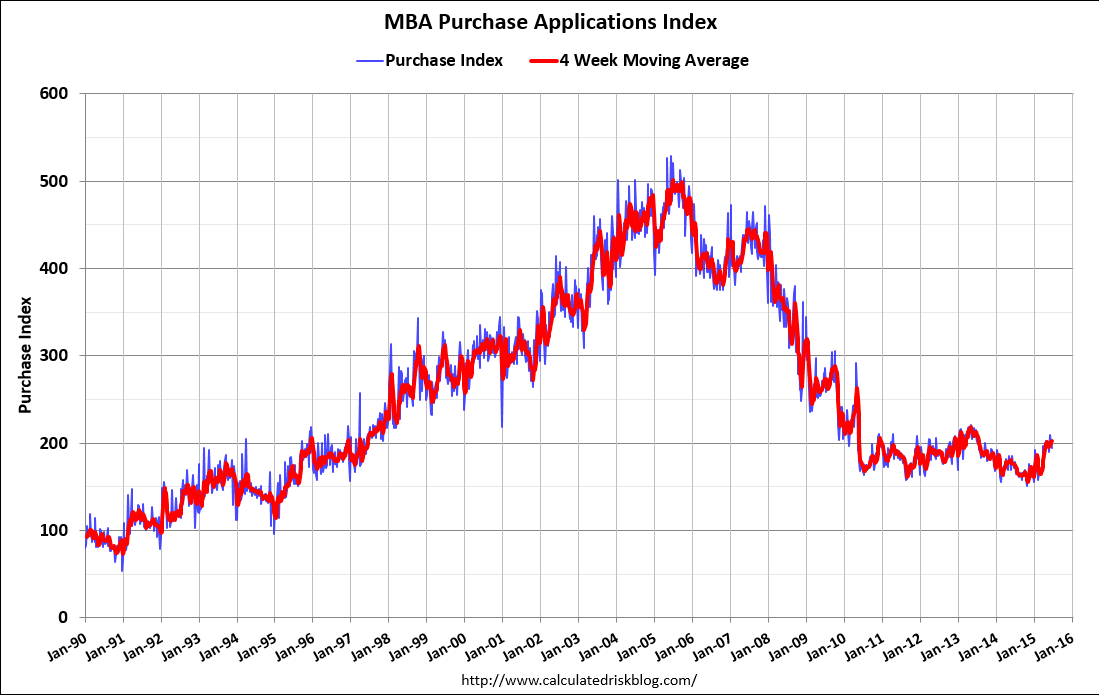

The purchase index had a nice increase, more than reversing last week’s decline, as cash purchases have declined and been ‘replaced’ with mortgage financing. There has been a pick up in total sales as well, though applications remain severely depressed and haven’t even recovered to 2013 levels. The July 4 holiday may also have created a distortion:

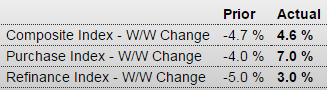

MBA Mortgage Applications

Highlights

Weekly data are often volatile, evident in MBA’s mortgage applications where big gains in the latest week offset big losses in the prior week. The purchase index rose 7 percent in the week with the refinance index up 3 percent. A fall in rates helped the week’s volumes with the average 30-year mortgage with conforming balances ($417,000 or less) down 3 basis points to 4.23 percent.

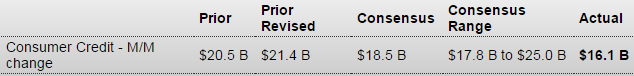

Low than expected and not reflecting an acceleration from Q1.

And note the misleading cheer leading:

