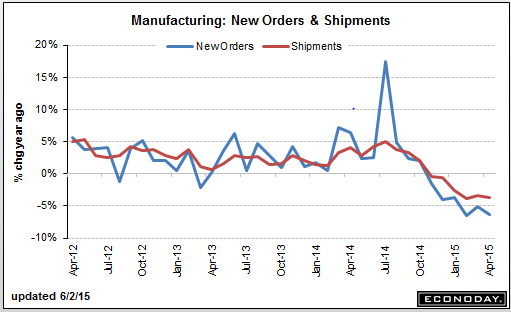

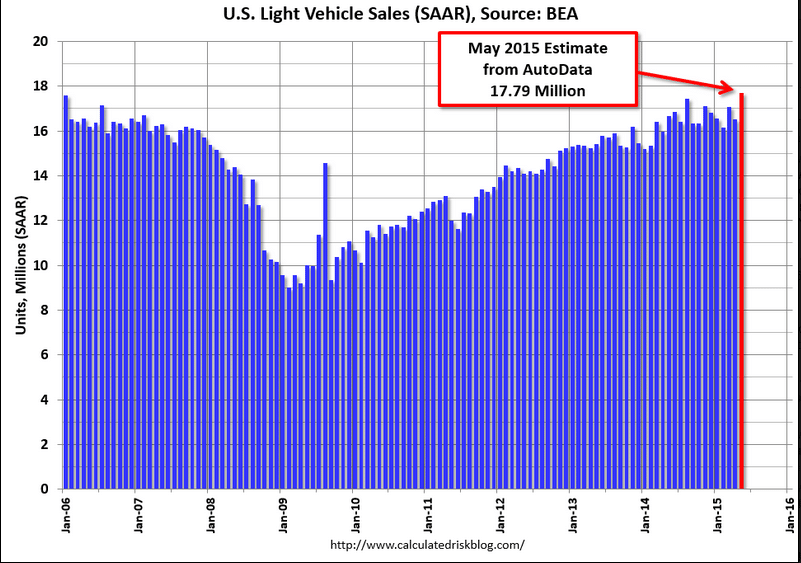

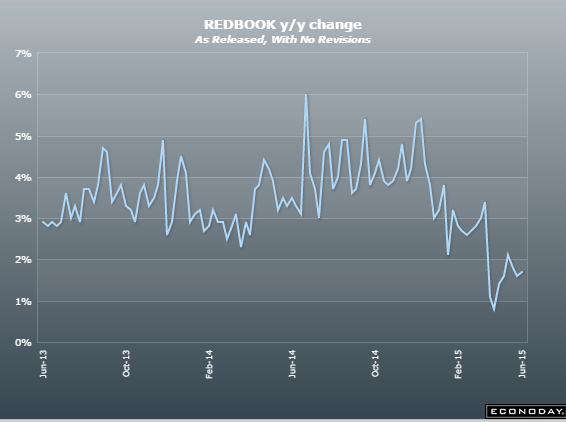

Strong number, bouncing from winter slowdown. Looking at the chart seems spikes are followed by dips, and imports are a large factor as well. Hopefully it continues:

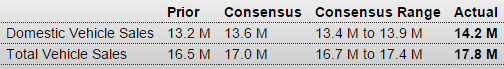

United States : Motor Vehicle Sales

Highlights

Consumers weren’t holding back in May when it came to buying cars and trucks which sold at a 17.8 million annual rate for a whopping 7.9 percent gain from April. The rate is above the top-end of the Econoday forecast and the strongest since July 2005. The monthly percentage change is the strongest since March 2010. Incentives and low rates no doubt boosted sales but May’s surge hints at pent-up demand, demand that has built up over the last six months when sales declined four times.

Among details, sales of North American-made vehicles rose 7.6 percent to a 14.2 million rate in a jump that points to a rise in future auto production and a rising auto contribution in the factory sector. Foreign-made vehicles sold at a 3.6 million rate for 9.1 percent gain which is among the largest monthly gains on record for this reading.

The April retail sales report proved to be a flop, but May’s vehicle sales data point to a big surge for the motor vehicle component which makes up nearly 1/4 of total retail sales.

This retail sales measure should have picked up by now:

Nor is this any good:

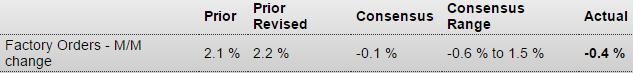

Factory Orders

Highlights

Factory orders fell 0.4 percent in April for the 8th decline in 9 months, a depressing streak interrupted only by March’s revised gain of 2.2 percent, a gain inflated by a monthly swing higher for civilian aircraft. There are significant downward revisions to the durable goods side of the report that was first published last week, with durables orders now down 1.0 percent vs an initial decline of 0.5 percent. Capital goods in that report looked strong, but not with today’s revision with orders for non-defense capital goods excluding aircraft sinking 0.3 percent vs an initial and very strong gain of 1.0 percent.

Ex-transportation, orders are unchanged, well down from the 0.5 percent gain in the durable goods report. Nondurable goods are a positive offset in today’s report, up 0.2 percent and reflecting strength for chemical products.

Outside of new orders, data show no change for shipments and a 0.1 percent dip for unfilled orders, both very weak. The lack of punch is putting pressure on inventory levels where the inventory-to-shipments ratio rose to 1.35 from 1.34 in March.

The downward revision to core capital goods orders is a setback, pointing to much less business optimism than first reported. The factory sector did not get any lift at all coming out of the first quarter, reflecting weak exports and trouble in the energy sector. Manufacturing employment has understandably been very soft with the next update part of Friday’s employment report.