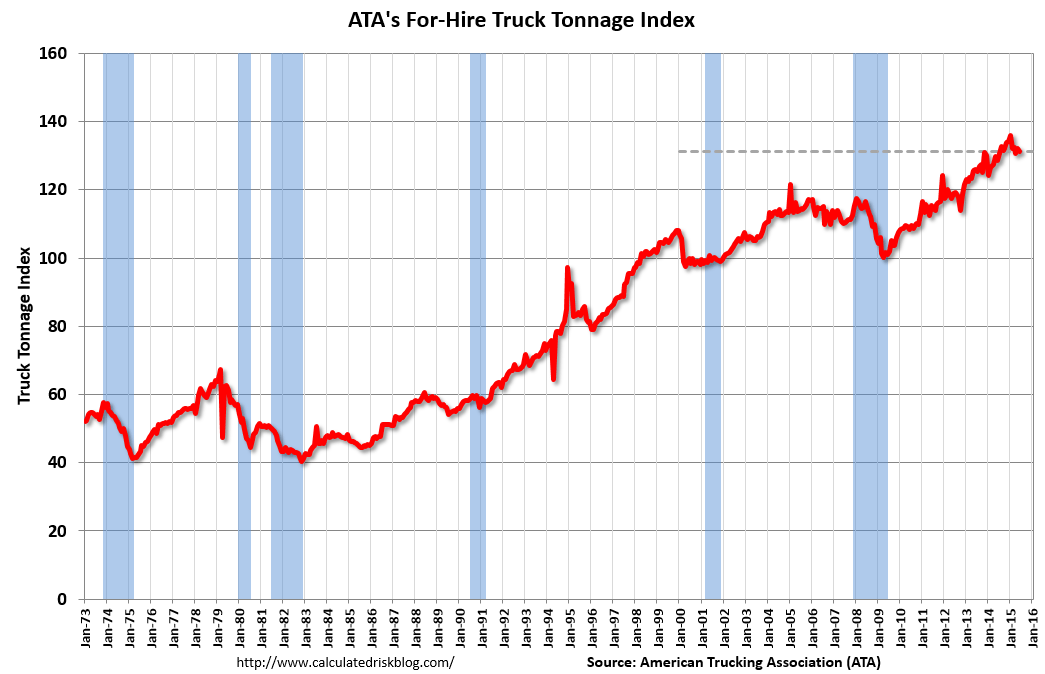

ATA Trucking Index decreased 0.5% in June

by Bill McBride on 7/27/2015 01:55:00 PM

Here is an indicator that I follow on trucking, from the ATA: ATA Truck Tonnage Index Fell 0.5% in June

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index decreased 0.5% in June, following a revised gain of 0.8% during May. In June, the index equaled 131.1 (2000=100). The all-time high of 135.8 was reached in January 2015.

Compared with June 2014, the SA index increased 1.8%, which was above the 1.5% gain in May. Year-to-date through June, compared with the same period last year, tonnage was up 3.4%. …

With flat factory output and falling retail sales, I’m not surprised tonnage was soft in June,” said ATA Chief Economist Bob Costello. “I also remain concerned over the elevated inventory-to-sales ratio for retailers, wholesalers, and manufacturers, which suggests soft tonnage in the months ahead until the ratio falls.

Read more at Calculated Risk Blog

The rate of growth of new car sales continues to slow, with most of the growth coming from imports:

From Kelley Blue Book: New-Car Sales To Increase Nearly 3 Percent In July 2015, According To Kelley Blue Book

New-vehicle sales are expected to increase 2.6 percent year-over-year to a total of 1.47 million units in July 2015, resulting in an estimated 17.1 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book www.kbb.com …

“As the industry settles into the summer selling season, new-car sales are expected to remain consistent with last month’s numbers, representing modest and slowing growth versus last year,” said Alec Gutierrez, senior analyst for Kelley Blue Book. “Sales in the first half of the year totaled 8.5 million units, a year-over-year improvement of 4.4 percent and the highest first-half volume since 2005. Total sales in 2015 are projected to hit 17.1 million units overall, a 3.6 percent year-over-year increase and the highest industry total since 2001.”

Read more at Calculated Risk Blog