Highlights

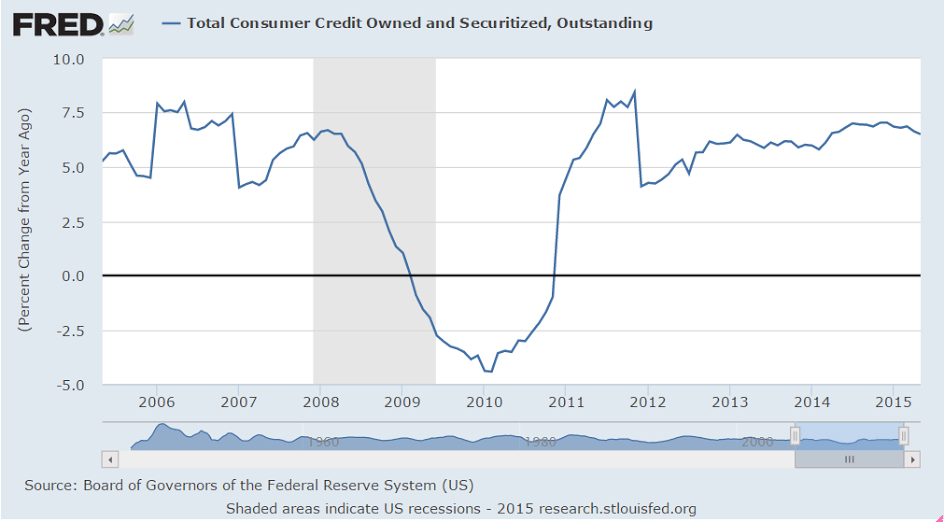

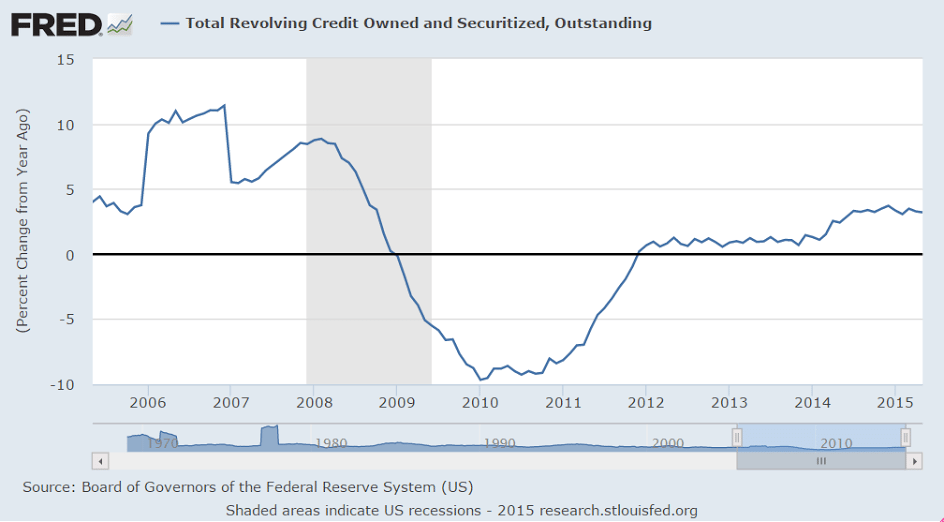

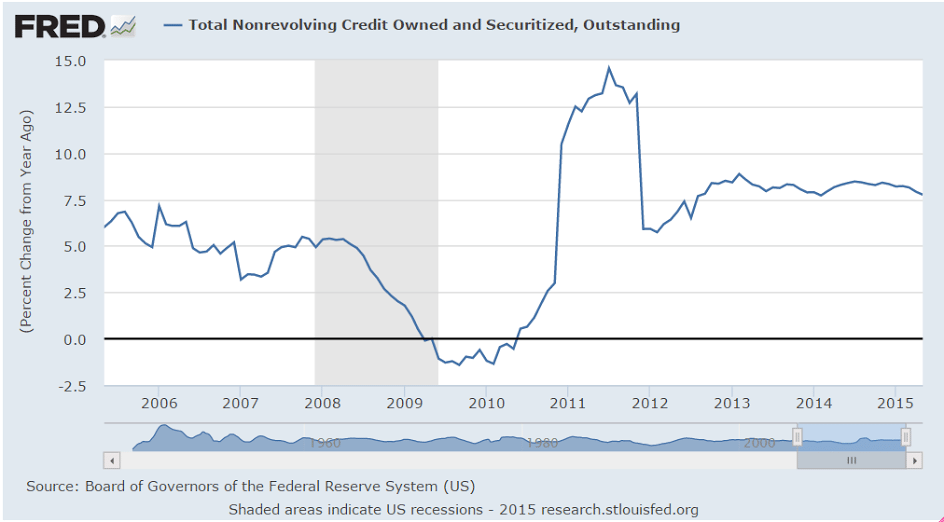

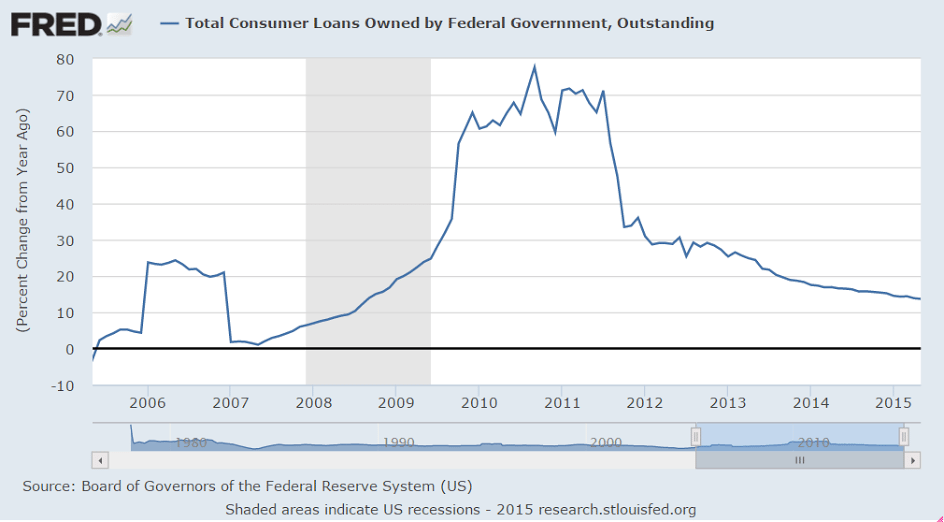

The consumer is showing some life. Consumer borrowing rose $16.1 billion in May following an upward revised $21.4 billion in April. Key to this report is the component for revolving credit which is where credit cards are tracked. Revolving credit rose $1.6 billion in May, a moderate gain that follows, however, two very strong gains in April and March. Non-revolving credit, inflated by the student loan subcomponent, rose $14.5 billion in May. Non-revolving gains, however, do reflect gains for vehicle financing.