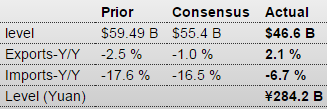

More reason to suspect US exports will disappoint and US imports will exceed expectations:

Highlights

China’s June merchandise trade surplus was $46.6 billion against expectations of a $55.3 billion surplus. In Yuan terms, exports were up 2.1 percent on the year while imports tumbled 6.7 percent. The first half of 2015 trade balance was CNY1.61 trillion or $263.9 billion. On a seasonally adjusted basis, exports were up 1.1 percent on the year after sliding 1.4 percent in May. Seasonally adjusted imports dropped 9.9 percent after a 14.1 percent plunge.

According to Chinese Customs, expectations are for export growth to rebound in the second half of the year. It noted that the Greek crisis will have some impact on China’s trade – it is hard to quantify just how big an impact there will be.

China sees exports increase 2% in June, imports decline

By Chen Jia and Zhong Nan

July 13 (ChinaDaily)

China’s export rose by 2.1 percent year-on-year to 1.17 trillion yuan($188.5 billion) in June, a better-than-expected increase after the 6.4 percent decline in April, according to data from Customs released on Monday.

However, the import figure fell by by 6.7 percent to 890.67 billion yuan last month, leading to an accelerated growth of monthly trade surplus to 45 percent year-on-year.

In the first six months, the country’s total foreign trade value was 11.53 trillion yuan, down by 6.9 percent from a year earlier. Exports increased by 0.9 percent to 6.57 trillion yuan while imports decreased by 15.5 percent to 4.96 trillion yuan.

Trade surplus in the first half rose by 1.5 times from a year earlier to 1.61 trillion yuan, the data revealed.

The structure of trade modes continued to improve when exports of general trade showed marked growth, and strong momentum was spotted in exports to emerging markets and some countries along the “Belt and Road”, said Huang Songping, a spokesman from the Customs department, at a press conference.

China’s bilateral trade with the European Union declined by 6.8 percent during the January-to-June period to 1.67 trillion yuan and trade with Japan fell by 10.6 percent to 832.02 billion yuan, said Hong.

“The Greek debt crisis is likely to influence China’s export, but it is difficult to predict the exact effects,” added Huang.

Varoufakis’ interview in the New Statesman:

Exclusive: Yanis Varoufakis opens up about his five month battle to save Greece

“He said he spent the past month warning the Greek cabinet that the ECB would close Greece’s banks to force a deal. When they did, he was prepared to do three things: issue euro-denominated IOUs; apply a “haircut” to the bonds Greek issued to the ECB in 2012, reducing Greece’s debt; and seize control of the Bank of Greece from the ECB.”

As suspected, he’s was in it over his head.

My response would be to let the banks remain open with circumstances limiting withdrawals to available liquidity. Liquidity might come from earnings on assets, asset sales, and new deposits. The banks would be free, by mutual agreement, to issue IOU’s to depositors who didn’t want to wait for actual euro. The govt might issue IOU’s if it ran out of cash for operating expenses. To ‘seize control of the Bank of Greece from the ECB’ is nonsensical, as there’s nothing there but a computer with a spreadsheet. It would not give Greece the ability to clear funds outside of Greek member banks that are on that spreadsheet. Haircuts to bonds issued to the ECB and reducing Greek debt would also be meaningless in this context.