-sales ratio that high usually means an unwanted inventory build-up, which would require businesses to liquidate stocks. That in turn could weigh on manufacturing and economic growth.

Inventory to sales ratio:

Total sales: